The coworking company was last privately valued at $47 billion. Then, its filing with the Securities and Exchange Commission revealed billions in losses, a huge collection of leases, and plans to continue spending aggressively.

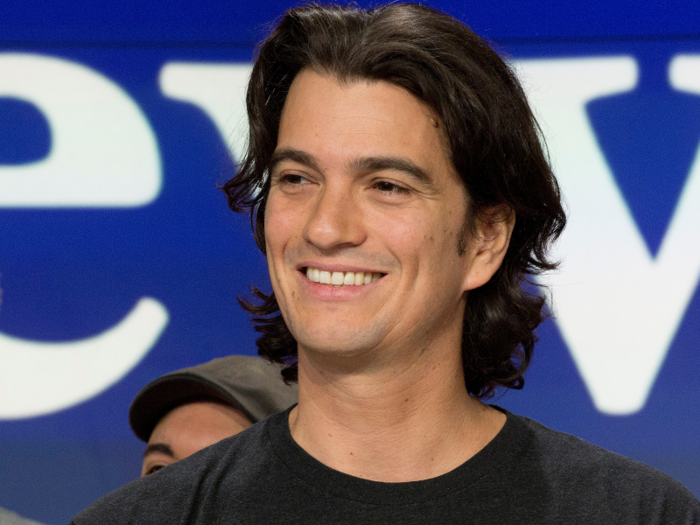

Filings also revealed that CEO and cofounder Adam Neumann owned several of the buildings leased by WeWork. According to documents in the filing, WeWork's' parent company, The We Company:

The IPO paperwork revealed that WeWork loaned CEO Adam Neumann $7 million in 2016, which he paid back in 2017.

WeWork also loaned several million each to three other executives, all of which was paid back except for a $0.6 million loan to Artie Minson, which was forgiven.

WeWork also loaned millions to We Holdings LLC, of which Neumann is a managing member.

The Wall Street Journal reported that Neumann cashed out $700 million in stock options before the company's IPO, an unusual move that raised eyebrows as founders typically wait until after their startup goes public if they believe the stock's value will increase.

Previous reports confirmed that Neumann made millions through leasing his buildings in New York and San Jose to WeWork.

Adam Neumann, like many startup CEOs, holds shares that will give him extra votes. His stock was worth 20 votes per share, twice as many as votes held by other CEOs.

According to the IPO filing, the We Company did not have a single woman on its 7-person board of directors.

The bank withdrew from the IPO after losing the lead underwriter role in the deal.

Yang shared a Business Insider article in which an NYU professor called the company "WeWTF."

For what it’s worth I agree with @profgalloway that WeWork’s valuation is utterly ridiculous https://t.co/CiqLasP5Sk if they are a tech company so is UPS. UPS trades for 1.4x revenue not 26x.

— Andrew Yang (@AndrewYang) August 21, 2019

In early September, WeWork brought Harvard Business School professor Frances Frei on board after the company was criticized for a lack of female directors.

At Uber, Frei had been charged with fixing a toxic corporate culture.

Nearly a dozen HR officials left the company in the year leading up to the S-1 filing, according to The Information's Cory Weinberg, including the department interim head, the senior director of talent acquisition, and the head of people strategy.

Before that, at least five more top HR officials left between 2015 and last year, including the chief HR officer. Several reported disagreements with Neumann. At least two former HR officials filed sexual harassment claims against the company, according to the report. One of these cases claimed the equity awards went almost exclusively to men.

Ahead of the IPO filing, WeWork officially rebranded as The We Company, and paid CEO Neumann almost $6 million for trademark rights as managing member of We Holdings, LLC.

After this came out in the IPO paperwork , the deal was widely criticized. Soon after, WeWork released an updated filing stating the Neumann returned the money to the company, which retained its trademark on "We."

The Wall Street Journal and Bloomberg reported on September 5 that The We Company was considering cutting its IPO valuation from $47 billion to $20 billion. It also began thinking about delaying the IPO.

WeWork's largest outside shareholder urged the company to postpone the IPO due to the lack of investor interest even after the company halved the IPO valuation it was seeking. Softbank has invested more than $10 billion in WeWork, its latest valued the company at $47 billion.

The company was reportedly considering reducing Neumann's voting power of 20 votes per share.

The company and advisers also considered removing Rebekah Neumann from her role in naming a successor if her husband died or became unable to run the company.

In an updated S-1 filing, the company said that it would hire a lead independent director by the end of the year, and another next year. It also announced plans to list its shares on the Nasdaq index.

WeWork slashed Neumann's voting power from 20 votes per share to 10 votes per share.

Neumann agreed to a 10% limit on the amount of stock he can sell in the second and third years after the IPO, and said that he will pay back profits from real estate deals with the company.

Investor pushback led WeWork to remove Rebekah's Neumann's influence from the company, according to an updated September 13 SEC filing.

Reuters reported on September 13 that WeWork did not feel confident that the changes in governance would convince investors concerned about its path toward profitability to reconsider.

On September 16, Reuters reported that the IPO was indefinitely delayed until at least October.

"The We Company is looking forward to our upcoming IPO, which we expect to be completed by the end of the year," WeWork said in a statement.

After delaying its IPO, WeWork's bonds fell as much as 7 cents on the dollar, the most since they were issued in April 2018.

The Wall Street Journal's Eliot Brown reported that Neumann asked his staff to fire 20% of employees each year as a cost-cutting measure, and his wife Rebekah Neumann asked that some employees be fired after meeting them for just a few minutes.

The Journal also reported that Neumann once announced layoffs and then sent around tequila shots before Darryl McDaniels of Run-DMC burst into the room for a surprise concert.

The piece also detailed Neumann's alleged marijuana use and how his love of flying high once resulted in a private jet being recalled in Israel after the plane's crew discovered marijuana hidden in a cereal box onboard.

Poor WiFi security allowed one WeWork tenant to view private information including bank accounts details and drivers' licenses from other companies in the building.

WeWork's chief investment officer of its ARK real-estate fund, Wendy Silverstein, resigned in mid September. She told The Real Deal that she left to care for her elderly parents and that her departure did not have to do with the company's recent IPO struggles.

She was one of many high-profile exits from WeWork in the past year.

The former WeWork executive, Richard Markel, described a "cultish" culture of endless alcohol and mandatory sleepovers until he was pushed out of the company. He is now in private arbitration with WeWork, Business Insider reported on September 20.

Some WeWork board members are now in favor of pushing out CEO Adam Neumann, according to The Wall Street Journal. The board is meeting today, and there may be a push to make Neumann WeWork's non-executive chairman and remove him as CEO.

Officials linked with WeWork's biggest backer, SoftBank, are in favor of Neumann leaving.

Neumann has not yet agreed to step aside as CEO of WeWork parent We Company, and there is no certainty he will do so, sources familiar with the discussions told Reuters on Monday.

A board challenge planned by investors, including SoftBank Group Corp and Benchmark Capital, has been put on hold until these discussions produce an outcome, the sources added.

Tesla tells some laid-off employees their separation agreements are canceled and new ones are on the way

Tesla tells some laid-off employees their separation agreements are canceled and new ones are on the way Taylor Swift's 'The Tortured Poets Department' is the messiest, horniest, and funniest album she's ever made

Taylor Swift's 'The Tortured Poets Department' is the messiest, horniest, and funniest album she's ever made One of the world's only 5-star airlines seems to be considering asking business-class passengers to bring their own cutlery

One of the world's only 5-star airlines seems to be considering asking business-class passengers to bring their own cutlery The Future of Gaming Technology

The Future of Gaming Technology

Stock markets stage strong rebound after 4 days of slump; Sensex rallies 599 pts

Stock markets stage strong rebound after 4 days of slump; Sensex rallies 599 pts

Sustainable Transportation Alternatives

Sustainable Transportation Alternatives

Copyright © 2024. Times Internet Limited. All rights reserved.For reprint rights. Times Syndication Service.