- TCS, Infosys and Wipro declared their December quarter results on January 12.

- While TCS continued to lead the three in terms of margins and signing up large $100 million or more clients, Infosys’ attrition rate worsened.

- Here are all the highlights from the December results of Indian IT giants.

- Check out our weekly explainers on the hottest topics and sign up if you like them.

The troika of Indian IT service giants, TCS, Infosys and Wipro announced their quarterly results on the same day for the first time. While the results were generally upbeat and in line with market expectations, there were some surprises like Infosys witnessing a worsening attrition rate, while Wipro witnessed its worst quarter this year in terms of revenue growth in constant currency terms.

Here’s how the three Indian IT giants stack up against each other:

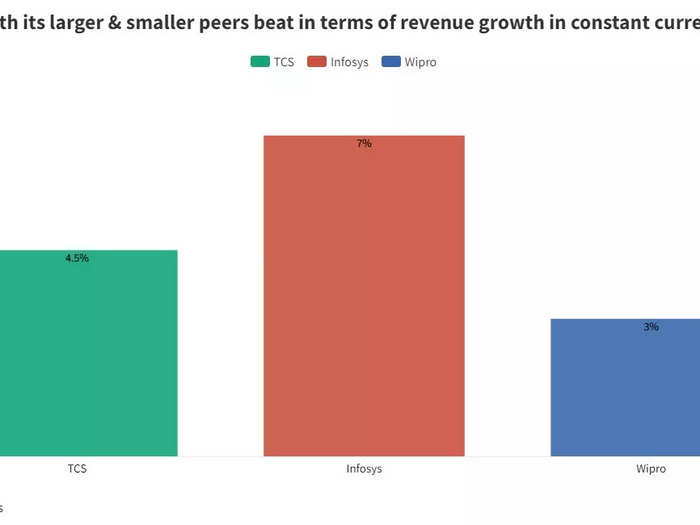

1. Revenue growth in constant currency

Company reports / Business Insider India / Flourish

While TCS’ growth wasn’t as stellar as Infosys’, it is worth noting that TCS brought in revenue to the tune of $6.5 billion, while Infosys generated $4.3 billion. Wipro’s revenue stood at $2.6 billion.

TCS is on track with an annual run rate of $25 billion, while Wipro is on track for a $10 billion run rate.

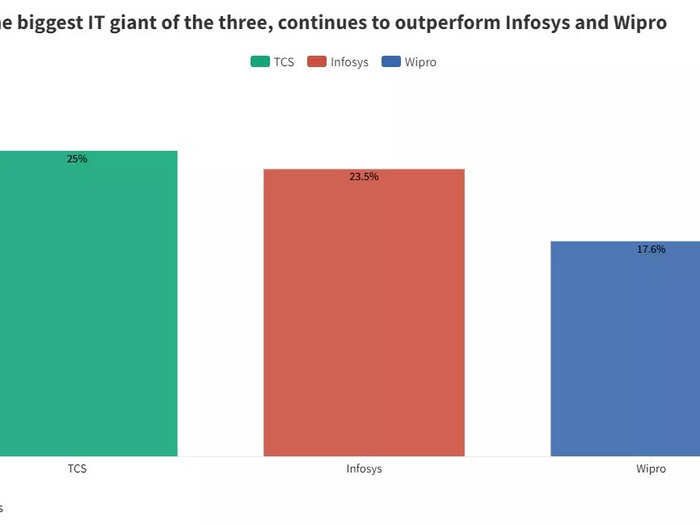

2. IT services margin

Company reports / Business Insider India / Flourish

The bread and butter of the three companies – IT services – were a mixed bag, with TCS and Infosys registering healthy growth while Wipro experienced a contraction.

The shrinking margin is largely due to the rising cost of hiring and retaining employees at a time when techies in India are spoilt for choice.

The rising costs of promotions and incentives as well as the record pace of hiring is eating into the profit margins of all tech companies.

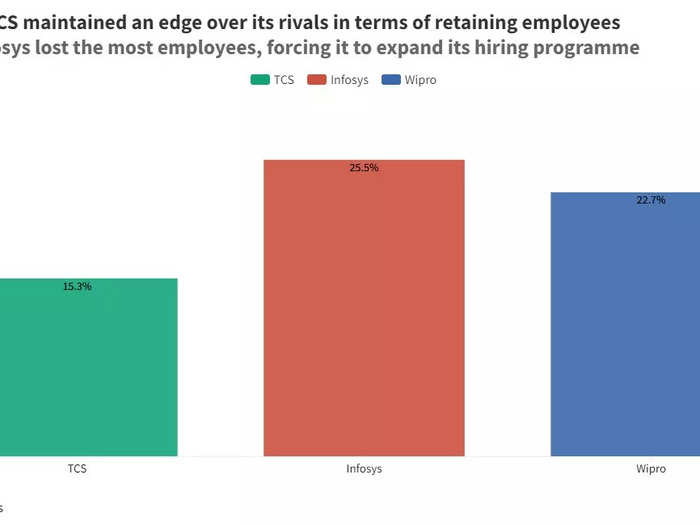

3. Attrition rate

Company reports / Business Insider India / Flourish

Even though attrition rates continue to worsen for all the three IT majors, TCS continues to enjoy the best rates. Infosys’ rates spiked enough for the company to expand its hiring programme for the year.

TCS has also given out a whopping 1,10,000 promotions in the first nine months of the financial year and plans to give out 40,000 more in the next three months.

4. New $100 million clients

Company reports / Business Insider India / Flourish

Large client sign ups amongst the three stood at 20 in the December quarter. TCS alone grabbed half of them, while Infosys took home 8.

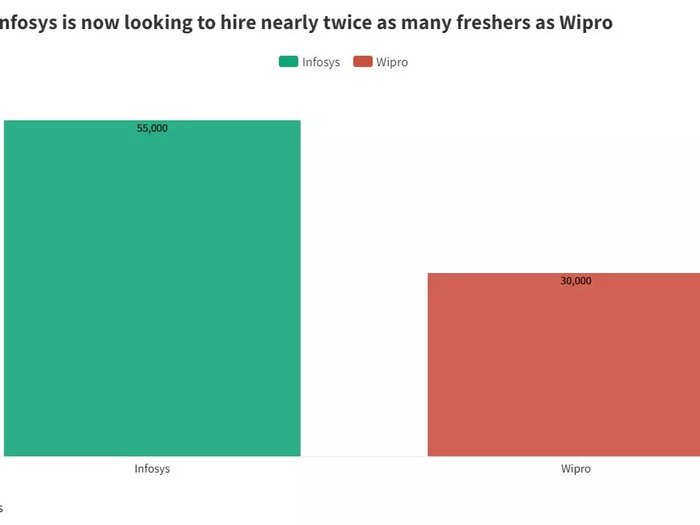

5. Hiring plan

Company reports / Business Insider India / Flourish

Infosys honcho Salil Parekh announced that the company will hire an additional 10,000 employees in the coming quarter, against an initial target of 45,000.

Expecting high churn rates, TCS has completed its full-year fresher hiring target by December and expects to continue hiring in the next three months as well.

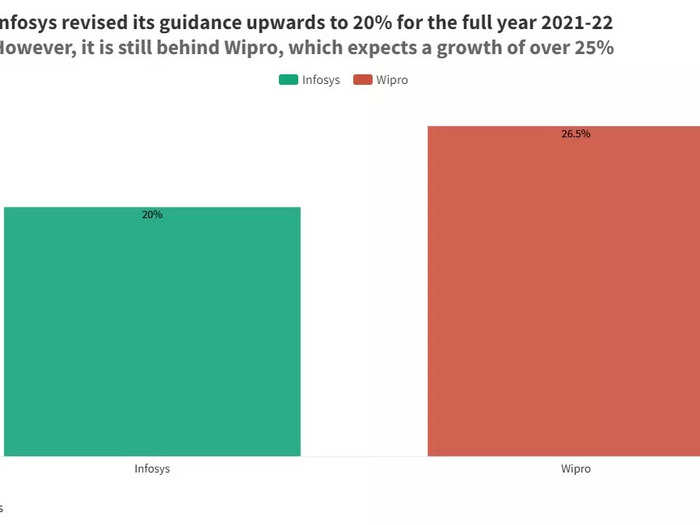

6. Guidance

Company reports / Business Insider India / Flourish

A stellar December quarter has led to Infosys raising its guidance for the financial year 2021-22.

TCS, which doesn’t give guidance, said “We continued our focus on growing organically and on developing the talent, methodologies, and toolkits for an ever-evolving technology landscape.”