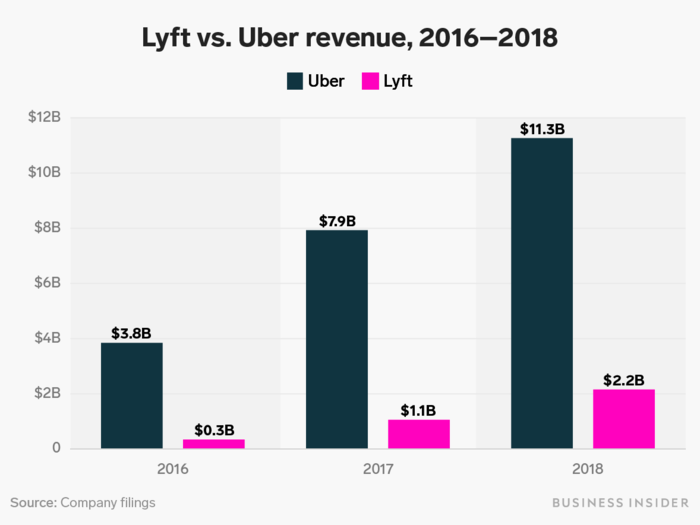

Uber's revenue is still growing like crazy, up to $5.2 billion in 2018 compared to Lyft's $600 million.

There's still plenty of room for growth, though. Americans spend $1.2 trillion annually on personal transportation, according to Tom White, an analyst at D.A. Davidson, who launched coverage of Lyft last month.

In a nutshell, gross bookings is the total Uber or Lyft charge from riders, before paying drivers, which is easily one of the biggest expenses for both companies. They both calculate the exact bookings line slightly differently (Uber includes Uber Eats, for example), but for showing directionality, it's a useful metric to investors.

"Our long-term valuation framework for Lyft assumes that the company achieves a 31.4% bookings share by 2029 (vs. an estimated 14.9% share today)," D. A. Davidson's White said in his initiation report.

Lyft, however, warned investors in its IPO filing that it might never make a profit. Since trading began at the end of March, shares of Lyft have fallen more than 26% from their first prices.

Revenue, of course, is meaningless without knowing what costs a company has to spend that income on.

"We believe there could be continued pressure on LYFT shares while investors wait for Uber's roadshow and dig further into the full financial metrics," Daniel Ives, an analyst at Wedbush, said in a note to clients this week. "In our opinion the battle for market share will be balanced going forward. "

I spent $2,000 for 7 nights in a 179-square-foot room on one of the world's largest cruise ships. Take a look inside my cabin.

I spent $2,000 for 7 nights in a 179-square-foot room on one of the world's largest cruise ships. Take a look inside my cabin. Colon cancer rates are rising in young people. If you have two symptoms you should get a colonoscopy, a GI oncologist says.

Colon cancer rates are rising in young people. If you have two symptoms you should get a colonoscopy, a GI oncologist says. Saudi Arabia wants China to help fund its struggling $500 billion Neom megaproject. Investors may not be too excited.

Saudi Arabia wants China to help fund its struggling $500 billion Neom megaproject. Investors may not be too excited. Catan adds climate change to the latest edition of the world-famous board game

Catan adds climate change to the latest edition of the world-famous board game

Tired of blatant misinformation in the media? This video game can help you and your family fight fake news!

Tired of blatant misinformation in the media? This video game can help you and your family fight fake news!

Tired of blatant misinformation in the media? This video game can help you and your family fight fake news!

Tired of blatant misinformation in the media? This video game can help you and your family fight fake news!

Copyright © 2024. Times Internet Limited. All rights reserved.For reprint rights. Times Syndication Service.