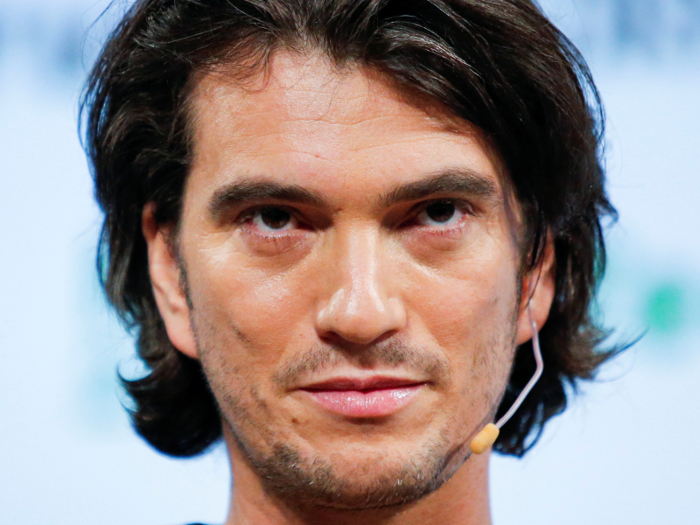

WeWork has already made Adam Neumann a very rich man, though the S-1 paperwork doesn't make it easy to figure out how much of his stake he's sold, what he personally still owns and what he's borrowed against.

Neumann has reportedly cashed out $700 million from a combination of selling shares to investors, selling shares back to the company, and taking out loans backed by his shares.

A separate company he controls called WE Holdings LLC is the largest shareholder in the We Company.

To clarify: The We Company is the company that is going public. We Holdings LLC is a separate company, controlled by Neumann and WeWork's other cofounder, Miguel McKelvey, that holds a good chunk of Neumann's shares (and, presumably most or all of co-founder McKelvey's shares, too).

While both of them are directors of this LLC, Neumann controls 100% of the voting rights of all of its shares, the S-1 says.

We Holdings LLC currently has:

If each share is worth $58, this stake, controlled by Neumann, is worth more than $6.6 billion.

Neumann also owns at least three other companies that have shares in the parent company We.

These are Anincentco1 LLC, Anincentco2 LLC and Anincentco3, LLC, the S-1 says.

Plus, he owns an undisclosed number of shares in another company called We Company Partnership, which holds 1.06 million Class C shares.

The shares controlled by We Company Partnership are owned by We's nine directors and executive officers including Neumann, according to the S-1. However, Neumann has sole voting rights, at 20 votes per share, of all of this Class C stock.

Because some of these shares are technically owned by other people, even though Neumann controls the voting rights, the S-1 doesn't spell out what Neumann's actual, personal stake is.

But it does disclose all of the shares that Neumann controls:

If each share is worth $58, this stake is worth over $6.7 billion. Presumably, the vast majority of that is personally owned by Neumann.

The S-1 does say that Neumann will not sell any shares during the IPO and that his lock-up period will last about a year.

The S-1 doesn't disclose much financial information regarding Rebekah Neumann, who is named as a co-founder, Chief Brand and Impact Officer and the Founder and CEO of WeGrow.

It says she's never been paid a salary from the We Co.

WeGrow, by the way, is a subsidiary of We that runs an elementary school. The We Co. says WeGrow plans to expand its education and learning programs.

However, because Adam Neumann is her husband, she is, presumably, co-owner of his vast stake and also most likely one of "permitted transferees" briefly mentioned in the S-1 who can assume control of the stock should he become incapacitated.

If each share that Adam controls is worth $58, she's party to a stake worth over $6.7 billion.

The S-1 also didn't disclose the stake of Miguel McKelvey, who is listed as Co-Founder and Chief Culture Officer.

Instead, it mentioned in a footnote that Miguel McKelvey is part of WE Holdings LLC, the company that collectively controls about 114.3 million shares.

Most of those shares may actually belong to Neumann. However, a footnote implies that 11.7 million Class B shares controlled by WE Holdings LLC are not owned outright by Neumann, even though he controls the voting rights to them.

The S-1 does not say that these shares are owned by McKelvey. It simply names both Neumann and McKelvey as the managing members of this company.

We'll see if future updates to the S-1 provide more information about this co-founder's stake.

But if he does own over 11.7 shares of Class B stock, and if they were worth $58 each, that stake would be worth nearly $679.8 million.

Ron Fisher, Vice Chairman SoftBank Group, is the man associated with handholding SoftBank's enormous investment in WeWork.

Softbank is the second largest shareholder after Neumann. It owns nearly 114 million shares. However, all of them are Class A shares, with 1 vote per share. Neumann controls nearly 114 million shares of Class B and Class C shares and all of them have 20 votes per share.

So while the stake is enormous, the power in the company is not.

Even so, should each share be worth $58, that stake would be worth more than $6.6 billion.

Benchmark Capital general partner Bruce Dunlevie is the representative for the VC firm's large investment in WeWork.

Benchmark owns almost 33 million shares.

If these shares are worth $58, that stake would be worth nearly $1.9 billion

A number of J.P. Morgan's private equity funds invested in WeWork and now collectively own 18.5 million shares.

Should those shares command $58, the stake would be worth nearly $1.1 billion.

It's worth noting that J.P. Morgan has been a lender to the company and to founder Adam Neumann.

It's also an underwriter bank for the IPO.

Artie Minson is the We Company's CFO.

Minson controls just over 1.9 million shares. This stake includes stock options that come due within 60 days, shares he's put in his family trust, and the Class C shares he owns as a member of the We Company Partnership, the S-1 says.

The We Company Partnership is the separate company that controls Class C shares owned by the nine top We executives, with Neumann retaining sole voting power of all of these shares.

It's worth noting, too, that Adam Neumann has the voting power over, 76,177 Class B shares, issued before 2015, that Minson owns as well.

Jen Berrent is We Co.'s chief legal officer.

Berrent's stake is about 458,725 shares when adding up all the stock that she can earn within 60 days, either through options or grants.

She also has some undisclosed shares in the We Company Partnership, the company that holds all of the 9 executive officer's Class C stock, however the S-1 says that none of those shares will be vested within 60 days. Neumann controls the voting rights to her Class B and upcoming Class C shares.

Should her 458,725 shares be worth $58, her stake would be worth $26.6 million.

Lew Frankfort is on the We Company's board of directors. He's best known for his years as CEO of luxury leather goods company Coach, where he is now the executive chairman.

He's also the founder of his own venture company, Benvolio Group.

He owns nearly 2 million shares between the shares owned by Benvolio and those owned by his own family trust. Some of his stake includes super-voting-rights shares that do not appear to be controlled by Neumann (at least the S-1 didn't say that they are).

Should the shares command $58, his stake would be worth about $115.8 million.

Many more investors bought shares of WeWork as it raised $8 billion in investment in the past.

Most of them are not disclosed in the S-1 because most of them are not considered major shareholders with at least a 5% stake in the company.

Some of the early investors have already sold all or part of their holdings to other investors who came in later.

But Pitchbook says there's still a total of 32 investors who appear to still have stock. It names investors like Israel's Aleph, Goldman Sachs. T. Row Price, and real estate magnate Mortimer Zuckerman.

I quit McKinsey after 1.5 years. I was making over $200k but my mental health was shattered.

I quit McKinsey after 1.5 years. I was making over $200k but my mental health was shattered. Some Tesla factory workers realized they were laid off when security scanned their badges and sent them back on shuttles, sources say

Some Tesla factory workers realized they were laid off when security scanned their badges and sent them back on shuttles, sources say I tutor the children of some of Dubai's richest people. One of them paid me $3,000 to do his homework.

I tutor the children of some of Dubai's richest people. One of them paid me $3,000 to do his homework. Why are so many elite coaches moving to Western countries?

Why are so many elite coaches moving to Western countries?

Global GDP to face a 19% decline by 2050 due to climate change, study projects

Global GDP to face a 19% decline by 2050 due to climate change, study projects

5 things to keep in mind before taking a personal loan

5 things to keep in mind before taking a personal loan

Copyright © 2024. Times Internet Limited. All rights reserved.For reprint rights. Times Syndication Service.