- The profits for the biggest of car makers like Maruti and Hyundai have been squeezed by lack of production triggered by the global chip shortage.

- Amazon and Flipkart sold goods worth $4.6 billion during the festive season sale (up to October 10) but nearly three-fourths of that came from mobile phones and other electronic devices.

- Fashion as a segment grew better than last year but demand for home furnishings and decor have been subdued this year.

Indian equity markets scaled new peaks in the hope that the festive season will show a remarkable economic recovery from corporate India. Companies too had prepared for the first real boom in demand since the pandemic with four straight months of

gains in manufacturing.

Those hopes have not come true, at least not for everyone, and not to the extent that investors, the government, and even the biggest of chains like Reliance Retail, or the biggest of consumer goods products like Hindustan Unilever and Marico, would have liked.

While the headlines from the mega online sales at Amazon and Flipkart are encouraging, the recovery in consumer demand — both online and offline — has been limited to certain product categories like smartphones, electronics, and

jewellery (because weddings couldn’t wait any longer).

It could have been better if people’s purchasing power was not limited by the rising prices of food and fuel as well as the price hikes undertaken by the companies to offset their rising costs.

The festive season in India

BI India

India’s festive season starts with a series of festivals in August, consumer demand peaks ahead of Diwali (on the 4th of November this year) and gets counted till the end of December.

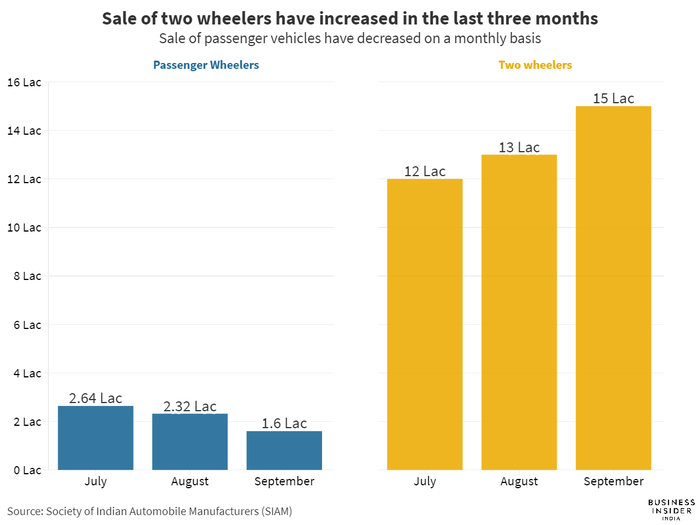

Sales growth for both cars and two wheelers remain modest at best. Aside from rising costs, the profits for the biggest of car makers like Maruti and Hyundai have been squeezed by lack of production triggered by the global chip shortage.

Not just discretionary products like cars, even everyday essentials like biscuits, tea and coffee, hair oil as well as popular confectioners like Haldiram’s had

lukewarm projections at best.

What data from Reliance Retail and DMart tell us

Canva

Reliance Retail, India’s largest retailer, was short of its September quarter of 2019 revenue by ₹4,000 crore.

The second biggest retail chain, DMart, did better than Reliance. The revenue grew 26% compared to the September quarter of 2019. However, the markets had hoped for even more. Despite the strong earnings, analysts at Geojit had to downgrade the rating to ‘sell’ after the earnings citing the sky-high stock price.

In fact, the total size of the fast-moving consumer goods segment shrunk between July and September 2021, according to data from Kantar Worldpanel. This was largely because of the high-base effect from last year and partly because of high inflation.

Smartphones make online flash sales look like a bigger success than they are

Canva

The festive flash sales from e-tailers like Amazon and Flipkart showed a 23% growth in the value of the goods sold to $4.6 billion (up to October 10) but nearly three-fourths of that came from mobile phones and other electronic devices.

Fashion as a segment grew better than last year but demand for home furnishings and decor have been subdued this year, consulting firm Redseer said in its report.

However, a lot of these sales were driven by discounts as the bulk of the buyers, nearly 61%, came from second-tier cities.

The fortunes of apparel makers are still uncertain

Canva

For a company like VMart, sales per square feet of retail space trended at around ₹9,000 before the pandemic. It’s far lower from that level even now.

“While for apparel retailers, pent up demand can play out, one also needs to keep in mind that wardrobes have not been used much in Covid times. So unlike paints (where depreciation is simply a matter of time) or jewellery (where there is a store of value angle), while consumers have not bought clothes for a long time, they have not used clothes over the same period either,” an IIFL report dated October 20 said.

As seen above, a lot of the purchases have moved online too. This has been a challenge for a player like Shoppers Stop, whose sales per square feet trended at around ₹10,000 before COVID-19 dealt a severe blow.

Demand has been squeezed by rising cost of living

BI India

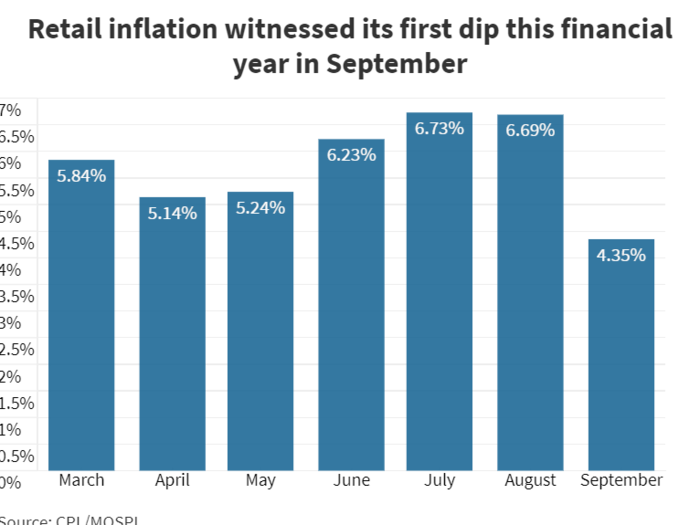

While the businesses are open, people are back to work, their monthly budgets are squeezed by the sharp rise in prices of petrol and diesel. While the gross domestic product (GDP) has grown 20.1% in the April to June quarter, inflation has also spiked in recent months and may have gotten worse in October due to crop damage and rising fuel prices.

At the same time, unemployment rose, particularly in the rural areas. “While manufacturing and construction industries in rural India added jobs in September, rural services sector shed a substantial 6.8 million jobs. Most major service industries shed jobs in September,” Centre for Monitoring Indian Economy (CMIE) added.

And the pinch that people feel in their pockets may get worse because key inputs — from vegetable oils to aluminium, from groceries to cars — are getting costlier. However, the headroom for upcoming hikes may be limited.

Companies are hiking prices and there may be more in the days to come

BI India

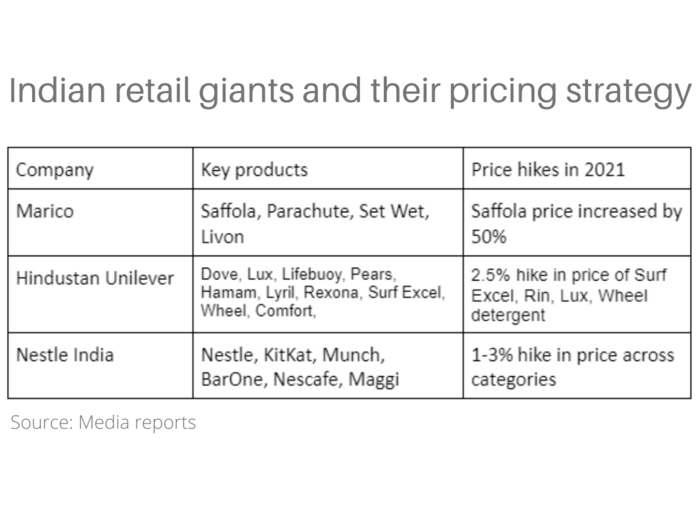

“... There has been an increase in input prices. That is leading to several price increases and what we really ensure is that their price increase does not go beyond 15% in a financial year,” Parle’s senior category head of marketing B Krishna Rao said, adding that 15% price rise is the point when customer’s demand for a specific product starts dipping.

Meanwhile, Sunil D’Souza, chief executive officer (CEO) and managing director of Tata Consumer Products, expects food inflation to worsen in the October-December quarter. He believes the rise in cost of beverages may be milder.

The CEO of Nestle India, Suresh Narayanan, reportedly pointed out that nine out of the 13 key ingredients that it buys from the market have not been this expensive in nearly a decade.

Even the market leaders in essential categories are thinking twice before hiking prices

Marico/BI India

Marico’s hair oil brand Parachute, which has a dominant 50% share in the coconut oil market, saw a 7% growth in volumes sold. Marico’s overall sales volumes were 8%, the lowest since the pandemic broke out in March. Marico decided to do away with freebies along with Parachute oil bottles — leading to a 5-6% reduction in input costs — while the company’s raw material cost has surged over 556 basis points over last year. 100 basis points make a percent.

Edible oil consumption has slowed down, for all brands, partly due to the spectacular rise in prices over the last one year as well as due to people stepping out more to eat out.

Nestle has the lion’s share of the instant noodles market, with its brand Maggi that is synonymous with the segment, but it has been slow to hike prices. The company has clocked a double-digit growth and increased its prices 1-3% across products this year.

Overall, the festive season has been a mixed bag. While some of the segments got to celebrate, others had to wait for their turn.