- Indian startup IPOs raised $6.1 billion from the public market, which is nearly 70% of $8.8 billion raised in IPOs this year.

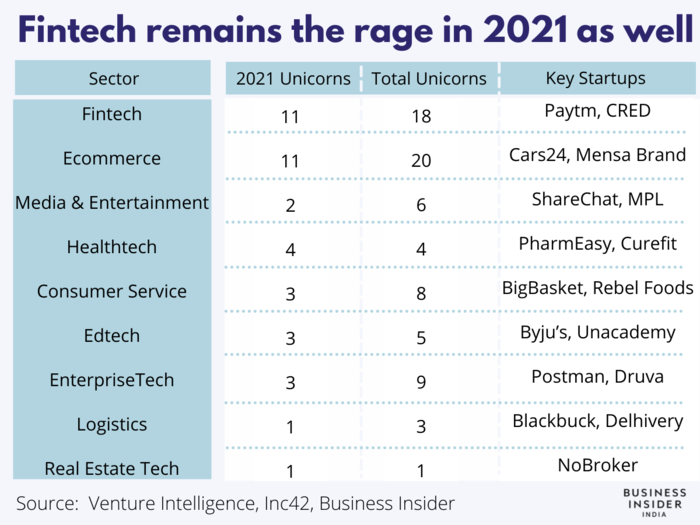

- Indian fintech companies raised $10.6 billion in 2021 till December 22, and continued to be the highest funded sector this year.

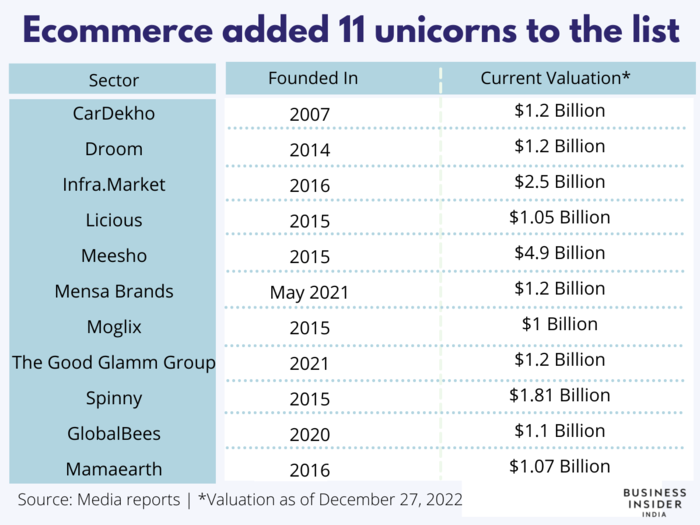

- Nine ecommerce players were valued over $1 billion this year, doubling the total tally of unicorns in the industry.

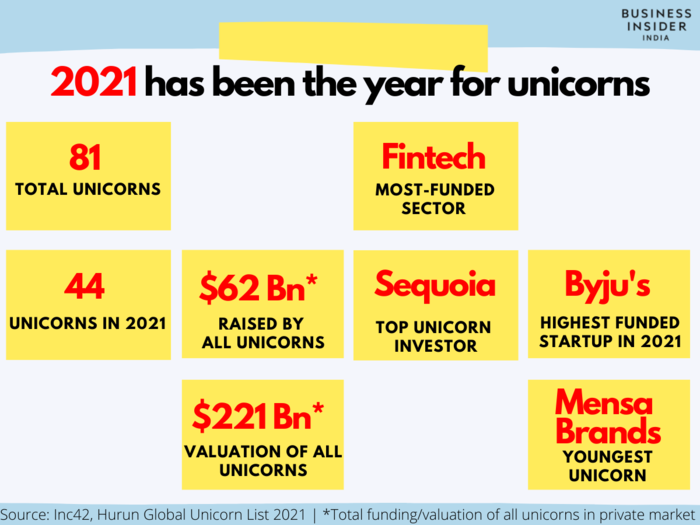

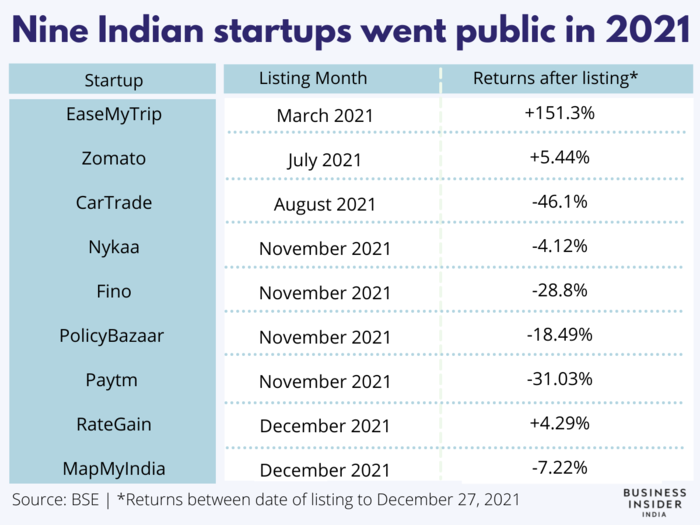

The year 2021 will be remembered for massive tech startup initial public offering (IPOs) — nine public issues raising ₹46,045 crore ($6.1 billion) of the total

$8.8 billion raised in public market this year— and the creation of four unicorns every month.

While nine Indian startups — including

digital payments giant Paytm,

food delivery business Zomato and

fashion ecommerce platform Nykaa — caught the fancy of India’s stock market investors, the unlisted space saw the creation of 42 unicorns, more than the total of the last three years combined.

Fintech and ecommerce remained the most sought after segment within startups in 2021, now two years in a row. But the excitement was palpable in other areas like edtech, and software solutions. The biggest fundraising this year was still Byju’s, which once again raised $1.3 billion across multiple tranches.

Let’s look at how it played out, what were the catalysts for such a boom in unicorns this year, and who were the big winners.

India surpasses UK as the third biggest unicorn hub

BI India

A record high of 42 Indian startups were valued over $1 billion this year, surpassing the United Kingdom (UK) as the third largest ecosystem with the most number of unicorns.

A unicorn, in startup purlance, is a company valued at over $1 billion.

The United States of America (USA) is currently leading the world with the most number of unicorns, followed by China, as per Hurun Global Unicorn Index for 2021. India proudly stands at third rank this year, with Bengaluru as the seventh biggest unicorn hub in the world.

Fintech remains the rage

BI India

Fintech companies have continued to grab investors attention this year as well. However, the segment has broken its own record of funding by multiples as India’s internet adoption rate increased in the last two years.

According to a report by Dolat Capital, Indian fintech companies raised $10.6 billion in 2021 till December 22. In comparison, fintech startups had raised $4.3 billion in 2019 and $3.1 billion in 2020.

Upasana Taku-led digital payments solution Mobikwik and Ruchi Deepak-led digital insurance company Acko Insurace became the first female-led fintech startups to enter the unicorn club. Other notable entries to the club was Kunal Shah-led CRED, Ashneer Grover-founded BharatPe, and online investment companies Groww and Upstox.

This year also turned out to be the year for crypto companies, as CoinDCX and CoinSwitch Kuber became the first unicorns in this segment. Even though the India government is looking to ban private cryptocurrencies in India, the duo collectively raised nearly $300 million collectively this year.

Anything that can be sold online is being preferred

BI India

Lockdown forced many consumers to buy online and many of them continued to do so even after the streets opened up. Even traditional retailers such as Marico, Nestle and Hindustan Unilever (HUL) have had to up their game to tap the growing demand online.

Nine ecommerce players — including Meesho, Moglix, Infra.Market — were valued over $1 billion this year, nearly doubling the total tally of unicorns in e-commerce. Mensa Brands, founded by the former CEO of Myntra, became one of the youngest unicorns in the world by hitting the milestone in six months of inception.

The online car sales only makes a marginal portion of the overall car sales in India, yet investors took special notice of the segment this year. CarDekho, Droom and Spinny entered the unicorn club. Cars24 became the highest valued company in the domain, valued at $3.4 billion.

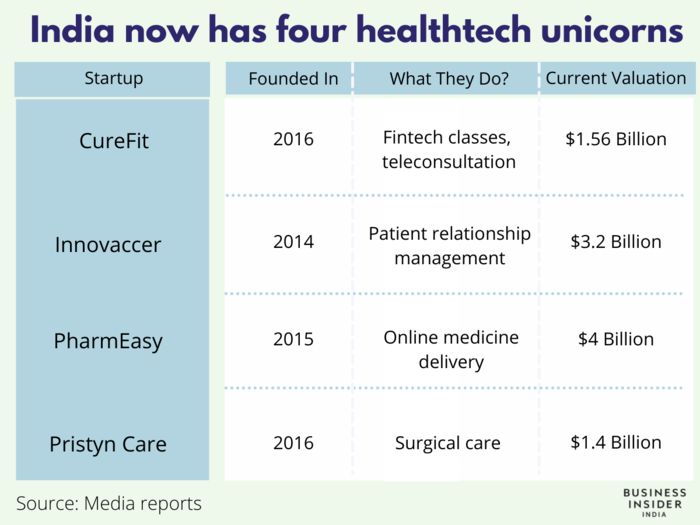

India now has four healthtech unicorns

BI India

Covid-19 brought down the healthcare infrastructure of even the world’s most developed countries like the US, UK, France and more. The need to further enhance the healthcare infrastructure was the top most priority for state-owned as well as private players.

Investors pumped in more money just as the state got enthusiastic about the potential for healthtech.

Epharmacy startup Pharmeasy, patient relationship management solution Innovaccer, health and fitness chain Cultfit and surgical care startup Pristyn Care were all valued over $1 billion this year.

The valuation of PharmEasy is one of the notable developments of 2021 as India still does not have any clear guidelines on online delivery of medicines. The Delhi high court banned online sales of medicine across the country in 2018, but the government of India has shown excitement for digital delivery of health services as well medicines.

The Indian government rushed to roll out its National Digital Health Blueprint (NDHB) and Telemedicine Practice Guidelines last year to further enhance India’s healthcare infrastructure with the intervention of digital solutions.

“Embracing digital payments is a prime example of adaptability… Another example is telemedicine. We are already seeing several consultations without actually going to the clinic or hospital. Again, this is a positive sign. Can we think of business models to help further telemedicine across the world?,” Indian Prime Minister Narendra Modi said, in a Linkedin post published in April 2020.

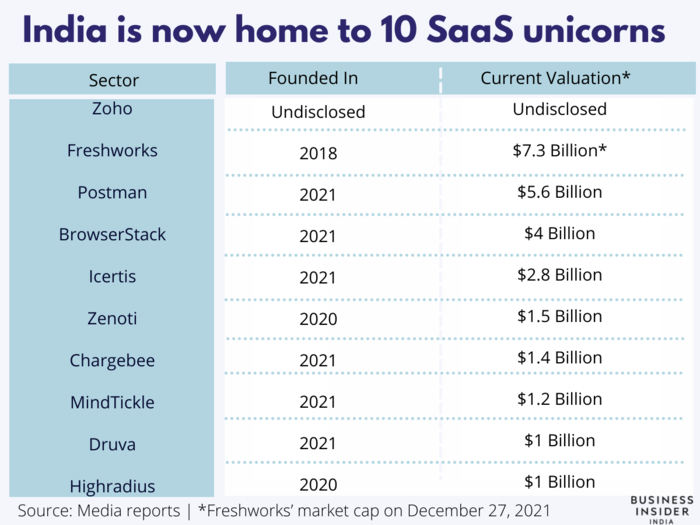

Indian SaaS industry got more sassy

BI India

Three Indian software-as-a-services (SaaS) — MindTickle, Chargebee and BrowserStack — were all valued at over $1 billion this year. The companies joined Freshworks, Postman, Zenoti, Highradius and Druva in the unicorn club.

Overall, India has over 9 SaaS companies in the unicorn club without counting Sridhar Vembu-led Zoho, a bootstrapped startup with a revenue of $584 million (₹4,385.99 crore) in FY2020.

According to a report by investment firm Chiratae Ventures and consulting firm Zinnov last month, the Indian SaaS segment has the potential to clock a total turnover of

$75 billion by 2025.

Startup IPOs of 2021

BI India

One of the highlights of 2021 was the listing of software-as-a-service (SaaS) company Freshworks made India proud with its stellar public debut in the USA’s Nasdaq, turning 500 of its employees into crorepatis (millionaires). “I have had relatives who have told me that I am only good enough to be a rickshaw puller,” Girish Mathrubootham, the man who went on to build Freshworks, told Business Insider in a candid conversation post the listing.

However, the fandom for Freshworks on Wall Street has sobered down and the stock is down over 40% since its listing.

Even those who are listed in India, only 6 of them have given returns to investors who subscribed to its public issue before listing. Paytm’s valuation, on the other hand,

eroded 30% since listing.

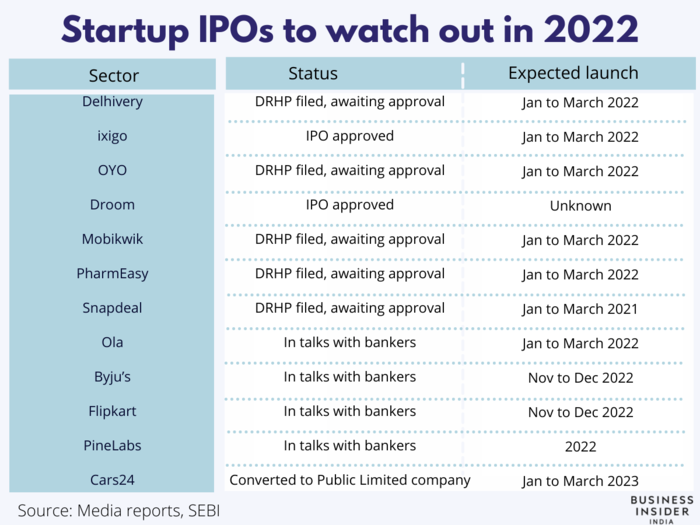

Startup IPOs to watch out in 2022

BI India

Now, 2022 will mark the public debut of logistics company Delhivery, online car sales platform Droom, payments company Mobikwik, hotel and hospitality giant OYO and once India’s biggest ecommerce company SnapDeal. All these companies have already filed their preliminary paperwork for the IPO, whereas Byju’s, Ola and Flipkart are yet to file it.