- Home

- slideshows

- miscellaneous

- Trump may have delayed stimulus money for several days so he can put his name on the checks. 6 struggling Americans told us what that extra time could mean for them.

Trump may have delayed stimulus money for several days so he can put his name on the checks. 6 struggling Americans told us what that extra time could mean for them.

Catherine Escalera fears she'll have to sell the home her family's owned for more than 70 years.

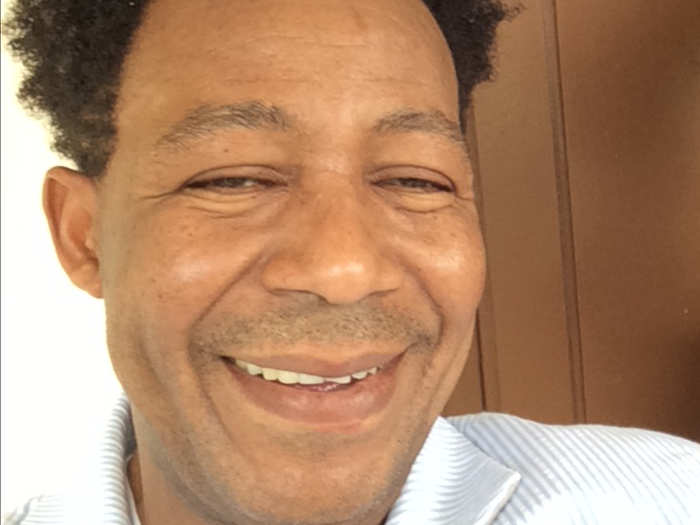

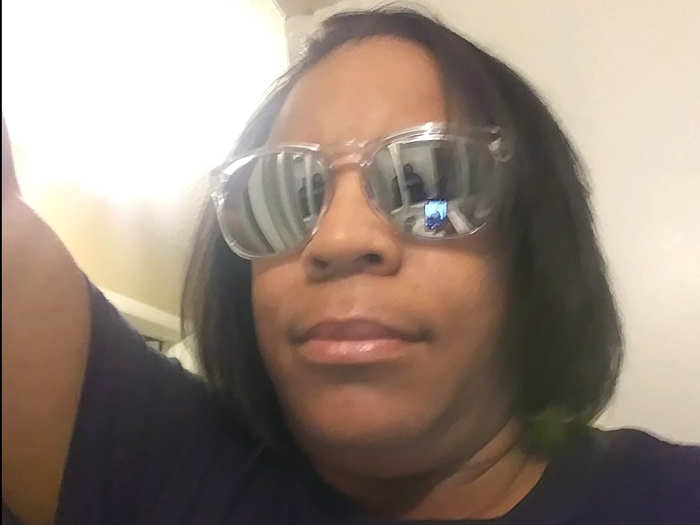

Bartenders Tim Namath and Kara Matos recently moved to Georgia and aren't yet eligible for unemployment. A stimulus delay of a few days 'would be devastating.'

Last March bartender Tim Namath showed up to the Pittsburgh, Pennsylvania, tavern where he worked to find out that it had been unexpectedly closed.

Almost a year to the day later, after moving to Atlanta, Georgia, with his girlfriend to be on an opening team for a new Dave & Busters, he lost his job again.

"Since I just got hired in August and the location opened in mid-September, Georgia is telling me I haven't paid enough in to receive unemployment," Namath, 41, said. "Currently unemployment is denying both me and my girlfriend."

Namath and his girlfriend Kara Matos both started at the new Dave & Busters at the same time and live together at an Airbnb community.

As bartenders, they rely on tips for their income so they have had no money coming in for the last month. Until Wednesday morning, when Namath's $1,200 stimulus check came in via direct deposit, the couple was five weeks behind in rent.

Come Monday, they will fall behind again on their weekly housing payments.

"I've appealed the unemployment and am asking for the company to refile for me," Namath said. "I can't get through to anyone in my HR department, or in the Department of Labor. I've sent emails, I've tried everything."

At this point, the couple is stretched incredibly thin. They were able to buy groceries with a few hundred dollars left over from Namath's stimulus check, but it won't get them far. They are a month behind in cellphone payments, too.

Because Matos didn't file her taxes until more recently, she's expecting to receive a paper check, rather than a direct deposit. For the couple, it can't come soon enough.

"I'm just waiting for anything," Namath said. "Her stimulus, her income tax, unemployment, the appeal. We're just waiting and running out of money very quickly."

Namath said that without any idea of when his company will reopen, he expects to fall behind at least another $1,500 to $2,000. Fortunately, their Airbnb host has been working with the couple, and other service industry employees living in the community, on their delay in rent, Namath said.

"He is being understanding, but it is a business," Namath said. "He's been very nice. I've had no issues working with him, but I do understand at some point push comes to shove. He can't just have people living here for free, running up bills and not paying."

At this point, every day that the couple has to wait is pushing them further into a hole they might not be able to dig themselves out of, Namath said.

If the paper checks are delayed even a few extra days, Namath and Matos could be on the street.

"It could be devastating," Namath said. "If it goes past a point when Georgia allows evictions to go into effect again, then we will get evicted,"

Stressed about how he was going to make rent, Majid Godje landed in the hospital from a panic attack last month.

Jersey City, New Jersey, resident Majid Godje was laid off from his construction job in September and has been barely surviving on his $330 unemployment check for the last 26 weeks.

Now that his unemployment period has ended, and his job search has been unsuccessful, he knows he won't be able to catch up on rent, and fears how he will afford to feed himself or his toddler.

"Two weeks ago, an ambulance had to pick me up from being scared. I ended up in the hospital," Godje, 53, told BI. "They do tests and tell me I have anxiety. Yes, I have anxiety; I'm scared for two reasons: the corona(virus) and the rent."

Godje said that because the IRS had his direct deposit information, he didn't have to wait for the paper check and received his $1,700 relief funds at 3 a.m. on Wednesday morning. By 6:30 a.m., he was already getting a check issued to put in the mailbox to his landlord. He's behind on rent as it is.

"It's gone. It's not enough to cover the two months rent that I owe," Godje said. "I don't know what to do. My brother just called to ask what I will do. I tell him there's no jobs, I'm all over town looking for any job."

Godje said that for the last two unemployment checks, he's received an additional $600 due to a state stimulus package. Now that his unemployment has ended, that will likely end, too.

He said tried to talk with the local unemployment office to see if his benefits can be extended, but he can't get through. He scheduled a hearing for next Wednesday, but until then he has no money.

"Right now, there is nobody you can speak to," Godje said. "I've made many sacrifices. It is very tight. I just have to take my daughter again to my neighbor so I can go look for a job. It's very difficult looking for a job right now."

His daughter Amani's 2nd birthday is next week. Celebrating with a cake is out of the question.

"I can't even think about it," he said. "I'm glad she won't even know about that."

Godje said that a few weeks ago there was a glimmer of hope when he was offered employment at a home improvement box store. Then he got an email days later that there was a hiring freeze.

Having missed his $1,200 rent in March and April, Godje emailed his landlord explaining the situation.

"I am unemployed due to COVID-19 virus crisis. With the little bit of the money that I have, I stash foods and medicines to try to stay alive, so I'm asking for your to waive the rents until things get back to normal again," Godje wrote in an email viewed by BI. "I'm asking for some compassion in this time of crisis."

His landlord responded: "We're all going through difficult times right now."

"The whole thing is horrible. We are not the ones that get a bailout, it's more about the billionaires that are sitting home. We're getting $1,200 to pay one month's rent and that's it," Godje said. "It's very scary. You panic all the time. You're scared all the time."

Janice McCorkle checks her bank every day for her small business loan. Without it, she might lose her livelihood

Janice McCorkle owns a massage therapy and hypnotherapy studio and school in North Little Rock, Arkansas.

Due to closures related to social distancing, she hasn't been able to pay the rent at her business and is a month behind in her car and credit card payments.

"Now it's the middle of this month, and the first of the month is coming up really soon," McCorkle said. "I'm 72. I love what I do. I love helping people and I do not want this business to go under. But I'm afraid if this continues, it might."

McCorkle has applied for unemployment several times over the last few weeks but has been denied, likely because she's a business owner.

"I have applied for the small business loan, which is $10,000, so every day I go onto my bank account looking for the $10,000," McCorkle said. "I now heard today that some of the stimulus checks are being delayed because Trump wants his name on them, and that just made my insides go into kinks. It stressed me out even more."

McCorkle said, so far, her landlord and creditors have been understanding. As she enters her second month without making payments, though, she fears her luck will run out.

"I did not pay my rent this month for my business, but my landlord said that if I could pay anything he wouldn't charge me a late fee so I gave him $100," she said. "Rent is $725 a month. I am going to need to pay him the first of the month."

Unlike many Americans, though, McCorkle hasn't been food insecure because she gets social security. She's been trying to make ends meet by doing virtual Reiki sessions and psychic readings.

"I have one Reiki session to help boost the immune system, so I'm doing those online," she said. "That helps bring in a little bit of money here and there, but basically I'm just really careful about what I eat."

McCorkle, who has two grown children and two grandchildren, said that she's never before been dependent on the government to pay her bills.

"I've never applied for unemployment, I've never been in a situation like this in my life," McCorkle said. "It's very new and scary."

Des'Rae Strome was lucky enough to have a well-paying job and savings account before the pandemic hit. Now she's almost out of money.

Des'Rae Strome, 52, feels like one of the lucky ones.

An orthodontic technician in Aurora, Colorado, who made $25 an hour before the pandemic hit, Strome was able to put some money aside in savings before she lost her job.

That account, which had a little under $5,000 on her last day of work on March 14, is nearly depleted.

"There are a lot of other people who are way worse off than I am," Strome told BI. "This is what's really sad."

Knowing that she'd likely be out of work for a while, Strome used her money to pay some bills in advance. She's also been buying groceries and paying bills for her struggling mother.

"Fortunately, my children are grown. Hopefully, they're doing OK, they haven't called and asked me for anything, which is the indicator. If they did, I probably wouldn't have much to give to them anyway," Strome said. "There are numerous bills I haven't paid. I haven't paid my electric, I haven't paid car insurance, I haven't paid medical insurance."

Strome said that it's expensive to buy groceries for her and her mother, and the fear of not knowing when she's going to start earning an income again is "very scary."

When she first learned that her office was closing, she wasn't immediately panicked because she knew she could rely somewhat on what she had saved.

"I couldn't say (I was in) fear, because I had a little bit. It was probably more of a deflated feeling," Strome said about her last day at work. "I tried to pay a few things that I could in advance so I didn't have to worry, but now we're coming to a point where there's no money and the stuff is piling up."

Now, Strome isn't deflated. She's angry and considers the $1,200 she'll receive from her stimulus check a bad joke.

By the time she gets back to work, she expects to be at least $3,000 behind on bills.

"We get $1,200, seriously? What good is it to get these businesses running if you don't have Americans who have money to spend at these businesses," Strome said. "If you sent every American an additional $3,000, they'd at least be able to pay what they owed in back payments and they wouldn't have to struggle."

Margo and Michael Manahan are artists with two immuno-compromised sons. They're afraid they may have to go nearly a year without a full income.

Artists Margo and Michael Manahan of Portland, Oregon, make nearly their entire income — around $40,000 — during the spring and summer months at outdoor markets.

This year, though, even if the markets start back up, they likely won't return.

"What makes our situation unique is that I'm a parent of two adult children, Nathan and Foster, who have Duchenne muscular dystrophy," Margo told BI. "They are confined to wheelchairs. They have extremely compromised immune systems. So we have been one of those families in complete lockdown."

Knowing the risks they face, the Manahans took their sons, 18 and 20, out of high school and college in early March. A week later, the schools closed to everyone.

The outdoor market at which the couple — a photographer and textile designer — make most of their money opened for a few weekends in late March before closing indefinitely. They never opened their booths this year.

"It was non-negotiable. There was absolutely no way we could go down to Saturday market even though it had been open for a few weeks," Margo Manahan said. "Clearly, we as a family have had to make the decision that there's absolutely no way that we can get back into the mainstream art circle, I'm thinking for the rest of the year. The risk of exposing our children to this virus is clearly not worth the money."

Outside of losing income, the family was also hoping to see a small disability check when Foster turned 18. But the family hasn't been able to get through to their state's disability office, likely because it is overwhelmed with coronavirus-related calls, Margo said.

It also didn't help that even though they are under their parent's care around the clock, neither Foster or Nathan qualified for the additional $500 children stimulus benefit, Margo Manahan said.

Fortunately, despite that, the Manahans believe that with their $1,2oo stimulus check and the money Margo receives from the state for being their eldest son's caretaker, they'll likely be able to slide through financially for another six months.

Their home is nearly paid off and the family has always worked hard to remain debt-free and live below their means, Manahans said.

They've also called their utility companies to postpone payments.

But many artists in the Manahans' circle can't afford to go without income.

And with Manahan advocating for businesses to remain closed to limit any possible exposure to her sons, and others struggling to stay afloat and demanding the market to reopen, it has created a rift in the Portland artist community.

Some of Margo's friends, for example, need to go back to work, even if it means risking exposure to the coronavirus.

"'I've noticed that my artisan friends who don't have children or don't have anybody with compromised immune systems, they are getting almost angry," Manahan said. "And when you're on the other side of that, it's easy to say, 'you know what, I don't need to be exposed by you. My children could die from this.' There's been a lot of heated discussions on our market page where I wonder how we'll come back."

Popular Right Now

Advertisement