- Home

- finance

- Wall Street

- The Rise And Fall Of Steve Cohen

The Rise And Fall Of Steve Cohen

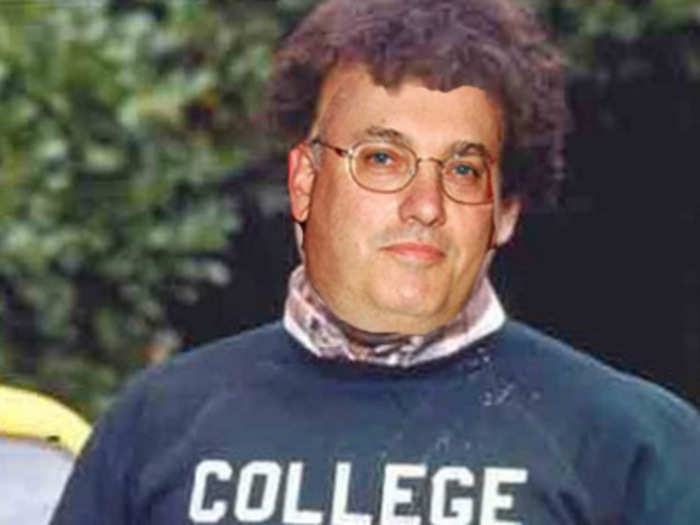

Steven Cohen originally hails from Long Island He grew up in a middle class family and had a lot of siblings.

In high school, the billionaire worked at a supermarket.

Cohen was a "fruit boy" at Bohack supermarket where he made a $1.85 an hour.

He quit that job because he was making more at the poker table.

He graduated from Wharton with a degree in economics.

He studied economics at the Wharton School of Business at the University of Pennsylvania.

Outside of class, he traded stocks and beat his friends at poker. He was in a fraternity, too.

According to a 2003 Bloomberg Businessweek profile, Cohen loved stocks so much that he would trade them in between his classes.

In his spare time, he would also beat all of his friends at poker.

He joined the Zeta Beta Tau fraternity.

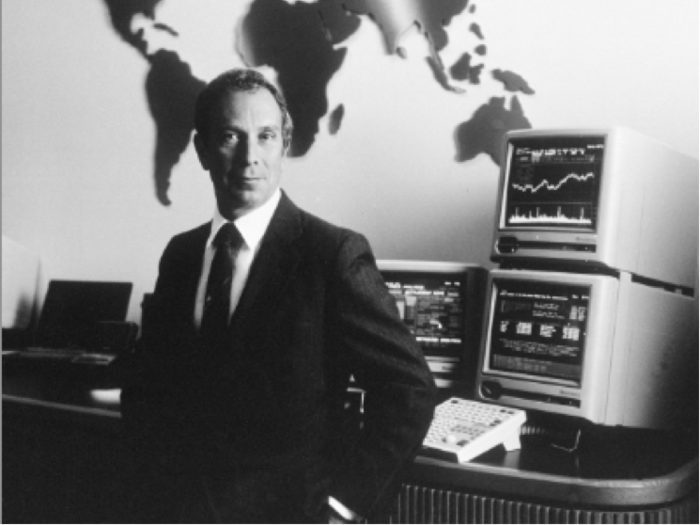

He started his career on Wall Street at Gruntal & Co, and essentially became a legend on his first day.

After graduating in 1978, he went to Wall Street to work for at boutique investment banking and brokerage firm Gruntal & Co. as a junior trader in the options arbitrage group.

We've all heard the Wall Street legend that he made $8,000 his first day and was bringing in around $100,000 each day.

By 1984, he started running his own group at Gruntal & Co.

He did this until he launched his own hedge fund.

Then in 1992, he launched SAC Capital in the same building as Gruntal.

In 1992, Cohen rented office space nine floors above Gruntal to start his own $25 million hedge fund, SAC Capital.

Some of his traders from Gruntal joined him there.

SAC is headquartered in Stamford, Connecticut.

The super-secretive SAC Capital is one of those closely followed hedge funds on Wall Street. Here are some details about it what the trading floor is like:

Here's how the Wall Street Journal described the trading floor in a 2006 article:

The 20,000-square-foot trading room at SAC Capital Advisors, chilled to 70 degrees to keep traders alert, was hushed. Mr. Cohen, who sits at its center, likes it that way. Phones blink rather than ring. Computer hard drives had been moved off the trading floor to eliminate hum. Rows of traders wearing SAC fleece jackets watched Mr. Cohen nervously, waiting for an order to sell shares.

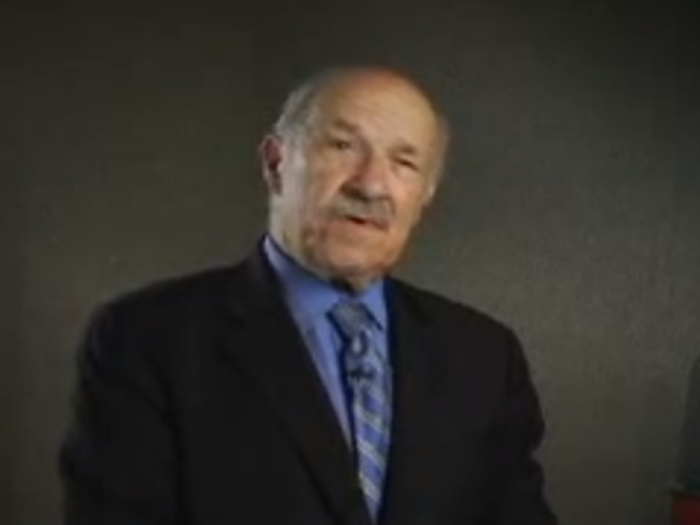

Another interesting tid-bit about SAC is Cohen hired an in-house psychiatrist for his traders.

In the early 1990s, Cohen hired psychiatrist Dr. Ari Kiev, who has worked with Olympians, to coach his traders in coping with stresses from the market.

He died in November 2009 at the age of 75.

SAC makes up a significant chunk of trading on the Street.

Back in 2006, the WSJ reported that SAC's trading accounted for 2% of all of the stock market activity.

As you can imagine, this would make them a desired client on the Street.

In 1998 and 1999, SAC delivered 70% annual returns.

That's when SAC and Steven Cohen became household names on Wall Street.

Then, in 2000, his hedge fund bet against tech stocks and brought in 70% returns again!

Cohen has been married two times. In 1979, he got married to his first wife. The marriage didn't last long.

When he was 23 years old, Cohen married Patricia Finke.

They had two children together and got divorced in 1988.

In 2009, Cohen's ex-wife Patricia alleged that he hid millions from her and some of that money had come from insider trading in RCA shares back in 1985 before it was acquired by General Electric.

The case was ultimately dismissed in 2011.

He met his current wife through a dating service.

Cohen met his wife Alexandra (Alexandra Garcia) through a dating service in 1991 after he divorced his first wife.

Alexandra was a single mom of Puerto Rican descent who grew up in Washington Heights.

They have four children together.

Source: Vanity Fair

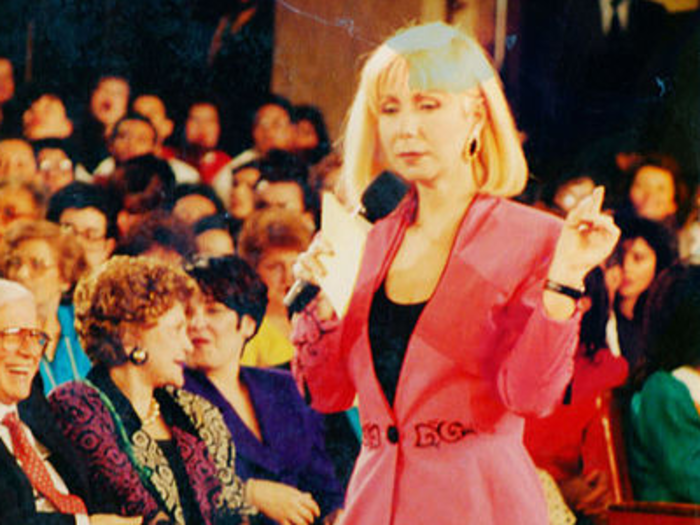

Back in the 90's, Cohen made an appearance on a Hispanic talks show where he talked about sleeping with his ex when he was dating Alex.

It's widely known that Cohen is press-shy and super-secretive.

However, back in 1992 he made an appearance on an incredibly famous Hispanic talk show, "Cristina" (she's like a Latin American Oprah) in an episode called "He Acts Like Her Husband, Too."

During the episode, Cohen talked about sleeping with his ex-wife when he started dating Alex, his current wife. He stopped when he got engaged.

A few more interesting facts — he collects tons of art, and hates being called 'Stevie'

On the Street, Cohen is often referred to as "Stevie." He apparently hates that nickname.

Cohen has been collecting art since 2000.

His impressive art collection, which is said to be worth around $1 billion, includes pieces by Monet, Picasso, Jasper Johns, Jeff Koons, Damien Hirst, Willem de Kooning, Francis Bacon and Andy Warhol, according to a 2010 Vanity Fair profile.

Cohen also loves himself some poker and has a stake in the New York Mets (a team he watched as a kid).

He also may or may not own a tattooed pig and apparently really likes Guy Fieri.

The pig is a walking piece of art by Belgium-born artist Wim Delvoye.

We're not sure if Cohen's interest in Guy Fieri is remotely artistic, but according to the NY Post, Cohen paid Fieri $100,000 to cook for him.

The Cohen family lives in this jaw-dropping massive Connecticut mansion and just bought a $60 million Hamptons house.

The Cohens live in a 35,000 square foot home on 14 acres in Greenwich, Connecticut. They purchased the jaw-dropping mansion in 1998 for $14 million.

The lavish estate features a basketball court, an indoor pool and a 6,734 square-foot ice skating rink.

He also bought a $60 million Hamptons house this spring.

Just as Cohen bought his Hamptons house in March, SAC also paid a $616 million fine for illegal conduct at an SAC subsidiary.

The charges were related to the insider trading case against former SAC portfolio manger Mathew Martoma, who was charged in what is believed to be "the most lucrative" insider trading scheme ever the year before.

Several media reports have identified "Portfolio Manager A" in the complaints against Martoma as Steve Cohen.

Cohen told investors in a client conference call that he's confident he acted appropriately. He has not been charged. He might not ever be charged.

A month later, Cohen put his NYC penthouse on sale for $115 million.

He bought the apartment for $24 million in 2005, and had late architect Charles Gwathmey completely transform the place.

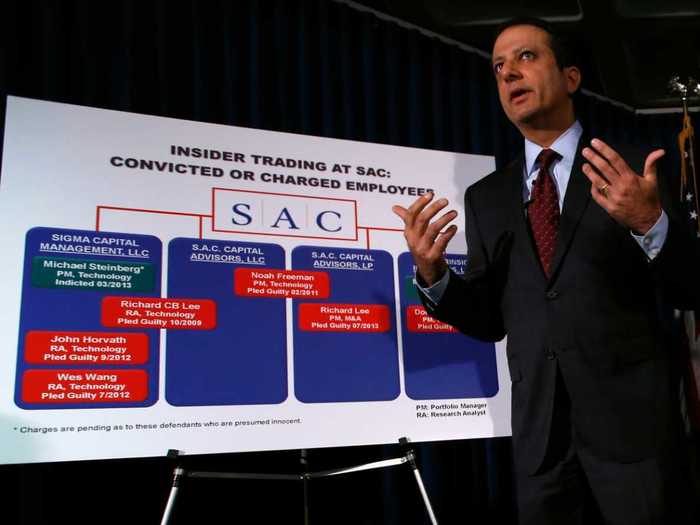

In July the Department of Justice indicted SAC Capital for insider trading amid a load of investor redemption requests.

The firm itself was indicted on criminal charges, not Cohen, and plead not guilty.

What Cohen WAS charged with, was 'failure to supervise' his traders — an SEC violation that could bar him from the securities industry for life.

At the time, investors had requested to pull around $3 billion out of the firm, according to estimates.

After that, reports of an epic settlement with the Feds started surfacing.

The WSJ reported that it would be over $1 billion.

Meanwhile, Cohen shut down SAC's London office, paid his traders more to stem the flow of defections to other funds, and sold some Warhol paintings and a Gerhard Richter.

The today, a settlement was announced. SAC would plead guilty to insider trading charges, pay $1.8 billion, and return all outside investor money.

This effectively ends SAC's impressive run as a hedge fund, turning the firm into a family office.

It remains to be seen, yet, what will happen to Steve Cohen. The SEC's 'failure to supervise' case is ongoing, and the FBI is still going through Cohen's own trades looking for traces of insider trading.

So Cohen could fall even farther.

Still, after all this, Cohen is fabulously wealthy.

With insider trading probes ongoing, Cohen could fall farther still — but his $9 billion fortune could cushion some of the impact.

Want to read a slightly more positive Wall Street bio?

Popular Right Now

Advertisement