- Four startups became unicorns on an average per month in 2021.

- Eighteen startups from the ecommerce and fintech space turned unicorns in 2021.

- Fintech and ecommerce will continue to be among investors’ favourites in 2022.

There were several high points in the Indian startup ecosystem in 2021. Nine tech startups got listed on the public market, whereas four startups became unicorns on a monthly basis on an average. A unicorn, in startup parlance, is a company valued at or over $1 billion.

Investors believe that the same streak is likely to continue in 2022 too as India is underway to have

150 unicorns by 2025.

You can read more about the high points of the Indian startup ecosystem

here.

Business Insider spoke to several investors and venture capitalists to compile a list of 21 startups that may turn unicorns in 2022.

“Hyper growth category leaders will continue to see startups achieving the unicorn status. These startups are founded by charismatic founders chasing a large untapped market and have limited competition. Ecommerce, fintech, software-as-a-service (SaaS), D2C [direct-to-consumer] will keep seeing more unicorns, but even emerging sectors like gaming, health tech, edtech, agritech will see more unicorns being minted,” Ankur Bansal, cofounder and director at Blacksoil told Business Insider.

Fintech will definitely be something to watch out for

BI India

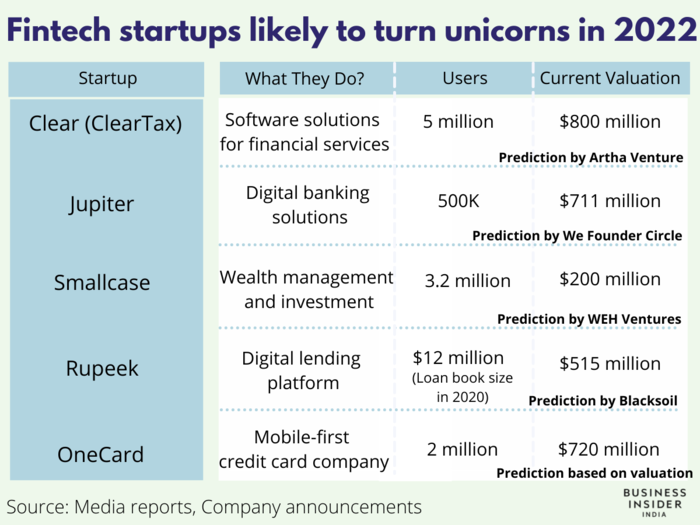

Fintech, along with ecommerce, was one of the most popular segments for investors based in India as well as abroad. The country saw 11 Indian fintech companies — including BharatPe, Cred, Groww, Upstox and Acko — turn into a unicorn in 2021.

The same trend is likely to continue in 2022 too, as more users get comfortable in transactions online and try out digital financial services offered by these platforms. Clear (formerly known as ClearTax) has already made its mark in financial services related to tax filing, but it now also focuses on wealth management and lending both in India and abroad.

Jupiter is making banking simple with its digital solutions, OneCard is pushing for financial inclusion with easy credit and Rupeek is helping

users get gold-based hybrid loans. Smallcase bagged

Amazon’s investment this year to help customers find the right investment portfolio for them.

At least two ecommerce players will turn unicorn in 2022

BI India

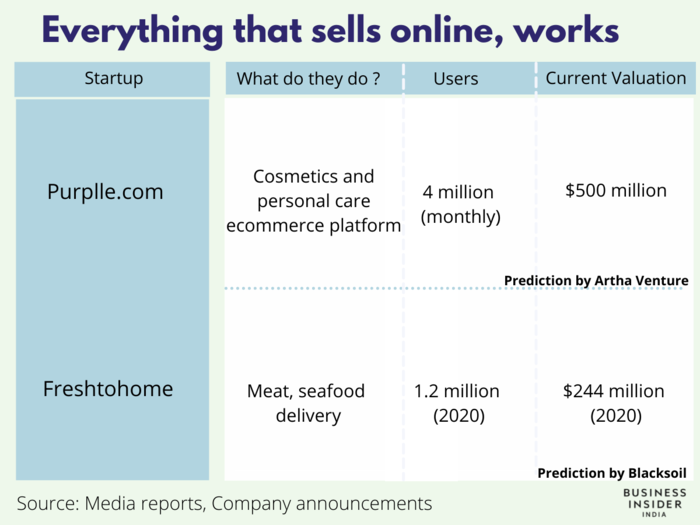

Ecommerce did hit its peak in the last two years as more shoppers were shopping online. Whether it was ecommerce, food delivery or even car sales, the companies in these spaces achieved big milestones. In 2021, 11 Indian ecommerce companies —including Cars24, Blinkit (Grofers), Meesho, Mensa Brands — turned into a unicorn.

This year, investors are placing their bets on Nykaa’s closest competitor Purplle and Licious’ competitor Freshtohome. Nykaa recently got listed on the exchanges and Licious had turned a unicorn in October 2021.

Then there are players that make online selling quicker

BI India

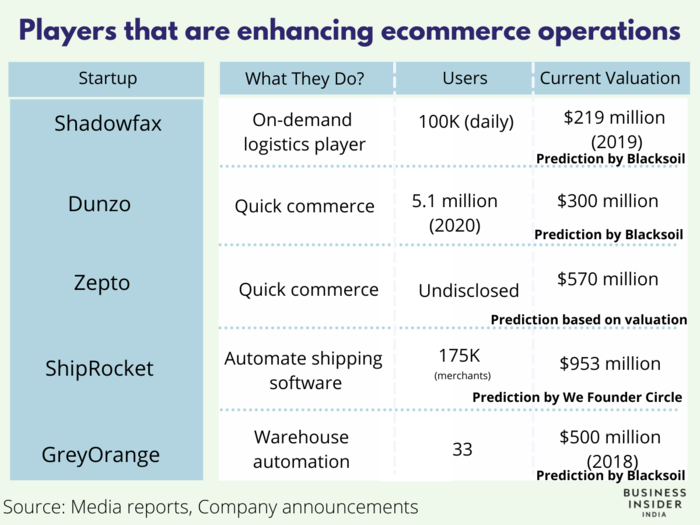

Quick commerce became a trend in the last quarter of 2021 as all players, big or small, decided to bet on 10-minute delivery. Swiggy announced its $700 million investment in this space, Grofers rebranded itself to Blinkit, Tata and Reliance were chasing Dunzo for funding and seven-month-old Zepto was valued at a whopping $570 million — this was the time for quick commerce players.

Then there was Shadowfax — which offers on-demand tech-backed gig marketplace that helps businesses outsource last-mile activities — that decided to focus on quick commerce as well as its regular delivery operations.

Shiprocket, which helps companies automate shipping software, may be making an entry into the unicorn club and so will GreyOrange that automates warehousing for ecommerce players.

The category creators

BI India

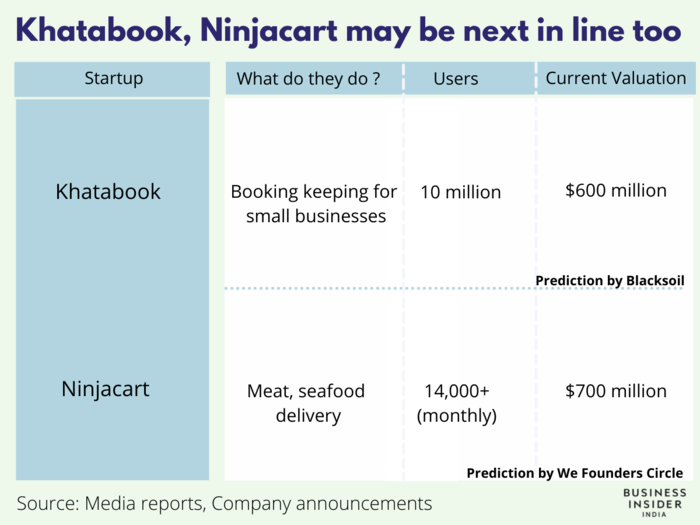

Khatabook was originally founded by Vaibhav Kalpe in 2016. The company was later acquired by Kyte Technology — founded by Ravish Naresh, Jaideep Poonia, Dhanesh Kumar and Ashish Sonone — in 2019, with Kalpe joining the company.

Khatabook helps small shopkeepers and kirana store (mom and pop stores) owners in India manage their account by keeping track of the money owed to them through digital ledger. It also offers several features to make collection of money earlier through the use of technology.

Ninjacart was set up by Thirukumaran Nagarajan, Sharath Loganathan, Sachin Jose, Kartheeswaran KK and Vasudevan Chinnathambi in May 2015. Ninjacart is an agritech startup that sources groceries, fruits and vegetables directly from farmers and supplies to supermarkets as well as kirana stores.

The company claims to move over 1,400 tonnes of fresh produce, which includes fruits and vegetables, per day from farmers to over 17,000 local stores and restaurants across 20 cities. “They have grown more than 20x in 4 years time and have been able to capture the market really well by streamlining the entire supply chain in agriculture. They have been able to amass a huge network of farmers and retailers and restaurants,” Gaurav VK Singhvi, cofounder at investment firm We Founder Circle, said.

Players in the mobility space are back on track

BI India

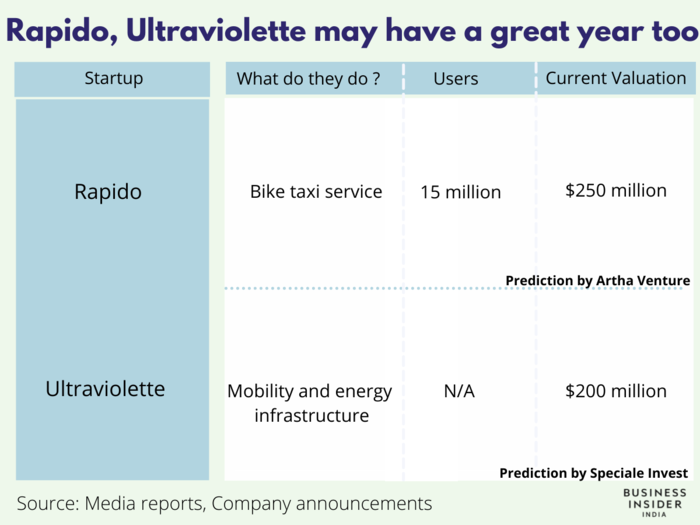

The players in the mobility space faced a huge setback as India stepped into a lockdown last year. Finally, investors think that this year we could see two players — Rapido and Ultraviolette Automotive — be valued over a billion dollars in 2021. Rapido — which was founded by Aravind Sanka, Pavan Guntupalli and Rishikesh SR in 2015 — is a bike taxi service app for intra-city commuting.

Ultraviolette Automotive was founded in 2016 by Narayan Subramaniam and Niraj Rajmohan. It develops sustainable mobility and energy infrastructure. The Bengaluru-based startup had first showcased the electric motorcycle in November 2019 and it has received over 50,000 booking requests so far. Speciale Invest, who predicted Ultraviolette Automotive’s entry into the unicorn club, is an investor in the company.

Investors are also counting on data-driven, cloud telephony solutions

BI India

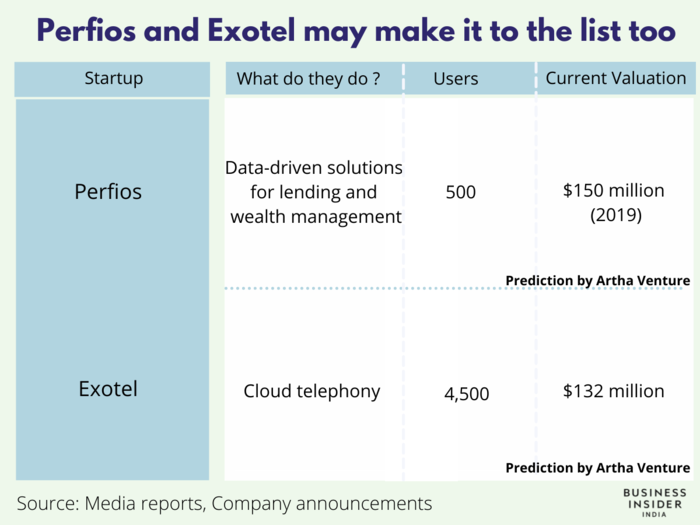

Artha Venture Fund believes that this is the year Exotel and Perfios step into the unicorn club as the demand around their product line increases.

Perfios offers data-driven solutions for consumer lending, sme lending and wealth management. “India's demand for credit will quadruple in the next 7 years. Perfios’ real-time credit decisioning platform is an essential tool for companies that want to provide instant loans at points of sale,” Anirudh A Damani, managing partner at Artha Venture Fund said.

Exotel is a cloud telephony platform that powers communication for enterprises, startups and small and medium enterprises in India and Southeast Asia. “Exotel – the telecom backbone of many Indian Unicorns and will not stay out of that league for long,” he added.

We may have our first spacetech unicorn, say investors

BI India

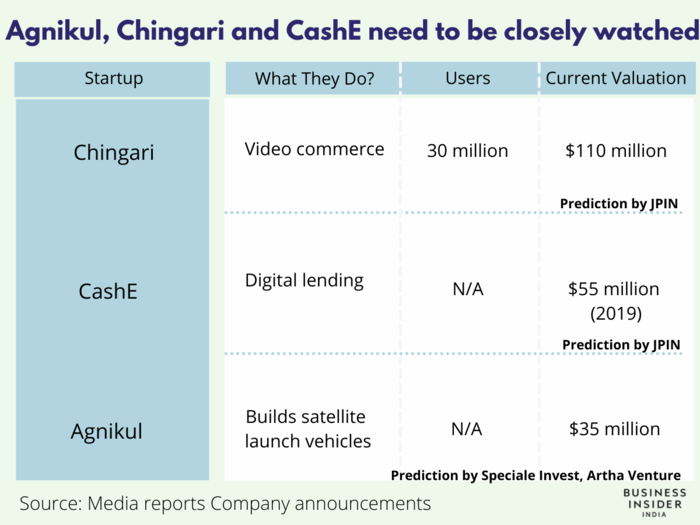

Agnikul was the first Indian space startup to enter into a non-disclosure agreement (NDA) with the Department of Space (DoS) under the Indian National Space Promotion and Authorisation Centre (IN-SPACe). Its investors — Speciale Invest and Artha Venture — now say that the company will be the first Indian spacetech startup to be valued at $1 billion. However, it may seem a bit far fetched as the company was reportedly valued at $35 million in March.

Meanwhile, venture capital firm JPIN has highlighted that its portfolio companies Chingari and CashE will also become unicorns in 2021. But it has to be noted that Chingari was reportedly valued at $110 million in October 2021 and CashE was reportedly valued at $55 million in December 2019.