- Home

- Enterprise

- Mobile

- The 14 fastest unicorns to reach $1 billion

The 14 fastest unicorns to reach $1 billion

14. Square makes accepting payments easy

13. Zynga used to be the hottest online game service in the world

Time it took to reach $1 billion valuation: 2.88 years

Latest valuation: $2.5 billion (market cap as of Aug. 15)

Total funding to date: Went public in 2011

What it does: Zynga is an online game service provider that created some of the most popular social games such as FarmVille, Mafia Wars, and Zynga Poker. It used to be one of the hottest gaming companies in the world, but lately has been struggling a bit, as its shares lost more than half of their value over the past 18 months. Zynga's founder Mark Pincus returned as CEO in April 2015.

12. Lazada is the Amazon of Southeast Asia

Time it took to reach $1 billion valuation: 2.75 years

Latest valuation: ~$1.12 billion

Total funding to date: $710 million

What it does: Lazada is one of the largest online shopping sites in Southeast Asia. Incubated by Rocket Internet’s Samwer brothers, Lazada targets people in Indonesia, Malaysia, Philippines, and Thailand. Last year it had $154.3 million in revenue, but its net operating loss was $152.5 million.

11. Instacart makes grocery shopping super easy

Time it took to reach $1 billion valuation: 2.58 years

Latest valuation: $2 billion

Total funding to date: $274 million

What it does: Instacart allows users to do online grocery shopping at local stores by sending personal shoppers to pick up and deliver it for you. Users can shop at a variety of local stores like Safeway, Whole Foods, and Costco. Some of the biggest VCs have invested in it, including Kleiner Perkins, Andreessen Horowitz, and Sequoia Capital.

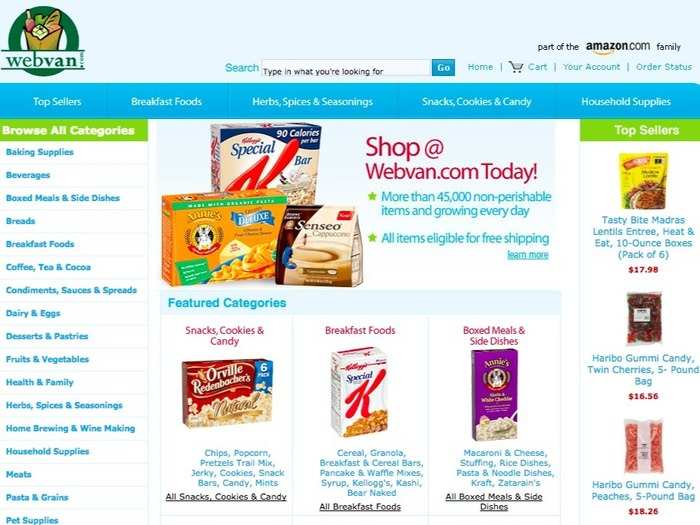

10. Webvan was the Instacart of the 90s

Time it took to reach $1 billion valuation: 2.56 years

Latest valuation: Bankrupt

Total funding to date: $441 million before IPO in 1999

What it did: Similar to Instacart, Webvan delivered groceries, but it did it out of its own warehouses, which cost up to $40 million each. It burned through over $800 million in cash in less than 3 years, and eventually went bankrupt, making it one of the poster children of the bubble dot-com era.

9. Pinterest lets you pin and share images online

Time it took to reach $1 billion valuation: 2.46 years

Latest valuation: $11 billion

Total funding to date: $1.3 billion

What it does: Pinterst is one of the most popular social media sites that let users “pin” photos on their wall and share them with other people. The images include shopping items items, recipes, and travel photos, among many others. It’s projected to have over 50 million active users in the US alone by next year.

8. Hangzhou Kuaidi Technology is the Uber of China

Time it took to reach $1 billion valuation: 2.43 years

Latest valuation: $6 billion

Total funding to date: $950 million

What it does: Hangzhou Kuaidi Technology is a Chinese taxi-hailing app that works similar to the way Uber does. It’s backed by Alibaba and Softbank, two of Asia’s largest tech companies, and is reported to have more than 200 million users.

7. Twitter has loyal users but has seen its growth stall a bit lately

Time it took to reach $1 billion valuation: 2.32 years

Latest valuation: $19 billion (public company)

Total funding to date: Went public in 2013

What it does: Twitter is one of the largest social media sites in the world with over 316 million monthly active users. But user growth seems to have slowed down a bit, which contributed to its share price cutting almost in half over the past 12 months. Recently, it had a management shake-up too, putting cofounder Jack Dorsey back in the interim CEO position.

6. Yello Mobile is a Korean mobile/media company that no one really knows about

Time it took to reach $1 billion valuation: 2.28 years

Latest valuation: $1 billion (public company)

Total funding to date: $100 million

What it does: Yello Mobile is a company comprised of 71 smaller startups, spread across mobile commerce, marketing, and advertising. It rose to fame after receiving $100 million in funding from Formation 8, the VC firm led by Joe Lonsdale, but it still remains largely under the radar in the US.

5. Calient Technologies was worth over $1 billion in 2001, but is now only worth a quarter of that

Time it took to reach $1 billion valuation: 2.02 years

Latest valuation: $247 million

Total funding to date: $428 million

What it does: Calient Technologies builds technology used in cloud networks and data centers. Pitchbook’s internal data shows Calient first raised its seed round in 1999, and in just about two years, got a valuation of $1.1 billion. But its value is estimated at about $247 million, losing roughly 75% of its worth in the last decade.

4. Xiaomi is one of the hottest smartphone companies in the world

Time it took to reach $1 billion valuation: 1.71 years

Latest valuation: $45 billion

Total funding to date: $1.4 billion

What it does: Xiaomi is a Chinese smartphone maker that has a huge loyal fan base, as some even call it the “Apple of China.” In fact, its founder and CEO Lei Jun often dresses in the same blue jeans, black shirt, and tennis shoes Apple’s Steve Jobs used to wear for product announcements. Xiaomi also sells other products like TVs, cameras, and earphones.

3. Akamai Technologies is a content delivery network that handles almost 30% of all Web traffic

Time it took to reach $1 billion valuation: 1.58 years

Latest valuation: $13 billion (market cap)

Total funding to date: Public company

What it does: Akamai’s content delivery network basically makes the internet faster and more reliable for its users. It claims to handle almost 30% of all web traffic, and over 2 trillion daily internet interactions. Akamai went public in October 1999.

2. Groupon may have lost some of its steam, but it’s still a huge company

Time it took to reach $1 billion valuation: 1.46 years

Latest valuation: $2.82 billion (market cap)

Total funding to date: Public company

What it does: Groupon is a social commerce site that was all the rage about five years ago. Its massive popularity propelled Groupon to an IPO, but it’s now lost some of its steam, trading at around $4 — or just about a fourth of its $20 IPO price. But the company claims it has 48.6 million active customers, and it recorded over $3 billion in revenue last year, albeit at a loss of roughly $73 million.

1. Slack is the fastest growing enterprise software ever

Time it took to $1 billion valuation: 1.25 years

Latest valuation: $2.8 billion

Total funding to date: $340 million

What it does: Slack is a business communication app that launched just about two years ago. Over that span, Slack saw crazy growth, reaching 1.1 million daily active users last month. It says it’s expected to hit about $30 million in annual sales, adding roughly $250,000 in revenue every single day.

Popular Right Now

Advertisement