Top ten categories of cryptocurrencies Canva

- Bitcoin focuses on making digital payments faster but it is only one type of cryptocurrency.

- Stablecoins and privacy-focused coins stand poised to extend the reach of crypto.

- Decentralised finance (DeFi) and non-fungible tokens (NFTs) are recent innovations that use tokens built upon existing cryptocurrencies.

There are over

6,000 cryptocurrencies in existence right now, but not all of them are aiming to become the new

king of digital cash like

Bitcoin. The crypto universe is wide and its applications are vast.

For example,

Ether, the second largest cryptocurrency in the market, is used to power the Ethereum blockchain network which enables ‘smart contracts’ — an example of which is

non-fungible tokens — and other decentralised finance (

DeFi) applications, called DApps.

Tether, on the other hand, is a stablecoin. It’s a token based on the value of the US dollar. Simply put, users can convert their cryptocurrencies into

USDT to have it attain the same value as the dollar but still stay on the blockchain.

Just like that, there are tokens based on privacy, exchanges, interoperability, payments, investing, and lending too — each trying to solve for a different set of problems in the existing

fiat financial system.

Here’s a quick look at the top ten categories of cryptocurrencies:

1. Digital cash – Bitcoin

Canva

The oldest cryptocurrency in the market, Bitcoin is an investor favourite. Other than the fact that it’s been around for the longest time — which isn’t really that long considering that it was launched just over a decade ago — investors like Bitcoin because it’s the biggest bull on the block. Simply put, it has the most value.

It was made with decentralised blockchain and stable supply in mind. A large community tries to hold it true to its root and continues to fine-tune it to minimise vulnerabilities. An extensive infrastructure has formed around Bitcoin — from its formation or ‘mining’, to trading, to validating transactions made using Bitcoin.

Right now, Bitcoin as a whole is worth $843 billion — more than double the value of the second runner up, Ethereum, which has a market cap of $386 billion at the time of publishing, according to CoinMarketCap.

2. Digital cash – Altcoins

Canva

A number of cryptocurrencies followed in the wake of Bitcoin, finding it good enough to copy its best aspects. However, they can be different from Bitcoin in critical ways.

For example, Litecoin enables more efficient transactions than Bitcoin and Dogecoin has no supply limit. Alternatively, Ethereum serves as a platform to enable crypto ‘tokens’ while Cardano aspires to be more environmentally friendly.

There are hundreds of other coins in the market trying to materialise their own vision. Such currencies, which have their own protocol and network, are sometimes termed as ‘alt coins’ to distinguish them as ‘alternatives’ to Bitcoin.

Many of the top altcoins are ‘forked’ or split from other coins with minor technical changes that lead to a major change of philosophy. Bitcoin and other cryptocurrencies like Litecoin and Dogecoin fall into the category of ‘digital cash’.

3. Privacy coins

Canva

In the real world, cash can be used by those who prefer more anonymity and less tracking, even if they can still be tracked using serial numbers. Similarly, currencies like Monero are less transparent and private compared to major ones like Bitcoin.

Privacy coins are attractive to those who don’t want to announce their every move to the world or avoid sales taxes, as they are less centralised and traceable by law enforcement to a lesser extent. To keep transactions legal, they usually cannot be traded at the largest crypto exchanges.

Private coins like Monero and Dash transact briskly, with Monero as a whole having a market cap of $5.47 billion.

4. Stablecoins

Canva

Think of a ten rupee note that can be exchanged for goods worth ten rupees at any time. Similarly, a stablecoin will try to maintain a stable value in comparison to other real-world instruments.

This attracts traders to stablecoins, as a relatively reliable store of value and an easy intermediate currency for trading on crypto exchanges. While it is not expected to rise in value, it is not expected to fall much either and thus is not volatile.

Examples include the Tether USDT and USDC which are tokens pegged to the dollar, and the DGX token that claims to be backed by gold.

At the time of writing, Tether had a market cap of $68 billion but its value is ‘stable’ at $1, which illustrates its purpose of being used for trading.

5. Ethereum and other blockchain platforms

Canva

Informally called the second generation of blockchain, platforms such as Ethereum allow for more flexibility in how the currency that operates on it can be used.

The Ethereum blockchain uses the Ether currency and maintains a ledger of Ether transactions. But it also allows for ‘tokens’ that represent ‘smart contracts’ – thus enabling decentralised apps or ‘dApps’ — that use their own ‘tokens’ to run on top of that blockchain.

The Ether and Cardano currencies are together worth $539 billion by themselves. But being platforms, they enable ‘tokens’ that run on top of their blockchain platform, such as Tether and Chainlink.

6. Interoperability platforms

Canva

Multiple platforms now exist, each catering to their own audience. So what happens when you want to transfer value from blockchain to the next?

You may want to, for example, exchange $100 worth of Tether on the Ethereum blockchain for $100 worth of agricultural futures contracts that reside on the Cardano blockchain. That is when being able to operate between platforms becomes necessary.

Examples of such platform-interoperability are ‘smart contract’ currencies like Chainlink and Polygon, with a market cap of $12.7 billion and $8.4 billion respectively. However, such ‘cross chain’ technology has been an attractive target for hackers over the past year.

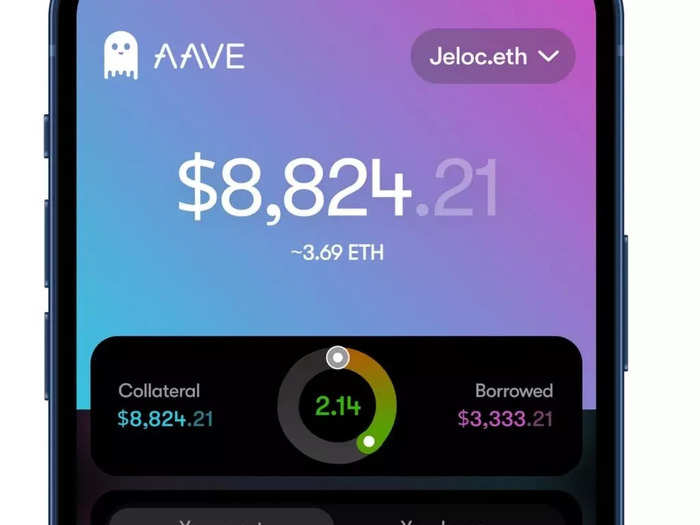

7. Finance operations – Lending

Canva

This sector of the crypto industry has grown rapidly in the last two years. As the saying goes, you make more money selling the axe and supplies to a gold prospector, than the prospectors earn from the gold itself — enter ‘decentralised finance’ (DeFi).

DeFi, can in turn, be split into four types of operations — lending, investing, payments and the trader’s favorite, exchanges.

Lending can be risky yet lucrative at the best of times, even in conventional banks. With the middle man being cut out of the picture, the process only gets more efficient.

It involves direct lending between parties or between ‘pools’ of lenders and borrowers. Interest rates are not regulated, and lending can be with or without crypto collateral provided by the borrower. The borrower benefits from lower fees, and the lender receives higher interest payments than retail banks.

Examples of peer-to-peer lending tokens include Compound and the open-source Aave which claims a market size of $20.5 billion on its site.

8. Finance – Investing

Canva

Who would say no to investing and growing existing wealth? With these specialised cryptocurrencies, you can participate in the wider economy through the use of blockchain.

When more of the economy begins to use blockchain solutions, or when cryptocurrencies themselves rise in value, investors in these currencies see gains.

Examples include the Polymath token that claims to enable blockchain migration for securities worth trillions of dollars, and the Crypto20 token that serves as a crypto index fund.

9. Finance – Payments

Canva

If you knew Visa and Mastercard as the main entities that process transactions, provide merchant services and generally connect banks, you may be surprised to know their crypto equivalents are more efficient and quite large.

A number of crypto companies are working to improve the speed of transactions and lower their fees, so that the crypto economy can function more efficiently. They are also useful to those who do not have conventional bank accounts, for processing payments.

Examples include Ripple XRP and Stellar XLM whose market cap is worth $59 billion and $8.6 billion respectively.

10. Finance – Exchanges

Canva

A crypto exchange is usually the easiest place to trade currencies online. But in a cue taken from casinos, the largest exchanges like to offer their own currency as well.

Apart from advantages the exchange gets from that, a currency which is largely used to buy and sell on their own exchange helps traders in converting between currencies with minimal fees.

Examples are

Binance Coin and KuCoin Token with a market cap of $82.5 billion and $1.1 billion respectively.