- Home

- personal finance

- 8 pearls of wisdom that will change the way you think about money

8 pearls of wisdom that will change the way you think about money

"How much you earn has almost no bearing on whether or not you can and will build wealth. Regardless of the size of your paycheck, you probably already make enough money to become rich." — David Bach

"No one comes out of the womb a financial genius. Every rich person learned how to succeed at the money game, and so can you ... Success is a learnable skill." — T. Harv Eker

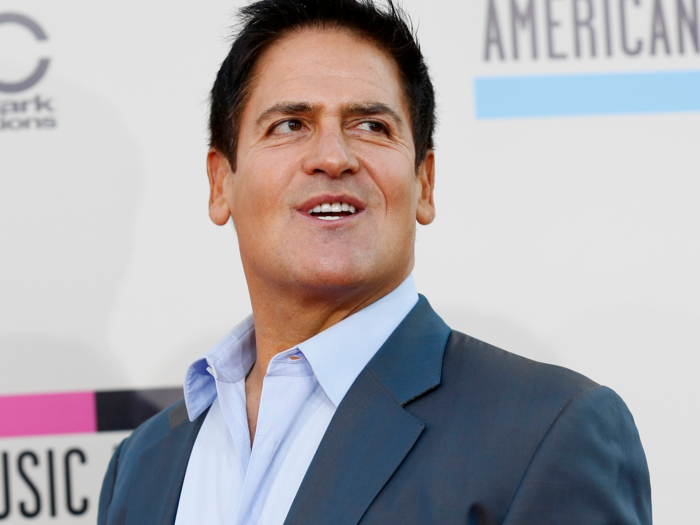

Even the wealthiest, most successful people had to start somewhere. Consider self-made billionaire Mark Cuban: "I've learned that it doesn't matter how many times you failed," he told Smart Business. "You only have to be right once. I tried to sell powdered milk. I was an idiot lots of times, and I learned from them all."

Getting rich is not out of reach. As Eker stresses, it's a learnable skill. Start by learning from the people who have already done it by reading a biography of someone incredibly wealthy and successful. Try "Titan: The Life of John D. Rockefeller," "Andrew Carnegie," "Steve Jobs," or "The Snowball: Warren Buffett and the Business of Life."

Source: "Secrets of the Millionaire Mind" by T. Harv Eker

"You don’t get what you deserve. You get what you negotiate." — Farnoosh Torabi

You can't sit around and expect a raise or bonus to fall in your lap — even if your boss notices your hard work and efficiency, he or she won't necessarily pay you more. You have to ask for what you want.

There's a right and a wrong way to go about this delicate conversation. Read up on things you should never say in a salary negotiation, know what you're worth before heading into the meeting, and consider tips from a 28-year-old woman who made a $30,000 leap.

"Money does not define success or happiness. In fact, if you are truly effective at what you enjoy, money usually follows your passion. Passion drives interest, which in turn drives focus and commitment. Both qualities are requirements for success." — Matt Maloney

Passion is crucial to success. It's far from a modern concept — one journalist discovered it nearly a century ago when studying millionaires — but is just as relevant today.

Don't toil away at a job that leaves you stressed out and dissatisfied with life. Quitting your job for a more meaningful opportunity, if the circumstances are right, can be incredibly rewarding and pay off in the future.

And if you find a job you love that fills a need, a purpose for others, you'll be even better positioned for success. "For me, the difference between being passionate and purposeful is that purpose serves others," says Sarah Kaler, who left her high-paying corporate job and started a business that earns up to $20,000 a month. "Passion can be a little more self-serving — not that it's not beautiful and wonderful, but how you're going to build your business and create momentum and resonate with other people is when you're being of service to others."

"I found the road to wealth when I decided that a part of all I earned was mine to keep. And so will you." — George S. Clason

The "road to wealth" is truly that simple: Pay yourself first. More specifically, set aside a minimum of 10% of your earnings with as regularly and diligently as you set aside money to pay your bills, Clason and other experts advise.

Today, it's easy to learn to live without a certain chunk of your income, thanks to technology. You can automatically deposit money from your paycheck and checking account into a retirement account, savings account, or other investment vehicle, removing the temptation to spend. If you never even see that money, you won't miss it.

Source: "The Richest Man in Babylon" by George S. Clason

"It's pretty easy to get well-to-do slowly. But it's not easy to get rich quick." — Warren Buffett

The golden rule of investing and building wealth is to think long term and not get caught up in the "get rich quick" mindset. The most successful investors leave their money alone.

If you've maxed your retirement accounts and have extra money to invest, steer clear of picking individual stocks and trying to beat the market — rather, research low-cost index funds, which Buffett recommends.

Source: Warren Buffett via Inc

"The number one reason most people don't get what they want is that they don't know what they want." — T. Harv Eker

Before you can achieve anything, you have to know exactly what it is that you want to achieve.

When it comes to building wealth, start with visualizing a savings goal with a specific price tag. Be realistic when setting a time frame to attain these goals, but at the same time, think big and don't be afraid to challenge yourself. Next, form a financial plan and determine exactly where you want your money to go.

Source: "Secrets of the Millionaire Mind" by T. Harv Eker

"Getting rich begins with the way you think and what you believe about making money ... Let's set the record straight once and for all: Anyone can become wealthy." — Steve Siebold

Mastering your money has a lot more to do with psychology and mindset than you might think. Rich people think differently than the average person — for instance, they find comfort in uncertainty; they focus on earning; they avoid thinking nostalgically; and they see money as a friend.

If you want to separate yourself from the crowd, start with your mentality.

Popular Right Now

Advertisement