- Home

- stock market

- 22 Brilliant Quotes From Legendary Short-Seller Jim Chanos

22 Brilliant Quotes From Legendary Short-Seller Jim Chanos

"When the leaders are all billionaires we must say that the Marxist-Leninist ideology has maybe been watered down a bit, sometimes with pigs in it."

"'Mr. Chanos has never been to mainland China.' Well hell, I didn't work at Enron either."

Chanos' response to continued criticism that he has bearish views on China without ever having visited the country. He had famously shorted Enron before its collapse.

Source: Business Insider

It's the accounting tail wagging the economic dog.

Chanos thinks has a "credit growth problem, not an economic growth problem." He attributes this to the nation's quest to meet its GDP forecasts.

Source: CNBC

I'm not the only guy crying in the wilderness about the data coming out of China.

Chanos who has long been a China bear said he is finally seeing more China critics. Chanos doesn't trust the data coming out of the country:

"…The last command economy that saw this kind of growth was the old Soviet Union and what happened was there was a lot of mis-allocation of resources… China's heading the same way. ...There's just a wholesale fudge factor."

Source: CNBC

The Chinese banking system is built on quicksand.

"When they talk about the foreign reserves of $3 trillion, what everybody forgets is that there's liabilities against those, and everybody seems to think its a free and open check book, but its not. That's what we've been trying to tell people. Focus on the lending system there, because everything occurs through the banking system."

Source: Bloomberg

Primary research is crucial and not as many people do it as you think.

Chanos thinks investors should start by looking at the newer filings of a company first. To watch for language in the newer ones and then read backwards.

"Read the proxy statements that are often neglected and are full of great information. By doing that and by spending a night or two with those documents, you can have a remarkably comprehensive view about a company. So start there and work your way out. This way you are looking at the most unbiased sources first.

"People on earnings calls will try and spin things, and analyst reports will obviously have a point of view. All of that is fine, because hopefully you will have first read the unvarnished facts."

Source: Graham & Doddsville

Nothing beats starting with source documents.

Chanos said the most important thing to succeeding in this industry is knowing that "nothing beats starting with source documents."

"So I teach my students and analysts: start first with the SEC filings, then go to press releases, then go to earnings calls and other research. Work your way out. Most people work their way in."

Source: Graham & Doddsville

The biggest mistake people make is being co-opted by management.

Chanos thinks analysts should avoid getting to0 pally with management.

"We never meet with management. For all of the bad asymmetries of being on the short side, one of the good asymmetries is that we don’t rely on the company. We can get information from the company if we want to, as we can go through the sell-side."

Source: Graham & Doddsville

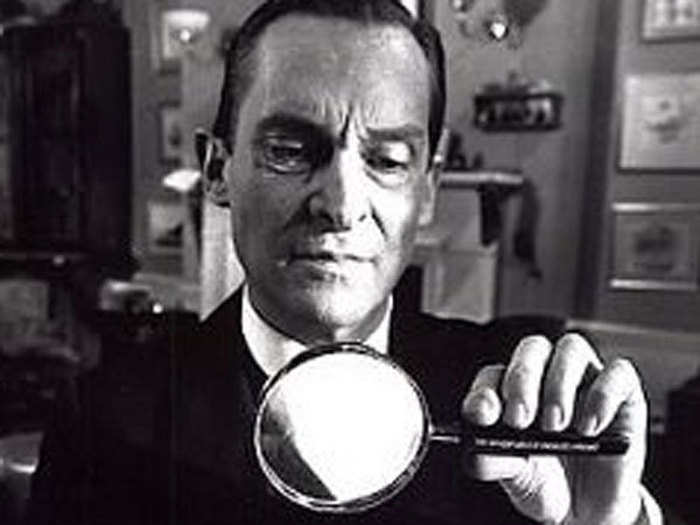

The most important function that fundamental short sellers bring to the market is that they are real time financial detectives.

Chanos admits that short-sellers have a financial incentive in detecting frauds, but emphasizes that they are way ahead in doing so than regulators.

"I've always said that the regulatory community and the law-enforcement community are the financial archaeologist. And that's no knock on them but they will tell you what happened with great clarity looking backwards and sifting through the rubble of a lot of lost money."

Source: Bloomberg TV

In investing, you can be really right but temporarily quite wrong.

One of the first stocks Chanos looked at for Gilford Securities was Baldwin-United. He noticed that at a time when regulators of Baldwin's insurance subsidiaries were threatening to declare them insolvent, brokerages across the board were recommending the stock.

"I recommended a short position in Baldwin-United at $24 based on language in the 10-K and 10-Qs, uneconomic annuities, leverage issues and a host of other concerns. The stock promptly doubled on me. This was a good introduction to the fact that in investing, you can be really right but temporarily quite wrong.

I put another report out in early December of 1982 with the stock at $50 and reiterated my thesis while pointing to additional evidence that had come out in the interim. I went home to visit my parents for Christmas and received a phone call from Bob Holmes telling me that I was getting a great Christmas present – the state insurance regulator had seized Baldwin-United’s insurance subsidiaries. Baldwin filed for bankruptcy shortly thereafter.

Source: Graham & Doddsville

Some of the best short ideas can look cheap from a valuation standpoint.

Chanos said he tries not to short on valuation but on "businesses where something is going wrong." Some of his best ideas have been those that looked cheap but had "ensnared a lot of value investors."

"Eastman Kodak was a great example of that. A few famous value investors were buying it all the way down because they assumed that the decline in the business would be a slow glide that would allow the company to harvest cash flows for the benefit of shareholders. The fact of the matter is that, for most declining businesses, management tends to redeploy cash flow into things outside of their core competencies in a desperate attempt to save their jobs. In the case of Kodak, they took some of their patent proceeds and cash flow and invested in a printer business, which is another declining business model.

"They ended up being decimated by their own invention of digital photography. When analyzing Kodak as a short candidate, valuation was almost the last aspect that we considered because, as I said, some of the best short ideas can look cheap from a valuation standpoint."

Source: Graham & Doddsville

We try to focus on businesses where something is going wrong.

Chanos explained how he shorts a company:

"We try not to short on valuation, though at some price even reasonably good businesses will be good shorts due to limitations of growth. We try to focus on businesses where something is going wrong.

Better yet, we look for companies that are trying -- often legally but aggressively -- to hide the fact that things are going wrong through their accounting, acquisition policy or other means. Those are our bread-and-butter ideas."

Source: Graham & Doddsville

There’s a big difference between a long-focused value investor and a good short-seller.

"I used to think that good short-sellers could be trained like long-focused value investors because it should be the same skill set; you’re tearing into the numbers, you’re valuing the businesses, you’re assigning a consolidated value, and hopefully you’re seeing something the market doesn’t see.

But now I’ve learned that there’s a big difference between a long-focused value investor and a good short-seller. That difference is psychological and I think it falls into the realm of behavioral finance."

Source: Graham & Doddsville

You need to be able to weather being told you’re wrong all the time.

Chanos thinks to a certain degree "the temperament of a good short seller is probably genetic." The skill set among other investors, especially value investors is largely the same in terms of the research required, but it's the mind set that is different.

"You need to be able to weather being told you're wrong all the time. Short sellers are constantly being told they're wrong. A lot of people don't function well in an environment of negative reinforcement and short selling is the ultimate negative reinforcement profession, as you're going against the grain of a lot of well-financed people who want to prove you wrong. It takes a certain temperament to disregard this."

Source: Graham & Doddsville

Go to Dubai and see what happened. It was…what I call it the 'Edifice complex'.

Dubai was a property bubble according to Chanos, a market that suffered from excess building. "it's just, we can grow by putting up lots and lots of buildings and trying to attract people to come here, stay here, and put up offices here and sooner or later, you put up too many."

Source: Business Insider

If everyone knows you're going to print money ... you know ... welcome to Zimbabwe.

Chanos argued that no country can print its way to wealth. Here he expounds on moral hazard, bailouts and quantitative easing:

"It definitely is an issue with compounding of interest. By kicking this stuff down the road it grows faster than our ability to grow out of it. That's the real problem. That's what we're facing in Greece, we're facing that in the U.S. states, in municipalities, which are facing real budget issues and demographic issues. All these things compound at rates faster than at which depressed economies can grow out of it. ...You can fool people for a while, but after a while people don't want to hold your paper.

Source: CNBC

We keep kicking the can down the road. But maybe now we're at the point where the can is kicking back

Chanos dismissed band-aid approaches to fix Europe's and America's economic problems:

"And i think that people don't want to see these cosmetic solutions or a monetizing the debt solution, they want to see a real change and they're not getting that change in Europe or in the U.S."

Source: Bloomberg

On being a broker: “They’re not interested in truth or what’s best for the client, but in making the sale with the least amount of work.”

When Chanos began his career as a junior analyst at brokerage firm Blyth Eastman Paine Webber, he told his boss McDonald's could make more money buying back its own shares than it could issuing bonds at 12%, which is what the firm was pushing McDonald's to do. His boss told him to drop the matter and that's when Chanos realized he couldn't be a banker.

Source: The Globe And Mail

Though I listen to the noise to make sure there’s no new information that I need to know, I don’t worry about most of it.

Jim Chanos says there's a lot of noise in the investment community, in terms of what reporters say, and what analyst reports prompt out of companies and rumor mills. For short-sellers much of this is "a cacophony of negative reinforcement":

"You’re basically told that you’re wrong in every way imaginable every day. It takes a certain type of individual to drown that noise and negative reinforcement out and to remind oneself that their work is accurate and what they’re hearing is not

…Though I listen to the noise to make sure there’s no new information that I need to know, I don’t worry about most of it. You need to be able to drown out what the Street is saying. I’ve come around to the view that to be a good short seller, in addition to having the important skill set, one must have the right mindset. I believe this is why a lot of great value investors aren’t particularly good short sellers."

Source: Graham & Doddsville

Beware of the law of unintended consequences

Chanos disagreed with the regulators' decision to ban short selling on American financial companies after the Lehman collapse. The confidence crisis meant banks and other institutions weren't dealing with one another. Short sellers he said help stabilize markets during sell-offs because they have to buy to cover their sale positions.

Source: The Globe and Mail

A lot of what happens in your life is merely serendipitous and really just luck.

In looking back at his career and how he has got to where he is today Chanos said:

"A lot of what happens in your life is merely serendipitous and really just luck. In a lot of ways, that’s the lens through which I look at my own career. If the McDonald’s share buyback episode hadn’t occurred, maybe I wouldn’t have left Blyth and I’d probably still be doing deals and be miserable. To join a new firm and to have the first company I look at turn out to be an enormous financial fraud was equally good luck."

Source: Graham & Doddsville

If you ever have an idea and you think you need to take career risk to accomplish it, do it early in your career.

Chanos thinks that if you have to take risk, take it early in life.

"Life intrudes -- as when you get older you end up with more responsibilities and your ability to take risk diminishes. If you are 25 and have a great idea and you fail, no one is going to hold it against you, and future employers and investors might actually look favorably upon it. So it you really want to pursue something, do it while you're young — you'll have more energy and you'll be able to take more financial and career risk. If it doesn't work, you still have your whole life ahead of you."

Source: Graham & Doddsville

But is there a bubble in the US stock market?

Popular Right Now

Advertisement