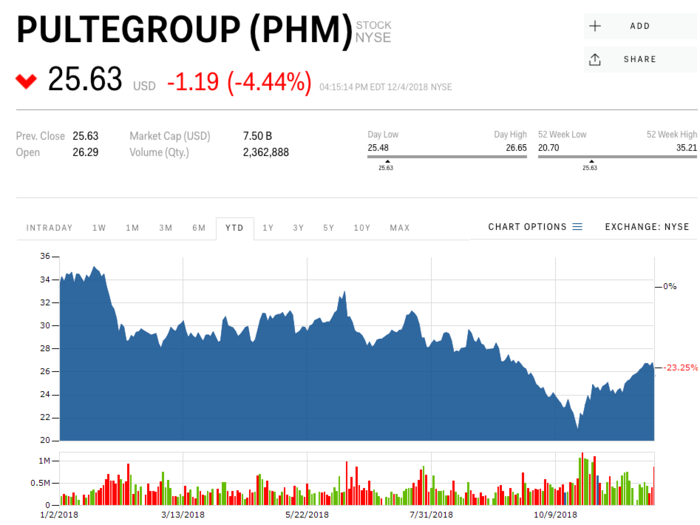

Ticker: PHM

Short interest: $747 million

Short interest change in 2018: +$136.2 million

Year-to-date performance: -23%

Source: S3 Partners

Ticker: LEN

Short interest: $717 million

Short interest change in 2018: +$368.9 million

Year-to-date performance: -37%

Source: S3 Partners

Ticker: DHI

Short interest: $347 million

Short interest change in 2018: +$144.3 million

Year-to-date performance: -29%

Source: S3 Partners

Ticker: TPH

Short interest: $277 million

Short interest change in 2018: +$103.2 million

Year-to-date performance: -34%

Source: S3 Partners

Ticker: TOL

Short interest: $235 million

Short interest change in 2018: +$107.1 million

Year-to-date performance: -32%

Source: S3 Partners

Ticker: LGIH

Short interest: $190 million

Short interest change in 2018: +$127.4 million

Year-to-date performance: -46%

Source: S3 Partners

Ticker: NVR

Short interest: $143 million

Short interest change in 2018: +$85.9 million

Year-to-date performance: -28%

Source: S3 Partners

Ticker: KBH

Short interest: $94 million

Short interest change in 2018: +$82.3 million

Year-to-date performance: -38%

Source: S3 Partners

Ticker: BLD

Short interest: $83 million

Short interest change in 2018: +$33.3 million

Year-to-date performance: -37%

Source: S3 Partners

Ticker: IBP

Short interest: $77 million

Short interest change in 2018: +$8.2 million

Year-to-date performance: -54%

Source: S3 Partners

6 Lesser-known places to visit near Mussoorie

6 Lesser-known places to visit near Mussoorie

7 Snacks that won't increase your cholesterol

7 Snacks that won't increase your cholesterol

Watch: Lord Ram Lalla's forehead illuminates with 'Surya Tilak' on the occasion of Ram Navami

Watch: Lord Ram Lalla's forehead illuminates with 'Surya Tilak' on the occasion of Ram Navami

Copyright © 2024. Times Internet Limited. All rights reserved.For reprint rights. Times Syndication Service.