- Home

- slideshows

- miscellaneous

- The 'PayPal Mafia' formed in the early 2000s, and includes everyone from Elon Musk to the Yelp founders. Here's where the original members have ended up.

The 'PayPal Mafia' formed in the early 2000s, and includes everyone from Elon Musk to the Yelp founders. Here's where the original members have ended up.

The so-called "don" of the PayPal Mafia is founder Peter Thiel.

Thiel went on to cofound Founders Fund, a venture capital firm that has helped launch companies like SpaceX and Airbnb.

Thiel cofounded the big data firm Palantir in 2003. He was the first major outside investor in Facebook and contributed early funding to Yelp and LinkedIn, along with a number of other ventures launched by his PayPal peers. Thiel continues to serve as a partner of Founders Fund.

Thiel has also drawn criticism in recent years for his support of President Donald Trump and for secretly funding Hulk Hogan's lawsuit against Gawker Media, which resulted in the company shutting down Gawker and selling the company's assets.

In October, The Wall Street Journal reported Founders Fund is raising nearly $3 billion across two funds, one of which will pump money into late-stage startups that want to delay an IPO. Thiel is also dabbling in the growing cryptocurrency market. Fortune recently reported he was part of a $50 million investment in Layer1, a San Francisco-based Bitcoin-mining startup.

PayPal cofounder Max Levchin served as the company’s chief technology officer.

Levchin is sometimes called the "consigliere" of the PayPal Mafia — in "The Godfather," a consigliere is an advisor to the boss.

Levchin made significant contributions to PayPal's anti-fraud efforts. Together with PayPal technical architect David Gausebeck, he helped create the Gausebeck-Levchin test, an early version of a CAPTCHA for commercial applications.

Levchin served as the chairman of Yelp from its founding in 2004 until July 2015.

Levchin now serves as the CEO of Affirm, a payment platform he cofounded.

Affirm works like an instant layaway program, allowing consumers to finance online purchases at the point of sale and pay for them over time. In April, Reuters reported Affirm had raised $300 million in its latest funding round to support hiring and expansion.

Levchin is also the chairman of Glow, a fertility-tracking app that helps users improve their odds of conceiving.

Ken Howery is one of PayPal’s cofounders and served as its CFO from 1998 to 2002.

After eBay bought PayPal, Howery stayed on as eBay's director of corporate development until 2003. In 2005, he entered into another venture with Thiel, serving as cofounder and partner of Founders Fund.

Howery is the current US ambassador to Sweden.

He was appointed by President Trump in January and confirmed in September.

Howery is active in several nonprofits and serves as a founding advisor to Kiva, an organization that facilitates loans to low-income entrepreneurs. Kiva was founded in part by Premal Shah, PayPal's former product manager.

Elon Musk founded a payments company called X.com, which merged with Thiel's Confinity in 2000. He was named CEO of PayPal, but it didn't last.

Musk was ousted from his role as PayPal CEO that same year. But as the company's largest shareholder, he still walked away from the PayPal sale to eBay with a cool $165 million.

Musk is currently No. 23 on Forbes' list of the world's richest people.

Musk's estimated net worth is $20.8 billion. The SpaceX and Tesla Motors founder aims to revolutionize transportation on Earth and beyond. In October, the Tesla CEO made headlines for sending a tweet from a SpaceX Starlink satellite, which is part of a program working to provide fast and accessible internet around the world.

In 2017, Musk purchased the X.com domain name back from PayPal, citing its sentimental value.

PayPal cofounder Luke Nosek served as the company’s vice president of marketing and strategy.

He's reportedly the person who clued in Peter Thiel to cryogenic preservation, which Thiel has since invested in heavily. In 2005, Nosek joined Thiel and Howery as a partner at Founders Fund.

In 2017, Nosek left Founders Fund to launch investment firm Gigafund, which helped raise money for SpaceX.

Nosek sits on the board of Musk's SpaceX as well as ResearchGate, a platform where scientists and researchers can ask questions, follow topics, and review one another's papers.

Roelof Botha started as PayPal’s director of corporate development.

Botha went to school to be an actuary. He said he never planned to get into tech, but when he saw the opportunity in Silicon Valley, his intuition told him it was where he needed to be.

He went on to become PayPal's vice president of finance, and in 2001 was named CFO.

Now a partner of venture capital firm Sequoia Capital, Botha is considered one of the top tech investors in the world.

When combined, the companies Sequoia Capital has invested in have a total market value of over $1 trillion, and the firm has funded tech giants like Apple, Google, YouTube, and Instagram.

Botha sits on the board of more than a dozen companies, including Square, EventBrite, and Weebly.

LinkedIn cofounder Reid Hoffman served on the board of directors when PayPal was founded.

He eventually joined the company full-time at PayPal's COO. In a New York Times interview, Peter Thiel referred to Hoffman as PayPal's "firefighter in chief," noting that there were many fires that needed putting out in the company's early days.

When PayPal was acquired by eBay, Hoffman was the company's executive vice president. He cofounded LinkedIn in 2002.

Hoffman is one of Silicon Valley’s most prolific angel investors.

He was an early investor in Facebook, Flickr, Care.com, and many more. In 2017 he joined the board of Microsoft.

Hoffman has coauthored several books on startups and professional development. He hosts the "Masters of Scale" podcast, on which he interviews founders about how they launched and scaled their companies, and is a partner at VC firm Greylock Partners.

Previously a management consultant for McKinsey & Company, David Sacks joined PayPal in 1999.

He, like Hoffman, served as COO for the company.

After PayPal was bought by eBay, Sacks produced and financed the box office hit "Thank You For Smoking," which would go on to be nominated for two Golden Globes. In 2006 he founded Geni.com, an online tool for building family trees.

In 2016, Sacks was briefly interim CEO at Zenefits, an HR software firm that was plagued by scandal, including allowing unlicensed brokers to sell insurance to its customers.

In 2017, Sacks cofounded the early-stage investment firm Craft Ventures.

Sacks is a serial entrepreneur and investor, with angel investments in Airbnb, Postmates, Slack, and many more. In October, TechCrunch reported that Craft Ventures closed its second funding round with $500 million in capital commitments.

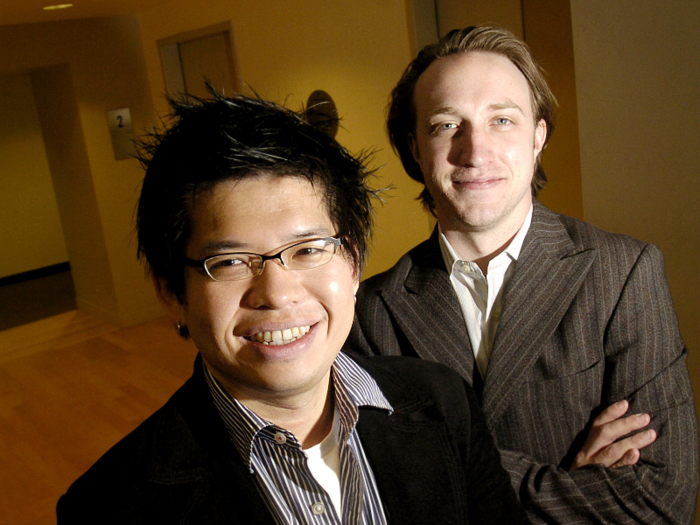

Jawed Karim, Chad Hurley, and Steve Chen met at PayPal during its early days.

Karim and Chen were engineers, while Hurley was a web designer.

In 2005, the trio launched the video-sharing platform YouTube. Karim uploaded the platform's very first video, "Me at the zoo," an 18-second clip of Karim in front of the San Diego Zoo's elephant exhibit. It's been viewed nearly 78 million times.

Today, Karim, Hurley, and Chen remain active entrepreneurs and investors with a hand in projects from finance to music.

In October, Karim contributed to a $15 million funding round for Truebill, a personal finance application.

News recently broke that Hurley is behind an in-the-works mobile gaming startup called GreenPark, which is reportedly set to launch in 2020.

Chen is an investor in actor Joseph Gordon-Levitt's musical collaboration platform HitRecord, which in February secured $6.4 million in Series A funding.

Andrew McCormack joined PayPal in 2001.

He worked as an assistant to Peter Thiel as the company prepared for its IPO.

In 2003, McCormack started a restaurant group in San Francisco. In 2008, he joined Thiel Capital and worked there for 5 years.

McCormack and Thiel partnered up once again in 2010 to launch Valar Ventures.

Valar Ventures has invested in technology startups well beyond Silicon Valley, including some in Europe and Canada. In August, Crunchbase reported the firm had closed on a $150 million funding round for a new venture capital fund, Valar Fund V.

McCormack continues to serve as a general partner of the firm.

Entrepreneur Keith Rabois served as PayPal’s executive vice president from 2000 to 2002.

He would go on to join his PayPal colleague Reid Hoffman at LinkedIn as its vice president for business and corporate development from 2005 to 2007. He was an early investor in startups like Square, where he spent two-and-a-half years as COO.

In February, Rabois joined Thiel, Howery, and Nosek as a partner at Founders Fund.

In October, TechCrunch reported that Rabois was part of a $2 million investment in Vise AI, which uses machine learning to automate portfolio management.

He has served on the board of directors for Yelp, Xoom, and Reddit.

Russel Simmons and Jeremy Stoppelman worked on technology at PayPal.

Simmons was an engineer and Stoppelman was the vice president of technology after joining PayPal from X.com.

In 2004, the pair came up with the idea for a platform where users could leave recommendations about businesses in their area. They pitched the idea to Levchin, who provided an early investment of $1 million, and Yelp was born.

Simmons left his official role at Yelp in 2010, while Stoppelman continues to serve as Yelp's CEO.

Stoppelman takes a salary of $1. This, of course, is in addition to his 11% stake in the company.

Jack Selby served as PayPal’s vice president of corporate and international development.

After leaving PayPal, Selby partnered with Thiel to start Clarium Capital Management.

In 2017, Selby was revealed to be the generous tipper behind "Tips for Jesus."

Starting in 2013, Selby began anonymously leaving tips for unsuspecting waitstaff, ranging into the thousands, and signing them "Tips for Jesus." His identity was confirmed by a New York City bartender who served him prior to receiving a $5,000 tip.

Selby serves as managing director at Thiel Capital.

Dave McClure served as PayPal's director of marketing for four years beginning in 2001.

According to McClure's LinkedIn, he began a program called the PayPal Developer Network, which consisted of about 300,000 developers that were using PayPal.

McClure left PayPal in 2004. He had a brief stint at Founders Fund before launching 500 Startups, an early stage venture fund.

McClure stayed at 500 Startups until June 2017, when he was accused of "inappropriate behavior with women" in a New York Times report and stepped down from his role at the firm.

"After being made aware of instances of Dave having inappropriate behavior with women in the tech community, we have been making changes internally," 500 Startups told The New York Times. "He recognizes he has made mistakes and has been going through counseling to work on addressing changes in his previous unacceptable behavior."

There are several more former PayPal employees who went on to have careers both in and out of technology.

- Yishan Wong was an engineering manager who later served as CEO of Reddit from 2011 to 2014.

- Jason Portnoy worked in finance at PayPal, and went on to work at Clarium Capital and Palantir. He's now a partner at VC firm Oakhouse Partners.

- Premal Shah was a product manager at PayPal beginning in 2000, then went on to work at technology nonprofit Kiva. He's currently working at financial-services startup Branch.

- David Gausebeck was a technical architect at PayPal. Now, he serves as chief technology officer at 3D modeling company Matterport.

- Joe Lonsdale started his career as a finance intern at PayPal before moving into venture capital — he's worked at VC firms Clarium Capital, Formation 8, and 8VC. Lonsdale also cofounded Palantir.

- Eric Jackson was director of marketing at PayPal and went on to write a book about the company called "The PayPal Wars." He's currently the CEO of two companies, CapLinked and TransitNet.

Popular Right Now

Advertisement