A report by Bain and Company noted that 80% of all M&As in India was carried out by first time buyers. Unlike 2016-2019, India has not witnessed any mega deal over $5 billion in the last two years.

“With shareholders expecting companies to grow their annual earnings by nearly a third over the next three years, companies are being bold and looking at transformational deals where the objective is not just increasing scale but building new engines of growth and new capabilities, beyond the company’s core business,” Karan Singh, managing partner at Bain & Company India, said while announcing the launch of the company’s latest report on M&As.

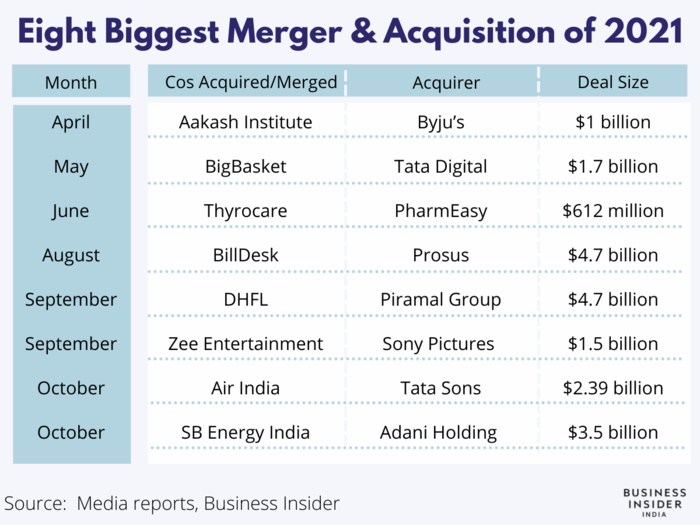

Here are the top mergers and acquisitions of 2021:

Multinational conglomerate Piramal Group completed the acquisition of Dewan Housing and Finance Limited (DHFL) for ₹34,250 crore ($4.7 billion), which includes a cash component and non-convertible debentures. The deal includes an upfront cash payment of nearly ₹14,700 crore ($1.9 billion).

About ₹3,800 crore from the upfront cash payment would be reserved for the creditors, as per the resolution plan. According to Piramal’s resolution plan, most of DHFL’s creditors will recover around 46% through the acquisition.

Nearly 94% of DHFL had voted in favour of Piramal’s resolution plan.

Investment bank and financial services company Jefferies believes that the acquisition of DHFL will help Piramal rebalance its portfolio and offer a strong growth platform in retail housing. A proposed demerger of pharma and financial businesses could simplify the corporate structure, sharpen the management's focus, and improve transparency around financials for the two verticals, the report said.

The acquisition of Indian payments giant BillDesk by technology investors Prosus NV was the largest merger and acquisition deal in the Indian fintech industry.

Prosus NV (formerly known as Naspers) acquired Bill Desk in order to complement its own fintech business PayU. The acquisition would allow PayU to become one of the leading online payments providers, globally, with presence in over 20 markets and increased total payments volume (TPV) of over $4 billion.

Prior to this, PayU had acquired CitrusPay, Paysense and Wibmo in the Indian market in order to expand its business across several vertices.

Adani Green Energy Limited (AGEL) completed the acquisition of SB Energy Holdings Limited (SB Energy India) in an all-cash deal worth $3.5 billion. This is the largest acquisition in the renewable energy sector in India.

The deal was announced in May 2021. The acquisition will help Adani Green Energy inch closer to its target of 25GW renewable energy capacity, giving it a boost of 4.9GW.

"The addition of these high-quality large utility-scale assets from SB Energy India demonstrates Adani Green Energy's (AGEL) intent to accelerate India's efforts to transition towards a carbon neutral future. Our renewable energy foundations will enable an entire ecosystem of new industries that can be expected to catalyse job creation in multiple sectors," Vneet S. Jaain, managing director and CEO of AGEL said.

In October 2021, Air India’s ownership came full circle after Tata Sons once again became the proud owner of India's first commercial airlines.

Air India (then known as Tata Airlines) dates back to 1932, when it was founded as a private entity by JRD Tata. The government of India had bought a majority stake in the carrier in 1953 and the company was renamed Air India.

The government of India has been trying to reprivatise Air India for decades now as it has not posted profit in the last 15 years.

Tata won the bid to acquire Air India for a whopping ₹18,000 ($2.39 billion). Reportedly, Tata Sons won the bid over SpiceJet founder Ajay Singh who had reportedly made a bid around ₹15,100 crore ($1.9 billion).

Tata Digital in a run up to building a super app acquired India’s biggest groceries delivery company BigBasket, earlier this year, for an undisclosed amount. The deal led to the exit of Alibaba, Actis, Ascent Capital and serial entrepreneur K Ganesh from BigBasket.

“Grocery is one of the largest components of an individual’s consumption basket in India, and BigBasket, as India’s largest e-grocery player, fits in perfectly with our vision of creating a large consumer digital ecosystem. We are delighted to welcome BigBasket as part of Tata Digital,” said Pratik Pal, chief executive of Tata Digital.

The company fulfills 15 million orders per month across 30 cities across India. The company also reached $1 billion in annual revenue in the fiscal year 2021.

Sony Pictures Networks India (SPNI) and Zee Entertainment Enterprises Limited (ZEEL) entered into an exclusive, non-binding term sheet to combine both the companies’ linear networks, digital assets, production operations and programme libraries.

The combined company would be a publicly listed company in India. Sony Pictures Entertainment would hold a majority stake in the combined company, and it will invest growth capital so that SPNI has a cash balance of approximately $1.575 billion at closing for use to enhance the combined company’s digital platforms.

The world’s most valued edtech venture Byju’s has acquired so many businesses this year that users have started jokingly referring to it as Buy-ju’s. The company has acquired about 10 new businesses this year, including Aakash Educational Services.

Aakash Institute is one of the most popular coaching institute networks in India, which focuses on coaching classes for undergrad admission in medical and engineering colleges. Besides this, it also offers coaching in Class 6 to 12 exams.

The company, founded in 1988, has more than 250 institutes across India and it has been a popular one. “If somebody has to distribute Byju's revenue — organic revenue versus revenue of acquired companies — Aakash would give them largest leverage purely from the EBITDA [earnings with interest, taxes, depreciation, and amortisation] and revenue perspective,” Dexter Capital’s Devendra Agrawal told Business Insider.

Besides this, Byju’s has also acquired companies in US, UK, Singapore and Australia to further boost its international expansion before it heads for a public listing in the United States.

Soon-to-be public epharmacy PharmEasy became the first Indian startup to acquire a publicly listed company Thyrocare, which runs a chain of diagnostic and preventive care laboratories. The acquisition, pegged at $610 million, was a way for PharmEasy to get its business as well as make it simpler for it to get publicly listed in India.

Founded in 1996 by Arokiaswamy Velumani, Thyrocare has over 3,300 collection centres in 2,000 Indian towns. The company claims to have carried out more than 110 million tests, as of June 2021.

The acquisition of Thyrocare is a part of PharmEasy’s vision to build an end-to-end healthcare platform from a customer’s point of view. “You don't have to run to somebody for medicine, somebody for devices, somebody for lifestyle, somebody for consultation, and somebody for a test,” founder and chief executive (CEO) API Holdings (the parent company of PharmEasy), Siddharth Shah, said.

I spent $2,000 for 7 nights in a 179-square-foot room on one of the world's largest cruise ships. Take a look inside my cabin.

I spent $2,000 for 7 nights in a 179-square-foot room on one of the world's largest cruise ships. Take a look inside my cabin. Saudi Arabia wants China to help fund its struggling $500 billion Neom megaproject. Investors may not be too excited.

Saudi Arabia wants China to help fund its struggling $500 billion Neom megaproject. Investors may not be too excited. Colon cancer rates are rising in young people. If you have two symptoms you should get a colonoscopy, a GI oncologist says.

Colon cancer rates are rising in young people. If you have two symptoms you should get a colonoscopy, a GI oncologist says. Mukesh Ambani’s JioCinema cuts subscription prices as India’s streaming war heats up

Mukesh Ambani’s JioCinema cuts subscription prices as India’s streaming war heats up

Data Analytics for Decision-Making

Data Analytics for Decision-Making

Experts warn of rising temperatures in Bengaluru as Phase 2 of Lok Sabha elections draws near

Experts warn of rising temperatures in Bengaluru as Phase 2 of Lok Sabha elections draws near

Copyright © 2024. Times Internet Limited. All rights reserved.For reprint rights. Times Syndication Service.