- A total of 7,422 crore digital payment transactions were recorded in the fiscal year 2022, the Indian government has revealed.

- The value of digital payments in India will grow three-fold to touch $1 trillion in the next four years, as per CLSA estimates.

- UPI was among the most popular digital payments methods in 2022 and its transaction volume doubled compared to previous year.

People across the globe have gotten much more comfortable with digital solutions ever since the world stepped in the lockdown due to the COVID-19 pandemic. In India, too, the inclination towards digital solutions was there, but it gained much more momentum during COVID-19.

The same stands true for digital payments. We were celebrating 2 billion monthly UPI transactions back in October 2020, and now the number has now crossed a whopping 5 billion 16 months later.

According to the ministry of electronics and information technology (MeitY), a total of

7,422 crore digital payment transactions were recorded in the fiscal year 2022, which represents the time frame between April 2021 and March 2022. Meanwhile, a report from Credit Lyonnais Securities Asia (CLSA)

notes that the value of digital payments in India will grow three-fold to touch $1 trillion in the next four years.

“Given increasing online purchases and digital adoption, we expect this to grow to $0.9-1 trillion by FY26, or 30% of Indian consumption,” the report added.

Before we are ready to discuss these expectations, here is how India’s digital payments ecosystem fared in FY2022.

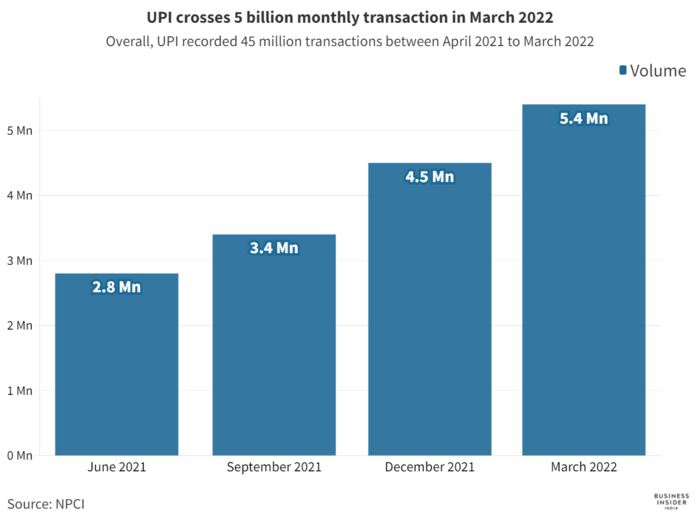

UPI recorded over 45 million transactions in FY2022

BI India

There is no denying that the Unified Payments Interface, or popularly known as UPI, is the most popular digital payments method available in the country at the moment. After all, the system has been designed to enable payments in a matter of seconds.

UPI recorded over 45 billion transactions in the fiscal year 2022, which is nearly double of 22 billion transactions recorded in the previous financial year. The value of these transactions more than doubled from ₹41,03,653 crore to ₹84,17,572.48 crore.

The next thing on the Reserve Bank of India’s (RBI) agenda is to make UPI more inclusive by enabling it for feature phone users and in offline mode. The central bank launched

UPI123Pay earlier this month especially for this purpose.

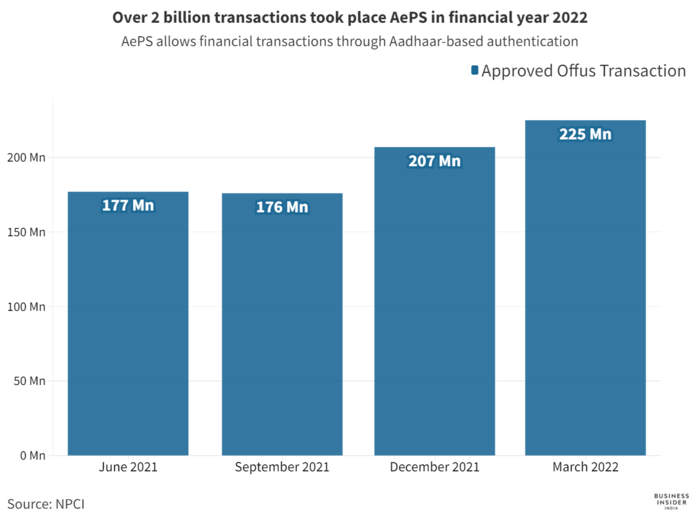

Over 2 billion transactions took place AePS in financial year 2022

BI India

Aadhar Enabled Payment System, or AEPS, is a bank-led payments model that is based on the unique identification number and allows aadhar card holders to make financial transactions through Aadhaar-based authentication.

A total of 2.3 billion transactions worth ₹3,00,38 crore took place through AePS between April 2021 and March 2022, according to the data shared by National Payments Corporation of India (NPCI). In March 2022 alone, 225 million transactions worth ₹28,522 crore took place through AePS.

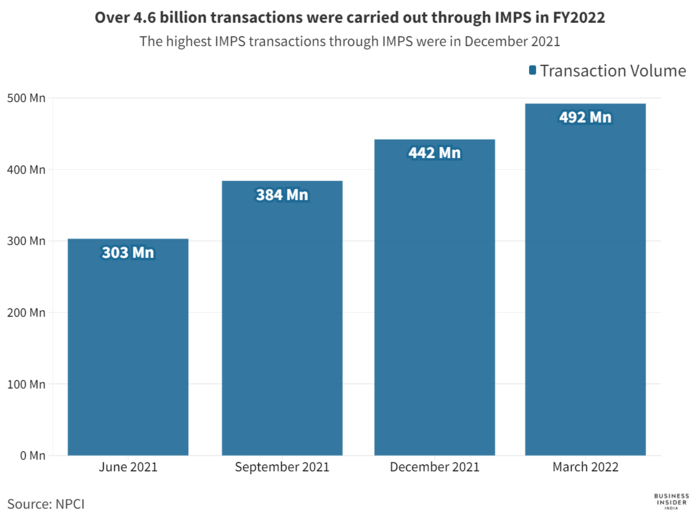

Over ₹37,00,000 crore was transferred through IMPS in FY2022

BI India

Over 4.6 billion transactions worth ₹37,06,363 crore were carried out through IMPS in the financial year 2022. Meanwhile, 3.2 billion transactions worth ₹29,41,495 crore were carried out through IMPS in the previous year.

Immediate Payment Services, or IMPS, is an instant interbank electronic fund transfer service through mobile phone. One can access IMPS through multiple channels like mobile banking, SMS, net banking and even ATM. While there is no cap on the minimum transfer amount, the maximum amount you can transfer per day through IMPS is ₹200,000.

The highest IMPS transactions through IMPS were in December 2021, when ₹3,96,411 crore were transferred through 442 transactions.

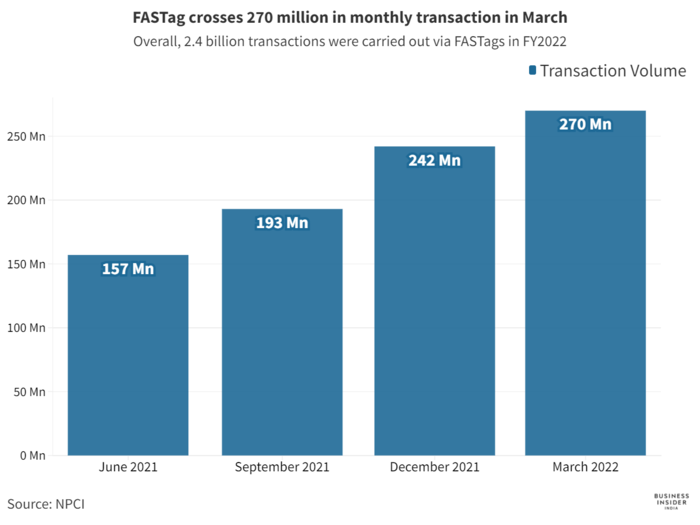

Over 400 million FASTags were issued in FY2022

BI India

FASTag, founded in 2014, is an electronic toll collection system in India that is operated by the National highway Authority of India. It employs Radio Frequency Identification technology to make toll payments directly from a prepaid or a savings account linked to the FASTag.

Overall 435 million FASTags were issued in fiscal year 2022, compared to 256 million in the previous year. Transactions worth ₹38,077 crore were carried out through 2.4 billion FASTags between April 2021 and March 2022. FASTag crossed ₹4,000 crore monthly transaction in March 2022, the highest in the entire year.