BharatPe

- BharatPe will be taking over the scam-hit PMC bank in a joint venture with Centrum Group.

- Former Cashe CEO Ketan Patel will lead MSwipe as the company pivots to helping India SMBs.

- Mastercard has made a strategic investment in Instamojo to strengthen its efforts to help small businesses.

As India celebrated its micro, small and medium enterprises (MSMEs) this week -- as part of the MSME week — the Indian fintech segment had an array of announcements that may help this underserved community. In the last two days, several fintech businesses — big or small — have launched services, products and shared plans on how they plan to help small Indian businesses.

Business Insider compiled a list of such announcements that may end up defining the course of Indian fintech for years to come.

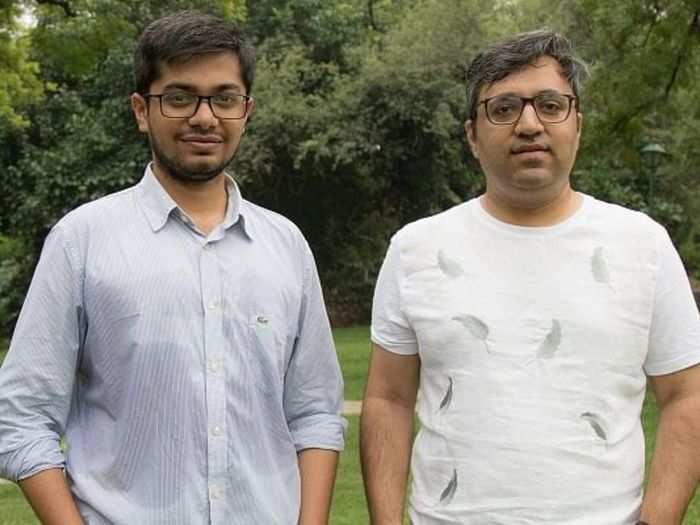

Three-year-old fintech startup BharatPe takes over PMC bank

BharatPe

Delhi-based merchants-focused payment company BharatPe will be taking over the scam-hit Punjab Maharashtra Cooperative (PMC) bank, in a joint-venture with financial services company Centrum Group. The startup’s cofounder Ashneer Grover noted that the duo will be collectively infusing $250 million-$300 million into the bank over the next two years.

Meanwhile, Suhail Sameer, BharatPe’s group president added that the company has studied the small and medium businesses’ (SMB) lending behavior over the last couple of years and knows exactly what criteria to give out loans on to these merchants. Talking at the Business Insider’s

MSME Exchange 2021 he added that they plan to do things differently to provide better offerings to MSME and enable them to grow.

Sachin Bansal introduces open-ended equity scheme

Mylittlefinger/Wikipedia

Navi General Insurance, led by e-commerce biggie Flipkart’s founder Sachin Bansal, has unveiled its plans to launch the cheapest index fund, Navi Nifty50 Index Fund, by July 3. The index, which will close on July 12, will charge an expense ratio of 0.06%.

Digit Insurance raising $200 million

Digit

Insurtech startup Digit Insurance, which was the first startup to enter the unicorn club in 2021, is planning to raise $200 million in its upcoming funding round. Sequoia Capital India, IIFL Alternative Asset Managers, along with existing investor Faering Capital is expected to participate in the round. The company made this announcement on July 2 and the fundraise is subject to the Insurance Regulatory and Development Authority (IRDAI) approval.

Former Cashe CEO Ketan Patel to lead Mswipe

BCCL

Merchant payments firm Mswipe has appointed former Cashe CEO Katan Patel as its new chief executive officer (CEO). The current CEO Manish Patel, who founded the company in 2011, will be elevated to the position of managing director (MD). The leadership shuffle will help the company pivot its business model from a merchant-focused payments firm to a digital small and medium enterprise (SME) bank.

Mastercard invests in Instamojo to strengthen India’s MSMEs

Instamojo

American financial services company Mastercard has made a strategic investment in payments and online selling platform Instamojo.The investment is expected to boost both the companies efforts to support India’s micro, small and medium enterprises (MSME) as well as the gig workers in the country.

Muthoot Fincorp acquires majority stake in Paymatrix

Paymatrix

Gold loan company Muthoot Fincorp has acquired 54% majority stake in Hyderabad-based fintech startup Paymatrix. This acquisition has been made by buying out the other shareholders in the company.

ClearTax rebrands itself as Clear to cater to a wider offering

Clear

ClearTax, the fintech startup that initially focused on providing tax-related services, has rebranded itself as Clear to target a wider array of services like invoices, wealth management and credit. “Today we make SaaS [software-as-a-service] for taxes, invoices for connected businesses and offer wealth management. Clear captures our huge ambitions to serve Indians in the areas of invoicing, wealth management, credit, and much more,” Clear’s founder and CEO Archit Gupta said.

UK’s Tide plans to invest ₹1,000 crore in India to help SMEs

Tide

UK-based fintech platform Tide has announced its plans to invest ₹1,000 crore in India in order to expand its geographical footprint into the country by 2022. The platform has about 350,000 SMEs in the UK alone. The company will help Indian businesses scale operations and help Indian SMEs by saving time while running their businesses.