- Home

- investment

- news

- 29 members of Congress caught violating a federal law on their stock trades in 2021

29 members of Congress caught violating a federal law on their stock trades in 2021

Dave Levinthal

- Insider and other media have identified numerous US lawmakers not complying with the federal STOCK Act.

- Their excuses range from oversights, to clerical errors, to inattentive accountants.

- Ethics watchdogs - and even some in Congress - want to ban lawmakers from trading individual stocks.

Insider and several other news organizations have this year identified 29 members of Congress who've failed to properly report their financial trades as mandated by the Stop Trading on Congressional Knowledge Act of 2012, also known as the STOCK Act.

Congress passed the law in 2012 to combat insider trading among their own members and force lawmakers to be more transparent about their personal financial dealings. A key provision of the law mandates that lawmakers publicly - and quickly - disclose any stock trade made by themselves, a spouse, or a dependent child.

But many members of Congress have not fully complied with the law. They offer excuses including ignorance of the law, clerical errors, and mistakes by an accountant.

While lawmakers who violate the STOCK Act face a fine, the penalty is usually small - $200 is the standard amount - or waived by House or Senate ethics officials. Ethics watchdogs and even some members of Congress have called for stricter penalties or even a ban on federal lawmakers from trading individual stocks, although neither has come to pass.

Here are the lawmakers who have this year violated the STOCK Act - to one extent or another - during 2021:

Sen. Dianne Feinstein, a Democrat from California

Feinstein was months late disclosing a five-figure investment her husband made into a private, youth-focused polling company.

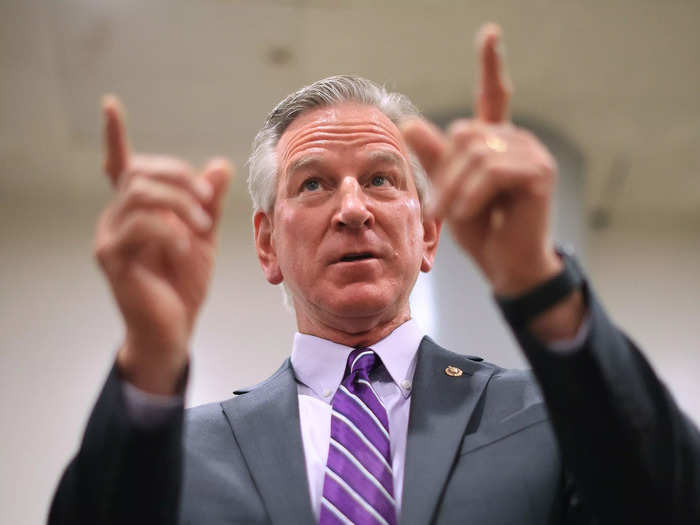

Sen. Tommy Tuberville, a Republican from Alabama

Tuberville was weeks or months late in disclosing nearly 130 separate stock trades from January to May.

Sen. Rand Paul, a Republican from Kentucky

Paul was 16 months late in disclosing that his wife bought stock in a biopharmaceutical company that manufactures an antiviral COVID-19 treatment, the Washington Post reported.

Sen. Mark Kelly, a Democrat from Arizona

Kelly, a retired astronaut, failed to disclose on time his investment in a company that's developing a supersonic passenger aircraft, Fox Business reported.

Rep. Tom Malinowski, a Democrat from New Jersey

Malinowski failed to disclose dozens of stock trades made during 2020 and early 2021, doing so only after questions from Insider. He faces a congressional ethics investigation, which the Committee on House Ethics confirmed in September.

Rep. Pat Fallon, a Republican from Texas

Fallon was months late disclosing dozens of stock trades during early- and mid-2021 that together are worth as much as $17.53 million.

Rep. Diana Harshbarger, a Republican from Tennessee

Harshbarger failed to properly disclose more than 700 stock trades that together are worth as much as $10.9 million.

Rep. Katherine Clark, a Democrat from Massachusetts

Clark, one of the highest-ranking Democrats in the House, was several weeks late in disclosing 19 of her husband's stock transactions. Together, the trades are worth as much as $285,000.

Rep. Dan Crenshaw, a Republican from Texas

Crenshaw was months late disclosing several stock trades he made in the early days of the COVID-19 pandemic, the Daily Beast reported.

Rep. Blake Moore, a Republican from Texas

Moore did not properly disclose dozens of stock and stock-option trades together worth as much as $1.1 million.

Rep. Sean Patrick Maloney, a Democrat from New York

Maloney was months late in disclosing he sold eight stocks he inherited in mid-2020 when his mother died.

Rep. Brian Mast, a Republican from Florida

Mast was late disclosing that he had purchased up to $100,000 in stock in an aerospace company. The president of the company had just testified before a congressional subcommittee on which Mast sits.

Rep. Debbie Wasserman Schultz, a Democrat from Florida

Wasserman Schultz was months late reporting four stock trades made either for herself or her child.

Rep. Lori Trahan, a Democrat from Massachusetts

Trahan was months late disclosing the sale of stock shares in a software company.

Rep. Kevin Hern, a Republican from Oklahoma

Hern did not disclose nearly two-dozen stock trades in a timely manner, in violation of the STOCK Act. Taken together, the trades are worth as much as $2.7 million.

Rep. Susie Lee, a Democrat of Nevada

Lee failed to properly disclose more than 200 stock trades between early-2020 and mid-2021. Together, the trades are worth as much as $3.3 million.

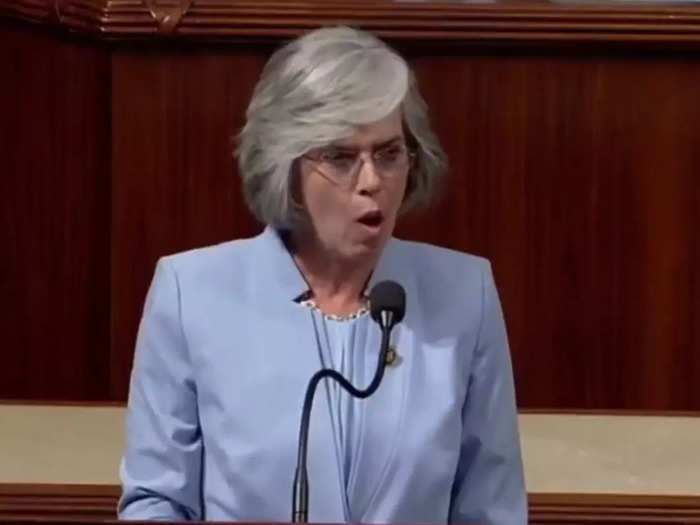

Rep. Kathy Castor, a Democrat of Florida

Castor was late disclosing the purchase of tens of thousands of dollars worth of stock shares throughout 2021.

Rep. August Pfluger, a Republican from Texas

Pfluger was several months late disclosing numerous stock purchases or sales made in January or March either by himself or by his wife.

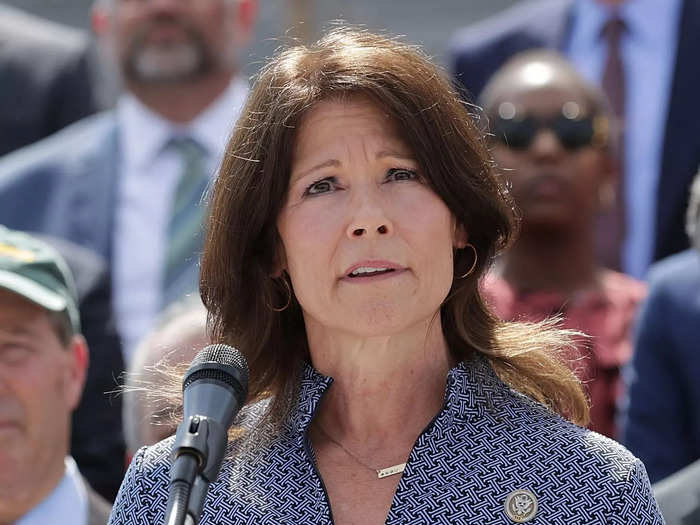

Rep. Cheri Bustos, a Democrat from Illinois

Rep. Steve Chabot, a Republican from Ohio

Chabot was months late disclosing a stock share exchange he held in early 2021.

Rep. Chris Jacobs, a Republican from New York

Jacobs was months late filing various transactions made throughout early- to mid-2021, Forbes reported.

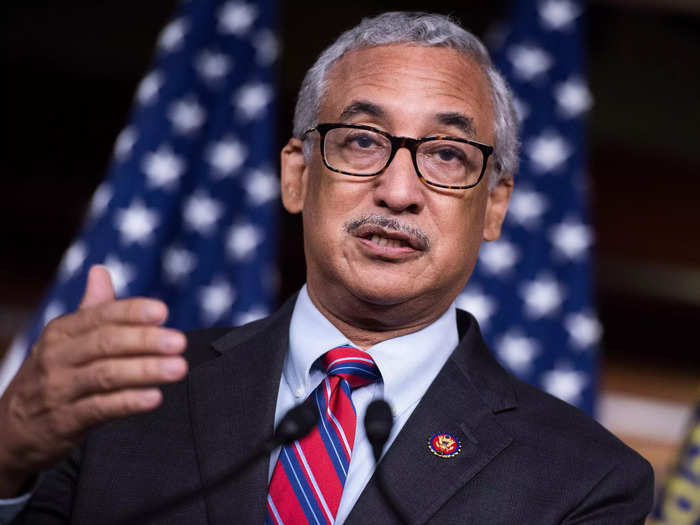

Rep. Bobby Scott, a Democrat from Virginia

Scott was months late in disclosing a pair of stock sales from December 2020, Forbes reported. NPR also reported several other late transactions, as first identified by the nonpartisan Campaign Legal Center.

Rep. Ed Perlmutter, a Democrat from Colorado

Perlmutter ran a few days late in filing disclosures for as much as $30,000 in stock trades his wife made in June.

Rep. Tom Suozzi, a Democrat from New York

Suozzi failed to file required reports on about 300 financial transactions, NPR reported, citing research from the Campaign Legal Center.

Rep. Cindy Axne, a Democrat from Iowa

During 2019 and 2020, Axne didn't file required periodic transaction reports for more than three-dozen trades, reported NPR, citing research by the Campaign Legal Center.

Rep. Warren Davidson, a Republican from Ohio

Davidson didn't properly disclose the sale of stock worth up to $100,000, reported NPR, citing Campaign Legal Center research.

Rep. Lance Gooden, a Republican from Texas

Gooden failed to file mandatory periodic transaction reports for a dozen stock transactions, per the STOCK Act, reported NPR, citing Campaign Legal Center research. Gooden's office disputed that the lawmaker did anything wrong.

Del. Michael San Nicolas, a Democrat from Guam

San Nicolas did not properly disclose two trades — one in 2019 and another in 2020, reported NRP, citing Campaign Legal Center research.

Rep. Roger Williams, a Republican from Texas

Williams did not properly report three stock transactions his wife made in 2019, reported NPR, citing Campaign Legal Center research.

READ MORE ARTICLES ON

Popular Right Now

Advertisement