President Barack Obama signed the STOCK Act in 2012 to increase transparency of lawmakers' trades. But the enforcement system is a mess.AP/Charles Dharapak

President Barack Obama signed the Stop Trading on Congressional Knowledge Act into law 10 years ago today, in a ceremony that marked a rare moment of bipartisanship during a midterm election year.

"It shows that when an idea is right that we can still accomplish something on behalf of the American people and to make our government and our country stronger," Obama said before taking up his presidential pen.

The law created new financial disclosure requirements and enforcement rules for members of Congress, their immediate families, and staff who decide to trade stocks. It clarified that insider trading was illegal on Capitol Hill. It defined how members of Congress could personally invest their money — and could not.

But in the months since Insider published "Conflicted Congress," an investigation into the personal finances of federal lawmakers, Congress is considering whether the STOCK Act went far enough.

While current law allows members of Congress to trade individual stocks, Insider's "Conflicted Congress" investigation found that more than 1 in 10 lawmakers have recently violated the STOCK Act's disclosure provisions, which requires members of Congress to publicly report their trades shortly after making them.

The Insider investigation also exposed numerous conflicts of interest and instances where members of Congress' financial investments ran afoul of their policy positions.

For instance, members who hold stock in defense contractors also work on committees that have jurisdiction over military policy. Others who craft anti-tobacco policy have invested in tobacco giants. In the weeks immediately before and after the COVID-19 pandemic gripped the nation in March 2020, dozens of lawmakers bought or sold stock in companies that manufacture COVID-19 vaccines, treatments, tests, and personal protective equipment.

A House panel is set to conduct a public hearing Thursday to explore the issue of congressional stock trading, including a possible ban on the practice. And Senate Democrats have been meeting on the issue.

Meanwhile, to mark the anniversary of the law's passage, current and former members of Congress, all of whom pushed for or voted on the original bill, told Insider how they thought the law lived up to its promises — but also how it could be improved.

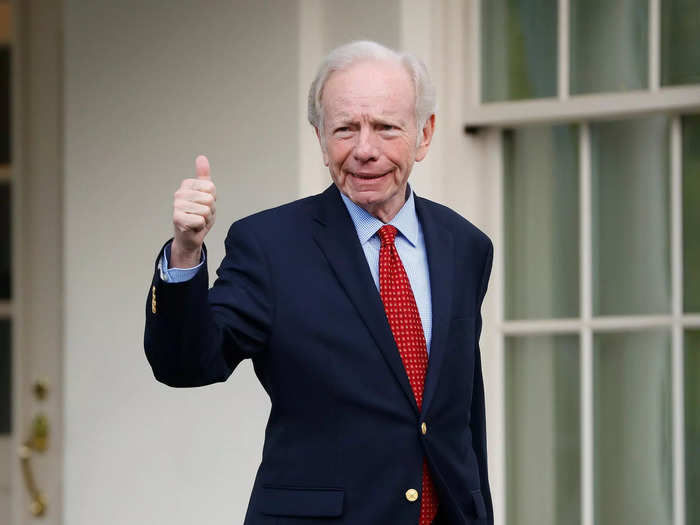

Lieberman pushed hard for passage of the STOCK Act. At a press conference months before it passed, in 2012, he said the bill he sponsored was "an attempt to take a step, a significant step, to rebuild the lost trust that the American people feel today in members of Congress."

Lieberman, who was Al Gore's running mate for the 2000 presidential election, told Insider that at the time he was motivated by a "60 Minutes" investigation "that raised serious questions about whether members of Congress were benefiting in personal stock trading from non-public information they had access to because they were in Congress."

"Now 10 years later, Insider has done extensive investigative work that indicates that the Stock Act is being violated too often by members of Congress," he continued, though a statement provided by the law firm Kasowitz Benson Torres where he works as a lobbyist.

He said that today, new legislation is needed.

"In the interest of protecting the already diminished credibility of Congress and upholding the personal honor of members of Congress, I appeal to my former colleagues to fix this real and corrosive problem as soon as possible," Lieberman said.

Republican Sen. Lisa Murkowski of Alaska is best known for being an unconventional member of her party.

She's co-sponsored Democratic-led voting rights bills, voted against her own party's Supreme Court nominees, and helped tank the effort to repeal the Affordable Care Act — a priority her party had run on for nearly a decade by then — in 2017.

But she also stands out in another way — she's the only incumbent Republican senator that has actually cast a vote to ban members of Congress from trading stocks.

In 2012, she was one of just 26 senators that voted for an amendment — it did not pass — that aimed to ban lawmakers from holding individual stocks altogether.

Four other Republican senators who are no longer in office — Scott Brown of Massachusetts, Dean Heller of Nevada, Kay Bailey Hutchison of Texas, and Olympia Snowe of Maine — also supported the measure.

Murkowski herself holds some individual stock — she reported owning between $100,000 and $250,000 in Wells Fargo — and earned a "Borderline" rating from Insider's Conflicted Congress project in part for filing two amendments to her personal financial disclosures due to errors.

When asked by Insider what she thought of the STOCK Act's performance over time, she demurred.

"You're kind of catching me off guard," Murkowski said as she walked to vote in the US Capitol. "I really, in earnest, have not thought about the STOCK Act and in quite some time, and whether or not it is doing the job that we need it to do."

Gillibrand pushed for passage of the STOCK Act a decade ago, and today, she said, its disclosure rules had created "oversight and accountability through transparency."

"That disclosure alone put a number of members of Congress into the spotlight where they could then be held accountable by regulators, by voters, and by their own ethics committees," she told Insider in an interview.

"Sunlight is always the best disinfectant," she added, "and it brought to light where members of Congress really are. Some members of Congress resigned, some members of Congress lost committee membership, some members lost their next election — and I think that is real accountability."

But Gillibrand said she thinks the work on the issue is far from done.

In February, she re-introduced the STOCK Act 2.0, which would make the disclosure database easier to use and search. It would also mandate that members of Congress report when they apply for, or receive, a benefit from the government.

She supports banning all stock ownership while serving in Congress, and co-sponsored the Ban Congressional Stock Trading Act and the Ban Conflicted Trading Act. She also wants more financial regulations on the executive and judicial branches, and said that creating higher fines or increasing ethics training wasn't sufficient in addressing the problems with current law.

"People are still creating an appearance of impropriety," she said.

Four bills are currently being considered among Senate Democrats. Together, they'll decide which measure to push for this year, she said.

She also said it was "pretty shocking" to learn through Insider's reporting "how careless members of Congress were in actually doing their disclosure, whether it was by mistake or intentional."

It made her think, as she said, "Maybe Congress isn't serious enough and they just need it to be banned."

While it's been mostly Democrats leading the charge to ban members of Congress from trading stocks, Hartzler — a Republican — is just as vocal about her belief that it's time for lawmakers to lose the ability to trade entirely.

The STOCK Act "put members of Congress on notice to make sure that there's not a conflict of interest," she told Insider at the Capitol.

But in the years that followed its passage, "we've seen that it clearly hasn't worked," said Hartzler, citing Insider's own reporting that 59 members of Congress and nearly 200 senior congressional staffers have violated the law. "There really isn't a strong enough penalty, to really be a strong deterrent," she added.

Hartzler introduced the House version of a stock trading ban put forward by Republican Sen. Josh Hawley of Missouri in January. The Missouri congresswoman, who's running to replace retiring Republican Sen. Roy Blunt, later earned Hawley's endorsement in the hotly-contested Senate race in February.

"I didn't think that there was a large problem with people using their information for personal gain, but I just thought it would be a good safeguard," she said of the STOCK ACt. "Now we're seeing individuals not complying with the transparency requirements, and so I think the next step is necessary: just to ban it completely while they're in office."

She also took the opportunity to ding House Speaker Nancy Pelosi, whose husband has frequently made eyebrow-raising trades.

"What Nancy Pelosi and her husband have done has raised a lot of question marks," she said, noting Paul Pelosi's frequent investments in tech stocks. "Nancy Pelosi is overseeing a lot of legislation that would rein in Big Tech, and it just seems like a conflict of interest."

Sessions has been open about opposing a congressional stock trade ban. The 11-term congressman has violated the STOCK Act twice in the last two years by failing to report his trades on time.

When asked about it in January on MSNBC's "Stephanie Ruhle Reports," he said the push for a ban from his colleagues was part of a "populist move" in Congress.

"I think we have enough rules and regulations," he said.

He told Insider that Congress should instead push for transparency and accountability.

"Listen, if your eggs are fresh, then open them up," he said in a statement sent through his office. "Said another way, if you have nothing to hide, then transparency is your friend. I am for Congress deliberating and developing more mechanisms that will uphold integrity and instill confidence in the minds of Americans."

He also stressed to Insider that he thought during a midterm year voters were more concerned about economic issues, including inflation, supply chain problems, gas prices, crime, and immigration.

"Just over a year with President Biden and the Democratic Party at the helm, we have seen chaos and crisis," he said. "They own these issues and deserve all the credit."

Polling shows voters favor a congressional stock trade ban, and many campaigns are weaponizing the issue during the election season.

To Hoyer, there is one clear example of a member of Congress being held accountable for clear violation of insider trading law, even if that law wasn't the STOCK Act.

While Hoyer didn't cite the congressman by name when Insider asked, it was clear from his context that he was talking about Rep. Chris Collins, a Republican of New York, who was convicted of insider trading related to his illegal activity as a corporate board director.

"In that instance, obviously, we have accountability," Hoyer said. (Collins did go to federal prison but was pardoned by former President Donald Trump.)

But Hoyer also said he didn't have enough information to take a stance yet on how the STOCK Act might become stronger. He noted that the Committee on House Administration was holding a hearing April 7 about the issue.

In January, House Speaker Nancy Pelosi asked the chair of the committee, Democratic Rep. Zoe Lofgren of California, to look into how well members were abiding by the disclosure provisions in the STOCK Act and whether penalties should be tighter. Peter Whippy, the spokeswoman for the committee, told Insider that the April 7 hearing was part of that review.

"I expect them to have recommendations in the not-too-distant future," Hoyer said. "There is a lot of interest in this, clearly nobody wants to have members of Congress using information they get as members of Congress — which may not be available to others — to profit.

"Whether that precludes, therefore, any ownership of stocks, whether they are traded or not, I think the committee is looking at that question and looking at others," he continued. "But I don't have the substance of their work yet. We are working on it."

"STOCK's my baby," Baird told Insider in a phone interview.

Therefore, even though he left Congress in 2011, Baird has closely followed its progress.

"People don't realize it," he said, "But the STOCK Act is why the Democrats have the Senate right now."

Baird was referring to the Senate runoffs in Georgia in 2020, where Democratic victories there resulted in the party controlling the Senate.

Democratic Sens. Jon Ossoff and Rafael Warnock won their seats after they repeatedly skewered their Republican opponents, then-Sens. Kelly Loeffler and David Perdue, over their personal stock portfolios. Financial disclosures showed Loeffler and Perdue dumped millions of dollars in stocks after receiving private briefings about the coronavirus pandemic.

None of those traders would have come to light if it weren't for the reporting requirement in the STOCK Act, Baird said.

Sen. Richard Burr, a Republican of North Carolina who will be retiring when his term ends in 2022, also stepped down from his perch at the top of the Intelligence Committee but the Department of Justice didn't charge him with wrongdoing after he, too, dumped his stocks.

"I dont know of any other ethics measure in recent memory that has led to the defeat of two US senators and the removal of the Intelligence Committee chair," Baird said. "That's a pretty significant impact. That led to the control of the US senate."

Today, Baird said he's still angry that lawmakers — led by former GOP Majority Leader Eric Cantor — quietly went back in 2013 and weakened the STOCK Act so that the disclosures were more difficult to search.

Now, he said, it's time for the law to be strengthened. Some people should face jail time if they willfully pass the reporting deadline, he said, and congressional stock trading should be banned from the time politicians announce their candidacies until six months after they leave office.

"The people who have tried to defend this on policy grounds have been tone deaf to the politics of this," he said. "The American people think this stinks – and they're right."

Those who oppose the movement to ban congressional stock trading have mostly stayed silent, with a handful of notable exceptions.

But not Bob Gibbs.

"I only do maybe 12 trades a year," he told Insider at the Capitol, adding that banning stock trading "causes lots of problems."

He argued that banning the practice would discourage potential candidates from running for office. He also pointed out that setting up qualified blind trusts — a financial vehicle Congress itself considers the best way for lawmakers to avoid conflicts of interest — can be an expensive process.

"In my case, I would have to resign, because I couldn't afford to do a blind trust," he said.

Gibbs has introduced the Transparency in Government Officials Trading Act, which would require members of Congress to disclose their trades within just 24 hours of making them — the current disclosure window is 30- to 45-days, depending on the trade — and fine them for the value of the trade if they fail to do so.

The bill has 4 Republican cosponsors.

"So if you buy $20,000 worth of stock, your penalty is $20,000," said Gibbs. "There's no reason why you can't report it in 24 hours. I mean, I pretty much do it all the time anyways."

Gibbs emphasized that he believes sunlight to be the best disinfectant, and claimed that rank and file members don't really have access to privileged information.

"I guess maybe I'm not on the right committees or something, because I literally can't think of an example where I had insider information," he said. "With leadership, you could make that argument because the speaker controls the agenda, controls what comes to the floor."

Insider caught up with Brown at the Capitol just as he was leaving a meeting with Schumer and several other Senate Democrats on hammering out a common proposal on banning stock trades.

Asked about the STOCK Act as it currently stands, Brown indicated that he wasn't that impressed with it. After all, he put forward an amendment to ban lawmakers from stock trading entirely in 2012.

"Well, it's a little more disclosure," he said of the existing STOCK Act. "But the benefits didn't stop David Perdue from being a full time day trader in the Senate."

Brown added: "Let's just say it diffused some public anger, but subsequently, it really wasn't very impressive."

The New York Times reported in 2020 that Perdue — who ultimately lost his re-election to Ossoff — made nearly 3,000 individual stock trades during his first term in office, including nearly 20 in a single day.

Perdue's successor, Ossoff, is now a leader in the movement to ban stock trading for lawmakers entirely.

Brown was relatively tight-lipped when Insider asked how present talks on banning stock trading were going.

"I don't have much comment about that," he said. "It's internal, inner machinations and you can make anything of it."

Brown did offer that Democratic senators were "getting closer" to a common proposal.

"That's why you have talks, right?" he said.

Jeff Merkley is the author of the Ban Conflicted Trading Act, among the most co-sponsored bills to ban members of Congress from trading stocks.

Asked about the impact of the 2012 law during a phone interview, Merkley praised Gillibrand for helping to clarify that members of Congress are subject to insider trading prohibitions and for creating the reporting requirements that have allowed the public to scrutinize trades.

He then noted his and Brown's amendment from a decade ago to ban lawmakers from holding individual stocks.

"Sherrod Brown and I put forward an amendment to say it's not enough; insider trading is very hard to demonstrate," Merkley said. "Senators shouldn't be holding individual stocks at all."

But the Senate defeated that amendment, with 26 in favor and 73 against.

"We've been reintroducing the bill through the last three legislative cycles, and with each scandal it gets a little more attention," Merkley said.

He also offered further details of the progress of ongoing talks between several Democratic senators aimed at finding a common stock trading ban proposal that transcends the differences between the myriad different stock trading ban proposals that have come forward.

"I've had my staff bring together what we've called the Unity Team," Merkley said. "Let's have a bill we can all sign on to and really try to get this on the floor and get it passed."

"There's some complicated pieces we're still trying to understand the details of," he said, adding that members are still discussing the timing of the implementation of a ban, as well as whether that ban should apply to lawmakers' spouses.

I spent 2 weeks in India. A highlight was visiting a small mountain town so beautiful it didn't seem real.

I spent 2 weeks in India. A highlight was visiting a small mountain town so beautiful it didn't seem real.  I quit McKinsey after 1.5 years. I was making over $200k but my mental health was shattered.

I quit McKinsey after 1.5 years. I was making over $200k but my mental health was shattered. Some Tesla factory workers realized they were laid off when security scanned their badges and sent them back on shuttles, sources say

Some Tesla factory workers realized they were laid off when security scanned their badges and sent them back on shuttles, sources say Essential tips for effortlessly renewing your bike insurance policy in 2024

Essential tips for effortlessly renewing your bike insurance policy in 2024

Indian Railways to break record with 9,111 trips to meet travel demand this summer, nearly 3,000 more than in 2023

Indian Railways to break record with 9,111 trips to meet travel demand this summer, nearly 3,000 more than in 2023

India's exports to China, UAE, Russia, Singapore rose in 2023-24

India's exports to China, UAE, Russia, Singapore rose in 2023-24

Copyright © 2024. Times Internet Limited. All rights reserved.For reprint rights. Times Syndication Service.