Representational image. Unsplash

- Out of 500 stocks in the BSE 500 index, 37 stocks have more than doubled investor wealth in the last six months.

- 7 of these stocks are from the infrastructure sector, delivering strong performance relative to the benchmark indices Nifty 50 and Sensex.

- Take a look at the top infrastructure stocks in BSE 500.

The Indian stock markets have been on a rally after recovering from the shock on March 23, last year, when India went into a strict nationwide lockdown. Both Nifty 50 and Sensex had tumbled by 13%, triggered by a massive sell-off.

Fast-forward a little over a year, the benchmark Nifty 50 and the BSE Sensex are at an all-time high, multiplying investor wealth in a year full of uncertainties.

37 companies in the BSE 500 index have doubled investor wealth in the last six months. Among these, the infrastructure sector has been the top performer, accounting for 7 companies on its own.

In the last six months, Sensex has surged by over 15%. In comparison, these infrastructure stocks have surged by a minimum of 110%.

One of the reasons behind the infrastructure sector topping the charts could be the Indian government’s National Infrastructure Pipeline, first announced on August 15, 2019, with a budgeted outlay of ₹111 lakh crore (approx. $1.6 trillion).

Here’s a look at the infrastructure stocks which have doubled or tripled investor wealth in the last six months (between November 26, 2020 to May 27, 2021):

Note: Penny stocks are not included in the list.

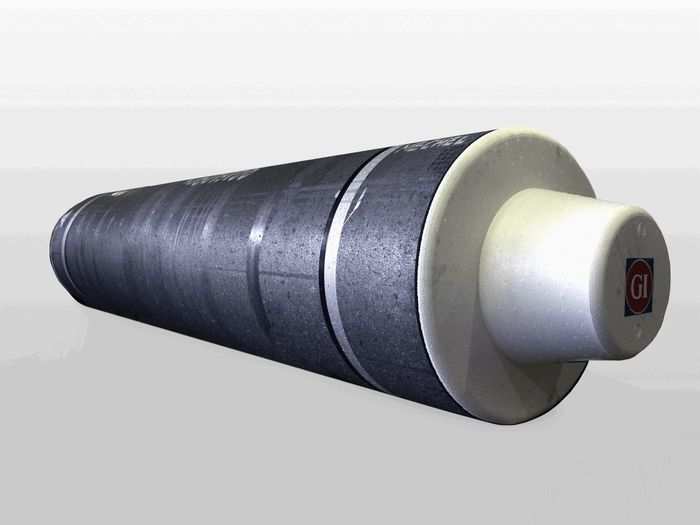

Graphite India

Graphite India

Graphite India manufactures graphite electrodes as well as carbon and graphite specialty products. Its share price has surged by over 200% in the last six months, going from ₹243 to ₹745 as of May 27, 2021.

An investment of ₹10,000 six months ago in Graphite India is now worth ₹30,600.

HEG

HEG

HEG is another company known for manufacturing graphite electrodes. Like Graphite India, its share price has also been rallying due to a surge in the demand for steel, which has also led to an increase in demand for graphite electrodes (GE). According to global research firm Jefferies, this cyclical revival in GE bodes well for HEG.

An investment of ₹10,000 six months ago in HEG is now worth ₹27,500.

Bharat Heavy Electricals

BCCL

Bharat Heavy Electricals, also known as BHEL, has been zooming over the last few weeks, going from ₹44 midway through April to ₹72.9 on May 27, 2021. The government-owned firm is India’s largest engineering company, with dominance in supply of equipment for power plants. Some of its key products include gas turbines, thermal sets, diesel shunters, generators, transformers among others.

An investment of ₹10,000 six months ago in BHEL is now worth ₹22,200.

CG Power and Industrial Solutions

CG Power and Industrial Solutions

Earlier known as Crompton Greaves, CG Power and Industrial Solutions is known for designing and manufacturing products related to power generation, distribution and transmission. The rally in the power industry has been driven in part due to the government’s ₹90,000 crore liquidity boost, announced on May 14, 2020, and relaxed working capital norms.

An investment of ₹10,000 six months ago in CG Power and Industrial Solutions is now worth ₹21,400.

Shipping Corporation of India

BCCL

Shipping Corporation of India, a government-owned company, operates and manages vessels in both national and international waters. Shares of the company have been buzzing after the government announced that it had received multiple bids for its privatisation.

An investment of ₹10,000 six months ago in Shipping Corporation of India is now worth ₹21,200.

Grindwell Norton

Grindwell Norton

Grindwell Norton is one of the leading manufacturers and exporters of abrasives and carbide. It has continued to deliver strong results, with its net profit surging by 30% in what has otherwise been a disappointing year for many companies. Research house Edelweiss has credited this strong showing to an uptick in the industrial cycle, robust exports growth and other factors.

An investment of ₹10,000 six months ago in Grindwell Norton is now worth ₹21,000.