- PharmEasy plans to raise ₹ 6,250 crore through its public issue.

- The company will use this capital to acquire new businesses and repay loans.

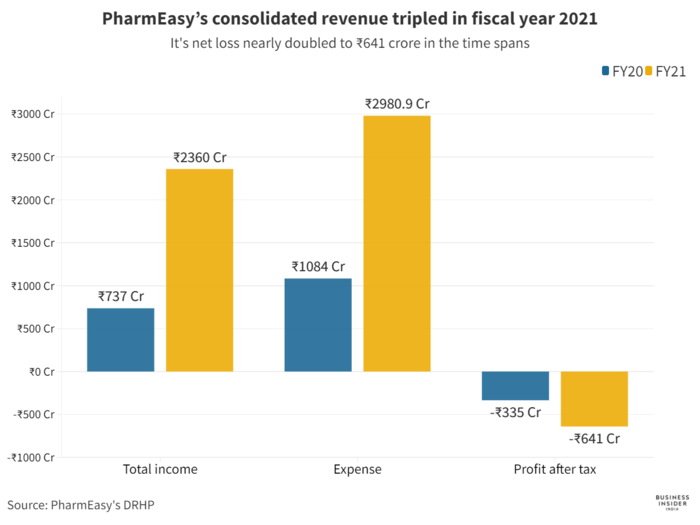

- Its consolidated revenue tripled to ₹2360 crore in the financial year 2021.

PharmEasy is all set to make its public debut to raise ₹ 6,250 crore in an initial public offering (IPO).

The online pharmacy startup, run by API Holdings, filed its draft red herring prospectus (DRHP) with the market regulator Securities and Exchange Board of India (SEBI) on November 10.

The company will be raising this amount as a fresh issue and none of its existing stakeholders would be selling their shareholdings.

PharmEasy, in consultation with the bankers to the issue, may consider a private placement aggregating up to ₹1,250 crore. If such placement is completed, the fresh issue size will be reduced.

PharmEasy may acquire new businesses

PharmEasy

PharmEasy would use the proceeds from this IPO to prepay or repay its outstanding debt of ₹1,929 crore, the DRHP highlighted. The company will be looking to invest ₹1,259 crore to fund organic growth initiatives.

It has also set aside another ₹1,500 crore would be spent on inorganic growth initiatives through acquisition and organic growth initiatives.

PharmEasy has already made three big acquisitions this year to grow its business. This includes rival Medlife, publicly listed diagnostics chain Thyrocare and Aknamed, which is a cloud-based hospital supply chain management startup.

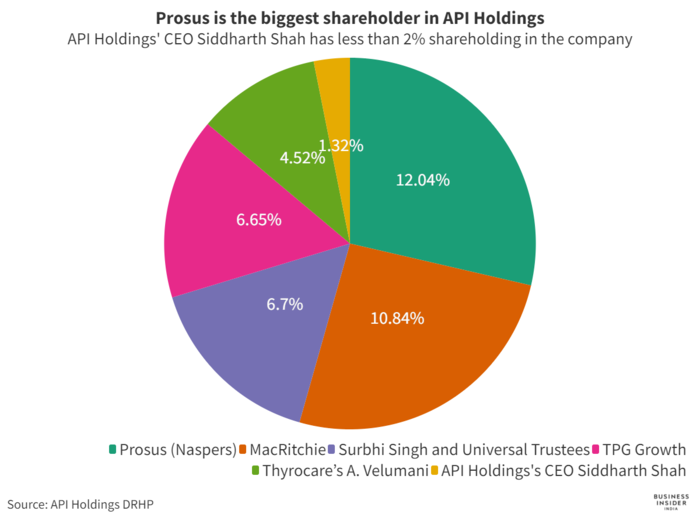

Prosus is the biggest shareholder at API Holdings

BI India

The seven-year-old startup has raised over a billion dollars to acquire these businesses and for other growth initiatives, according to business intelligence platform Crunchbase.

Naspers is the largest stakeholder in API Holdings, with a shareholding of 12.04%. It is followed by MacRitchie Investments with 10.84%.

The company’s cofounder and chief executive Siddharth Shah has 1.32% shareholdings in the company.

PharmEasy's revenue triples to₹2360 crore

BI India

PharmEasy’s consolidated revenue closed ₹2360 crore in the financial year 2021, which is nearly three times higher than the previous fiscal years. Its net loss has also nearly doubled to ₹641 crore.

Most of the company’s spending was targeted towards purchase of stock-in-trade, which would increase medicine and medical products PharmEasy sells on its platform. The company spent ₹2,266 crore in this regard, compared to ₹699 crore spent last year.

Another ₹270 crore was spent on employee benefits, which includes salaries and wages, gratuity and more. The company’s other expenses — rent, marketing expenses, legal fee and more — also almost doubled ₹481 crore.

It reported a loss of ₹314 crore in the April-June quarter of 2021, as its revenue reached ₹1207 crore.