The Reserve Bank of India on Monday released the April 2022 issue of its monthly bulletin. In the latest issue, the central bank has raised several concerns over the rising geopolitical risk factors to India’s economic growth.

The central bank has mentioned that India is currently facing tremors from the shocks coming from geopolitical tensions between Russia and Ukraine which have choked the supply chain and increased commodity prices. This has also led to inflationary pressures, with fuel and food prices putting

pressure on the common man’s pocket.

“The Indian economy is not immune to these negative externalities. The surge in commodity prices is already posing inflation risks, especially through the conduit of surging imports,” the report added.

Notably, RBI’s April 2022 bulletin includes current statistics, monetary policy report for this month and six articles, among other reports. The RBI, however, said views expressed in the article are those of the authors and do not necessarily represent the opinion of the central bank.

These were the major issues raised in the report.

Inflationary pressures are on an upwards trend

BI India

The Reserve Bank of India (RBI) has mentioned that India’s economic activity was regaining momentum in several sectors after the third wave of Covid-19 pandemic. These gains, however, are at risk from disruptive spillovers from geopolitical hostilities.

The central bank highlights that the risks are “increasingly evident” in inflation prints, tightening financial conditions and in terms of trade shock accompanied by portfolio outflows.

“India faces these challenges with improving fundamentals and strong buffers,” the central bank said in the State of the Economy article.

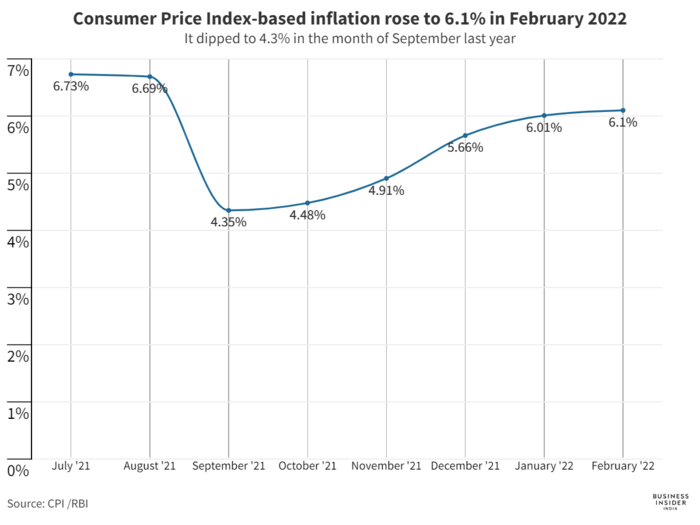

It has also mentioned that the consumer price index (CPI)-based inflation rose to 6.1% in February 2022 — after easing to 4.3% in September 2021 — especially due to the increase in food inflation.

The report added that the Russia-Ukraine conflict poses considerable upside risk to the price of key food items like sunflower oil, wheat and other items, since they account for a significant chunk of the global exports.

Also read: All you need to know about Russia-Ukraine crisis’ impact on Indian kitchens, pharma sector, crude oil prices and more

“Lingering war and sanctions, elevated oil and commodity prices, prolonged supply chain disruptions, accentuated global financial market volatility emanating from monetary policy shifts in major economies, and renewed waves of COVID-19 across countries pose downside risks to the growth and upside risks to the inflation outlook,” the April 2022 bulletin read.

Supply chain pressures could be another pain point

Canva

RBI mentioned that the supply chain pressures, which were expected to ease, are rising once again. There has been a broad jump in the global commodities prices has worsened inflationary pressures across advanced economies and emerging market economies. This is one of the reasons why there is a sharp revision to RBI’s inflation projections.

The ongoing conflict in the Black Sea region and ensuing sanctions have hampered global supply chains and have also sent prices soaring with aluminum and nickel prices rising to the highest level in the last decade, RBI said in its monetary policy report.

“Russia is one of the largest producers of aluminum, widely used in the transportation and construction industry, and of nickel, mostly used for high grade steel manufacturing and in batteries. Further geopolitical tension in the region is likely to aggravate global chip shortage and could impact prices of vehicles and electronic products,” the report added.

The central bank’s staff also relied on an index of supply chain pressures for India (ISPI) to emphasise that an upside risk to inflation and downside risk to exports may persist.

"Our ISPI appears to track supply pressures on the Indian economy quite well, as evident in the close co-movement with indicators such as inflation, the growth of industrial production, export volume and GDP, especially through the period of the pandemic," the report added.

"Looking ahead, coordinated actions are required to fast track consensus-based supply chain protocols, gaps in the physical and digital infrastructure, labour shortages and shortfall in investment in capacity creation," the article added.