- Home

- slideshows

- miscellaneous

- 'Big Short' investor Michael Burry was among the few who predicted the 2008 housing collapse. Here are his biggest investments right now.

'Big Short' investor Michael Burry was among the few who predicted the 2008 housing collapse. Here are his biggest investments right now.

1. Autech

2. Western Digital

Market value: $13.77 million

Position: 250,000 shares

Ownership stake: .08% of shares outstanding

Year-to-date performance: up 54%

Source: Bloomberg

3. GameStop

Market value: $12.69 million

Position: 3,000,000 shares

Ownership stake: 3.32% of shares outstanding

Year-to-date performance: down 68%

Source: Bloomberg

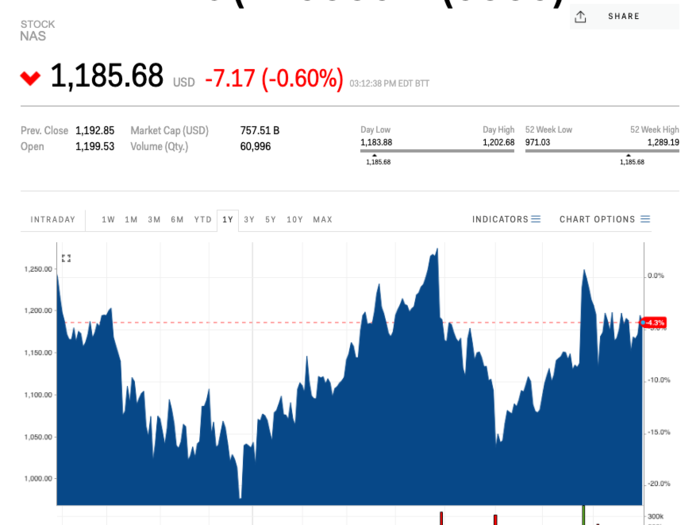

4. Alphabet Inc. Class C

Market value: $10.74 million

Position: 9,000 shares

Ownership stake: <0.01% of shares outstanding

Year-to-date performance: up 14%

Source: Bloomberg

5. Tailored Brands

Market value: $9.66 million

Position: 2,600,000 shares

Ownership stake: 5.15% of shares outstanding

Year-to-date performance: down 61%

Source: Bloomberg

6. FedEx

Market value: $9.45 million

Position: 60,000 shares

Ownership stake: .02% of shares outstanding

Year-to-date performance: down 1%

Source: Bloomberg

7. Sansei Technologies

Market value: $9.39 million

Position: 1,104,000 shares

Ownership stake: 5.71% of shares outstanding

Year-to-date performance: down 50%

Source: Bloomberg

8. Cleveland-Cliffs

Market value: $8.77 million

Position: 1,100,000 shares

Ownership stake: .41% of shares outstanding

Year-to-date performance: up 3%

Source: Bloomberg

9. Alibaba

Market value: $8.64 million

Position: 50,000 shares

Ownership stake: <0.01% of shares outstanding

Year-to-date performance: up 27%

Source: Bloomberg

10. Cardinal Health

Market value: $8.45 million

Position: 200,000 shares

Ownership stake: .07% of shares outstanding

Year-to-date performance: down 4%

Source: Bloomberg

11. Walt Disney Co.

Market value: $8.27 million

Position: 60,000 shares

Ownership stake: <0.01% of shares outstanding

Year-to-date performance: up 25%

Source: Bloomberg

12. Sportsman's Warehouse Holdings

Market value: $6.52 million

Position: 1,597,011 shares

Ownership stake: 3.71% of shares outstanding

Year-to-date performance: down 4%

Source: Bloomberg

13. Yotai Refractories

Market value: $6.35 million

Position: 1,280,000 shares

Ownership stake: 5%

Year-to-date performance: down 9%

Source: Bloomberg

14. Tazmo

Market value: $6.03 million

Position: 686,800 shares

Ownership stake: 5.08%

Year-to-date performance: up 39%

Source: Bloomberg

15. Ezwelfare

Market value: $4.72 million

Position: 574,000 shares

Ownership stake: 5.27% of shares outstanding

Year-to-date performance: up 30%

Source: Bloomberg

Popular Right Now

Advertisement