BCCL

- Shares of auto component makers involved in the manufacturing of certain components for electric vehicles seem to be the flavour of the season.

- Currently, there is a huge demand to produce lithium batteries, charging stations, related parts, and more required to produce EV.

- On the occasion of World EV Day, let us get to know about some of the companies that seem to be celebrating the electric vehicle revolution.

With the recent launch of Ola’s electric scooters, and buzz around existing electric vehicle (EV) models by Tata Motors, MG Motor, Mahindra and Mahindra (M&M), Audi and others, electric vehicles are increasingly becoming the flavour of our times.

For small traders and investors looking to make the most of this boom, who don’t get the chance to buy or sell shares of unlisted companies like Ola or international ones like Tesla, there are other options too.

Beyond carmakers like Tata Motors and M&M, there are a bunch of other companies in the EV ecosystem making components like lithium batteries, charging stations, related parts, and more.

On the occasion of World EV Day, let us get to know about some of the companies that seem to be celebrating the electric vehicle revolution.

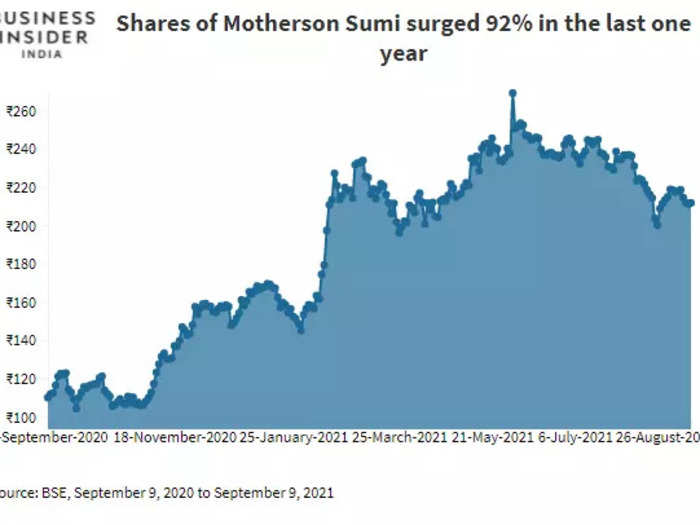

Motherson Sumi climbed 92% led by its strong position in the electric vehicle segment

Flourish chart/BSE data

Shares of auto parts maker Motherson Sumi surged 92% in the last one year. The company has received good orders in this space from global clients. Its subsidiary, Sam Vardhana Motherson Automotive System Group, has at least 25% of new orders for EVs, according to the FY21 annual report. Daimler Group, Audi and Volkswagen are some of its key clients.

ICICI Direct Research reportedly says that Motherson Sumi is largely unaffected by the global chip shortage and the outlook remains bright.

The market capitalisation of the company is at ₹66,644 crore.

Minda Corporation gearing up to become one stop shop for EV charging solutions

Flourish chart/BSE data

The Gurugram-based company, which makes everything from wiring harnesses to electronic security systems and sensors for cars, has surged 75% in the last one year.

In the meantime, Minda Group has changed its name to Spark Minda. However, the stock is still identified with the name Minda Corporation.

To strengthen its footing in the space, last week its subsidiary Spark Minda Green Mobility Solutions acquired a 26% equity stake in charging solutions startup EVQPOINT Solutions.

The company believes that the strategic partnership will position Spark Minda to capitalise on the accelerating shift to electric mobility and further boost its position as a one stop shop for comprehensive charging solutions for EVs.

The market capitalisation of the company is at ₹2,981 crore.

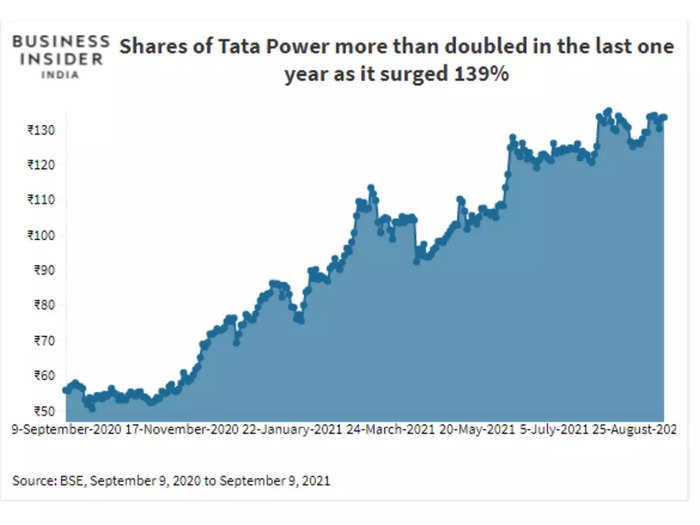

Tata Power seems to be having the strong game in EV charging points

Flourish chart/BSE data

The power distribution company Tata Power has also entered the EV market by deciding to set up charging stations at state-run Hindustan Petroleum Corp’s (HPCL) fuel retail outlets in multiple cities and across highways in the country.

Moreover, today, realty developer Lodha Group has partnered with Tata Power to provide electric vehicle charging points at Lodha projects across Mumbai Metropolitan Region (MMR) and Pune.

Currently, the company is present across all segments of the EV ecosystem – public charging, captive charging, home, workplace charging and ultra-rapid chargers for buses. It has over 500 public chargers in more than 100 cities covering petrol pumps, metro stations, shopping malls, theatres and highways.

The market capitalisation of the company is at ₹42,561 crore and the stock has surged 139% in one year.

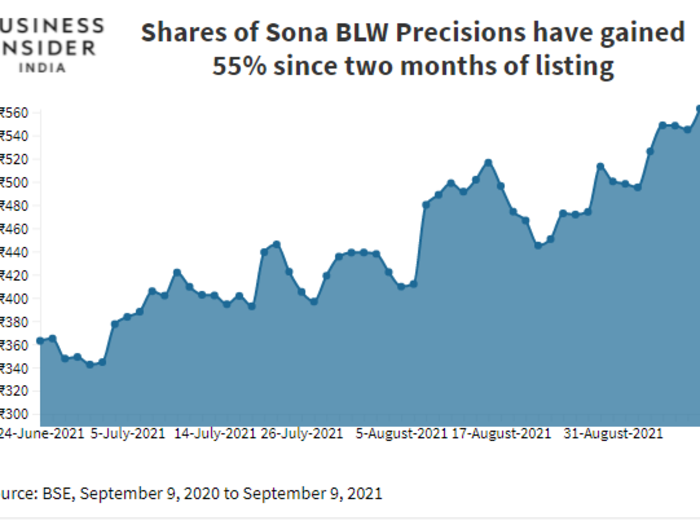

Sona BLW Precisions have zoomed 55% in two months of listing

Flourish chart/BSE data

The supplier of parts for large automobile companies like Ashok Leyland and Maruti to Volvo and Jaguar Land Rover has been one of the stocks gaining on rumours that it could benefit from the entry of Tesla in India.

Earlier in July, Tesla’s chief executive officer Elon Musk had announced plans to set up a factory in India if the response to its electric cars is good. Stocks like Sona and Sandhar Technologies surged on hopes and rumours that they will get juicy business from the American EV giant.

However, the management of Sona later clarified that it is not engaged in any such discussions with respect to supply of components to Tesla for its India plan.

The market capitalisation of the company is at ₹31,783 crore. The two-month old stock has gained 55%.

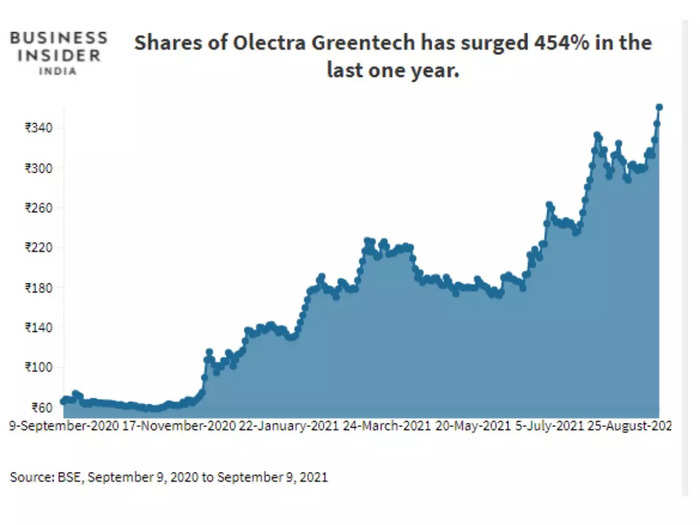

A multibagger stock that turned an investment of ₹10,000 to more than ₹50,000 in one year

Flourish chart/BSE data

Hyderabad-based electric bus and insulator manufacturing company Olectra Greentech has created immense wealth for investors in the last one year. The stock surged 454% in the last one year.

The company made a profit of ₹5.65 crore in the June quarter compared to ₹3.26 crore loss in the previous quarter last year. The company has a healthy order book for 1,325 e-buses out of which 87 buses are already delivered.

The market capitalisation of the company is at ₹2,821 crore.

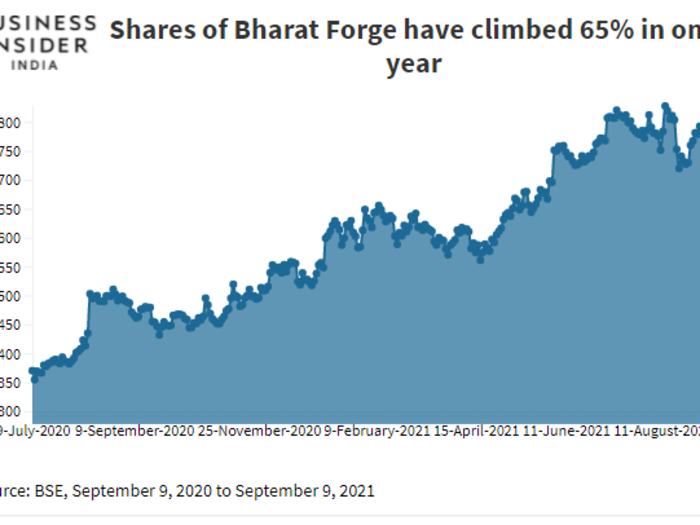

Bharat Forge runs up 65% returns in one year

Flourish chart/BSE data

The Pune-based component maker, which exports parts for the class 8 trucks in the US, has also decided to ride the EV wave.

Recently, Bharat Forge formed a new company named Kalyani Powertrain to look into its EV business initiatives. Shares of the company have gained 65% in the last one year.

Moreover, it also plans to make electric two- and three-wheelers with the help of a startup Tork Motors, a Pune-based electric motorcycle startup, where Bharat Forge has about 49% stake. The first model is expected in the market in 2022.

The market capitalisation of the company is at ₹35,971 crore.

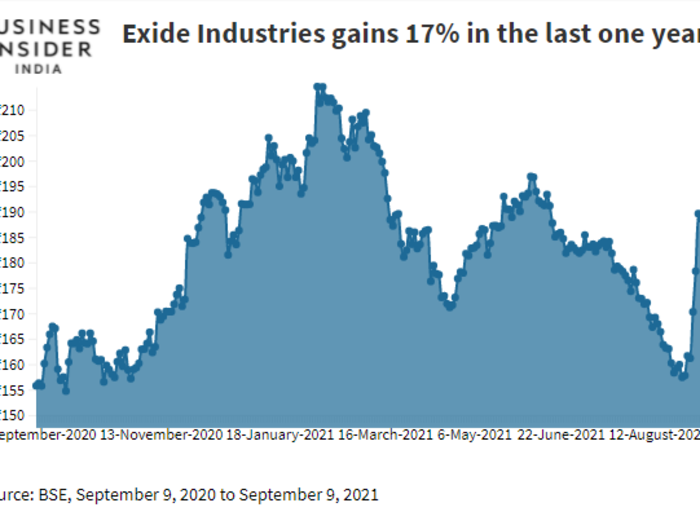

One of India’s largest battery manufacturers, Exide industries, gains 17% in the last one year

Flourish chart/BSE data

One of India's largest manufacturers of batteries, Exide Industries, provides lithium-ion batteries and energy storage solutions to power the growth of India's electric vehicle market.

The company has signed an exclusive joint venture agreement with Switzerland-based Leclanche to address India's transition to green energy and clean transportation. The JV focuses on e-transport, stationary energy storage systems and speciality storage markets. In e-transport, the target segment is fleet vehicles including e-buses, e-wheelers and e-rickshaws.

The market capitalisation of the company is at ₹15,559 crore.