Former Reserve Bank of India (RBI) governor Raghuram Rajan BCCL

- Former RBI governor Raghu Rajan believes that India’s latest edition of GDP data is only going to worsen once the impact of the pandemic on the informal sector is accounted for.

- He warns that the longer the remedial measures aren’t implemented, the harder it will be to recover.

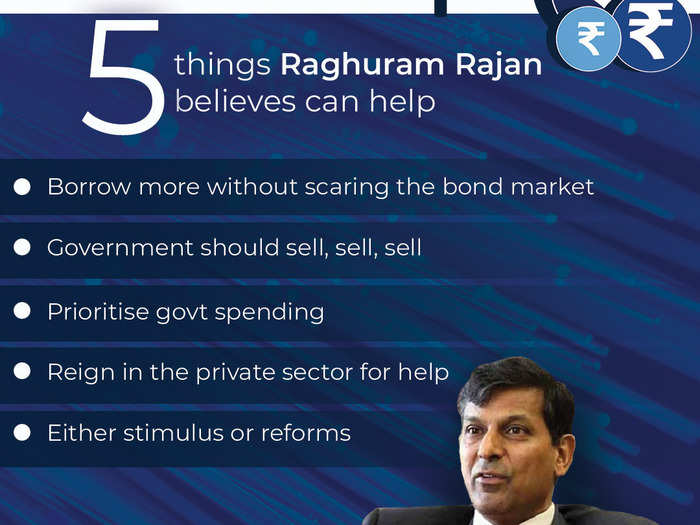

- In order for the Indian economy to recuperate some of its losses and sustain growth, here are five things that Rajan recommends the government of India should do.

The former governor of the Reserve Bank of India (RBI) Raghuram Rajan believes that India’s latest GDP data should ‘alarm us all’. According to him, the numbers are likely to look worse when the estimates of the damage to the informal sector roll in.

“The pandemic is still raging in India, so discretionary spending, especially on high-contact services like restaurants, and the associated employment, will stay low until the virus is contained. Government-provided relief becomes all the more important,” he wrote in a post shared on

LinkedIn, pitching for an economic stimulus as soon as possible.

“So government officials who hold out the possibility of a stimulus when India finally contains the virus are underestimating the damage from a more shrunken and scarred economy at that point,” he pointed out.

Here are five things that Raghuram Rajan believes that the Government of India can do to reduce the coronavirus pandemic’s impact on the economy:

Five things that Raghuram Rajan believes can help India's GDP stabilise

BI India/Raghuram Rajan's LinkedIn post

1. Borrow more without scaring the bond market

BCCL

Raghuram Rajan recommends that India has the option to borrow more, but it needs to be committed to returning to fiscal viability in the medium term. “For example, by setting future debt reduction targets through legislation, and committing to honest and transparent fiscal numbers with a watchdog independent fiscal council,” he wrote.

2. Government should sell, sell, sell

BCCL

To get more money on hand, the government should have its public firm shares ready for on-tap sale in order to take advantage of high levels of activity in the market, according to Raghuram Rajan.

“The current period of buoyancy already looks like a missed opportunity,” he said, adding that many public sector entities have surplus land holding in prime areas that can be prepared for sale.

Even if a sale is not made immediately, preparation for the same will lend confidence to the bond market.

3. Prioritise government spending

BCCL

The government will need to spend, but where it chooses to spend will be even more important for the sustained recovery of the Indian economy. Raghuram Rajan believes that since Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA) is a “tried and tested means of providing rural relief,” funds be made available as and when required.

For those poor households which do not have access to MGNREGA, the government should provide direct cash transfers (DCTs), he recommends.

4. Rein in the private sector for help

BCCL

The private sector has more capital at hand, which is why, according to Raghuram Rajan, bigger companies should help smaller ones get back on their feet — especially in cases where it helps the overall supply chain.

“Cash-rich platforms like Amazon, Reliance, and Walmart could help smaller suppliers get back on their feet, even funding some of them,” Rajan cited as an example.

5. It’s either stimulus or reforms

BCCL

Given the impact of the coronavirus pandemic on India’s GDP, Raghuram Rajan believes that a stimulus will be needed — especially in sectors like construction, which can create multiple jobs and increase the demand in other associated sectors like cement and steel.

Here, he says, that the centre should help the state governments with finances for them to spend more on infrastructure development.

Reforms can also be a type of stimulus. Like the announcement of Atmanirbhar Bharat, just a timeline or the indication of upcoming reforms can boost investor sentiment, according to Rajan.

“The world will recover earlier than India, so exports can be a way for India to grow,” he said. However, in order to take advantage of that, Rajan believes that India needs to undo its recent tariffs increase so that inputs can again be imported at a low cost. This will boost the margins for companies using those inputs and shipping out value-added products.