Wikimedia Commons

- The probe is for the company’s practice where merchants have to sign exclusive cooperation pacts, which prevents them from selling on rival platforms.

- The decade began with a 46-year old Jack Ma looking unstoppable as he became the poster boy of China’s continued rise from the industrial era, into the digital era.

- Here’s how the last 10 years have panned out.

The decade began with a 46-year old Jack Ma looking unstoppable as he became the poster boy of China’s continued rise from the industrial era, into the digital era. As 2020 comes to an end, Alibaba and Ant Group, founded and guided by Ma, one of the most iconic entrepreneurs of all time, are faced with an

antitrust probe for alleged monopolistic practices.

This is at least the second setback in recent times. Alibaba and Ant Group's $34 billion initial public offering (IPO) was suspended by the

Shanghai Stock Exchange. The world’s biggest IPO, Ant Group, was scheduled for a dual listing on November 5 — on Shanghai and Hong Kong bourses and it was stopped in China with less than 48 hours to go.

As

Bill Bishop, a China watcher famous for his newsletter Sinocism, put it, “The Party has once again reminded all private entrepreneurs that no matter how rich and successful you are it can pull the rug out from under your feet at any time.”

Things were a lot different at the start of the decade

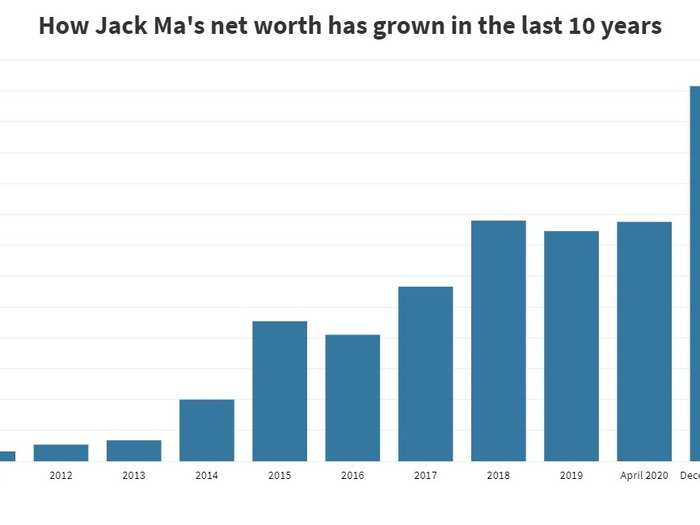

Jack Ma's net worth over the last decade

BI India/flourish

2011

Wikimedia Commons

In 2011, a confident Jack Ma, with one of the world’s largest e-commerce companies under his name, made another bold move that left one of its biggest investors Yahoo miffed. Ma transferred Alipay, Alibaba’s payment vertical, which was a take on PayPal, into a company under his personal control. Ma, who had taken a $1 billion cheque from Yahoo in 2005, was beginning to be discontent with Yahoo’s stake in the company. "I just don't trust them. I've been working with them for years, and I'm disappointed,” he had said in an interview with Forbes.

2012

Wikimedia Commons

Jack Ma bought back half of Yahoo’s stake in Alibaba for as much as $7.6 billion – reducing their stake from 40% to 23%. ““The completion of this transaction begins a new chapter in our relationship with Yahoo,” Alibaba CEO Jack Ma had then said, as the company was getting close to an IPO.

In the same year, Alibaba booked nearly double than Amazon’s sales and with $157 billion in sales, Alibaba secured its place as the world’s largest e-commerce company.

2013

Wikimedia Commons

Ma surprised everyone by stepping down from his post of the CEO of Alibaba, but continued to remain the Chairman of the company. He handpicked his successor Jonathan Lu. “I’m 48. I’m no longer young enough to run such a fast-growing business. When I was 35, I was so energetic and fresh-thinking. I had nothing to worry about,” Ma had said in an interview.

2014

Alibaba Group

The year will be remembered by market experts as the year when Alibaba’s iconic IPO debuted. Back then, valued at $25 billion, it was the world’s biggest IPO. The same year, Ma was a finalist for Time Person of the Year. “This new Wall Street juggernaut, based 7,000 miles away in Hangzhou, China, is Alibaba,” the Time had said about Alibaba’s IPO.

2015

Business Insider

Competition rose as Alibaba, which was pushing boundaries across digital platforms, saw one of its biggest rivals JD.com follow its heels and enter the US market. But there was also another trouble brewing for the Chinese giant in the US, more and more reports of fake goods and counterfeited products sold on the platform began to rise.

2017

Wikimedia Commons

Jack Ma secures his position as Asia’s richest man again, this time with a net worth of $37.4 billion. In the same year, Ma ranked second in Fortune’s "World's 50 Greatest Leaders" list.

2018

Alibaba Group

Ma surprises the world yet again as he announces that he is stepping down from the post of executive chairman of Alibaba, after being at the helm for 20 years. The teacher at heart, said that he wants to get back to education and philanthropy through his Jack Ma Foundation which was started in 2014. “Before I'm 70 years old, I can do something in other fields, in areas like education," Ma had said earlier.

2019

Alibaba Group

Yahoo finally severed all ties with Alibaba. Yahoo’s spin-out company Altbaba, which was created to consolidate its stake in Alibaba, announced that it was selling its entire stake in the Jack Ma-founded company. “Any shareholder has the right to deal stock anytime on the market, for any purpose. We’re happy to have had Yahoo! invest in Alibaba in the past and to see it now collecting a strong return on its investment,” an Alibaba spokesperson had then said.

But the sale came in a year, when Alibaba announced its massive Hong Kong IPO – which was touted to be another of the world’s biggest IPOs. “Alibaba Group is guided by our mission to make it easy to do business anywhere with the vision to be a good company that lasts for 102 years,” Alibaba Group Chairman and Chief Executive Officer Daniel Zhang had said then.

After his initial announcement, Jack Ma officially stepped down from his post as executive chairman. . However, Ma continues to be on the board of Alibaba, holding on to 6.22% shares of the company.

2020

Alibaba Group

In a pandemic year that saw businesses across the world take a big hit, Alibaba wasn’t immune to the impact of COVID-19, especially given the fact that the coronavirus pandemic began in China.

Alibaba’s market value is a whopping $600 billion, and hopes are pinned on the dual IPO in Shanghai and Hong Kong bourses. But a massive blow comes for the e-commerce giant as Alibaba and Ant Group's $34 billion initial public offering (IPO) was suspended by the Shanghai Stock Exchange. The Shanghai Stock Exchange had cited changes in the regulatory environment as the reason behind this suspension. China’s regulators had earlier warned Ma and his company that the listing would mean the group would be subject to scrutiny and could face new curbs to its expansion.

And on December 24, another hit came in for the Chinese giant, as it now faces an antitrust probe by its own country. According to reports, Alibaba had earlier been warned by the regulators for its “choosing one from two practice under which merchants are required to sign exclusive cooperation pacts preventing them from offering products on rival platforms.”

The statement was issued by China’s State Administration for Market Regulation, which is responsible for keeping a check on market competition, monopolies and more.

Representatives from Ant Group are set to meet the regulatory authorities soon, as the regulators will “guide Ant Group to implement financial supervision, fair competition and protect the legitimate rights and interests of consumers.”

As the decade comes to a close, Ma has not only lost his Asia’s richest man tag to India’s Mukesh Ambani, but has now also lost the tag of being China’s richest man to Ma Huateng, founder and CEO of Chinese Internet giant Tencent Holding. In 2020, Ma and his longtime friend Masayoshi Son, the Chairman of SoftBank, both resigned from each other’s company’s boards.

As of December 23, 2020, Alibaba has lost over $165 billion in market value, from its 2020 high of $858 billion in October.