Wikimedia/Unsplash/Bitmain

- It’s been a mixed bag for crypto this week with two crypto-exchange founders pulling off the largest crypto heist in history, John McAfee ending his life, and crypto companies looking for ways to be more environmentally friendly.

- El Salvador continues to roll out the red carpet for its new crypto-based economy that will come into effect on September 7.

- Check out everything that happened in the cryptocurrency market last week.

The world of

cryptocurrencies saw some noticeable developments in the week gone by.

Anti-virus mogul and Bitcoin bull, John McAfee, allegedly committed suicide while waiting to be extradited to the US in a Spanish jail. He was accused of evading tax for four years.

Meanwhile, in South Africa, two brothers have reportedly made off with nearly $4 billion in cryptocurrencies. They told investors that the exchange was hacked, but the authorities have been unable to track down the founders for more questions.

Yet, the crypto community carries on. El Salvador has created an ‘official’

digital wallet to help its citizens hold Bitcoin and is offering anyone who signs up $30 in the cryptocurrency as a reward.

On the other side of the ocean, Dubai is hosting The Bitcoin Fund on its exchange. This makes the Arabian country the first to have a digital asset-based fund in the Middle East and North Africa marking a huge sign of adoption within the region.

Here’s our weekly roundup of the best cryptocurrency news from the week gone by:

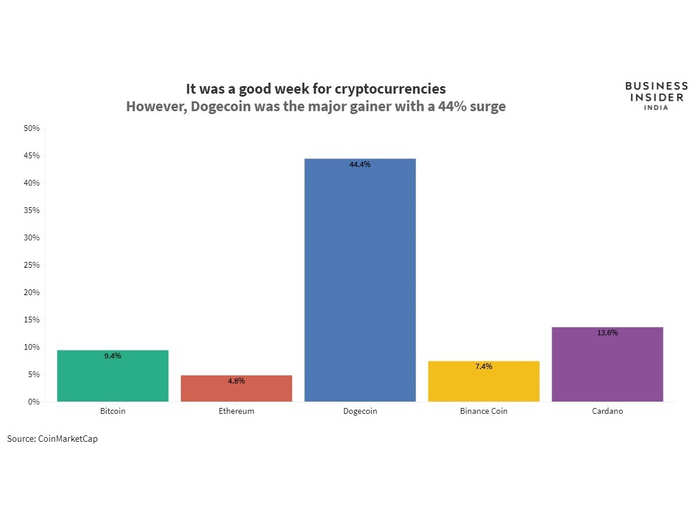

Here’s how the top cryptocurrencies performed in the last week

BI India

Anti-virus mogul and Bitcoin bull, John McAfee, allegedly commits suicide

John McAfee Wikimedia

The founder of the McAfee anti-virus software company and Bitcoin evangelist, John McAfee, allegedly committed suicide in his Spanish jail cell at the age of 75.

McAfee had been arrested in Barcelona last October for evading tax and held in jail while awaiting the outcome of the extradition hearings. The news of his death broke after Spain's National Court approved the extradition of McAfee to face the US-based charges.

McAfee has recently returned to the limelight for making bullish bitcoin price predictions. He frequently touted cryptocurrency and said, "crypto is the key to unlocking our prisons." In another prediction, he forecast that BTC would hit $1 million by the year 2020.

The biggest crypto heist in history — $3.6 billion gets wiped from Africrypt

South Africa's Finance Sector Conduct Authority is looking into the issue but has its hands tied on the investigation considering that crypto assets are not legally considered financial products in the country Google Play

Ameer Cajee and his younger brother, Raees Cajee, founded the South Africa-based Africrypt in 2019. However, when Bitcoin hit $4 billion in April, they were nowhere to be found.

That month Ameer told investors that Africrypt had been hacked, compromising their accounts and wallets. However, the 20-year old did file a report with the authorities.

The brothers continue to remain missing and efforts to track them down have hit roadblocks in light of no regulation to dictate which agency should take lead on the investigation.

The $3.6 billion heist is estimated to be the largest Bitcoin theft till date.

El Salvador plans to give each of the residents $30 in BTC come September

All adult citizens signing up for El Salvador's new digital wallet, Chivo, will get $30 in Bitcoin Press Secretariat of the Republic of El Salvador/Twitter

El Salvador’s President, Nayib Bukele, is leaving no stone unturned to ensure that the launch of Bitcoin as legal tender in September is a hit. The country has launched its own ‘official’ crypto wallet for citizens. Everyone who registers will get $30 worth of BTC for simply signing up.

El Salvador’s Bitcoin law was passed roughly two weeks ago. While the move has been welcomed by the global crypto community, the opposition party has called it for being ‘unconstitutional and the World Bank has refused to lend its help.

A Canadian bitcoin fund just became the Middle East's first crypto listing after debuting on Nasdaq's Dubai exchange

The fund was the first of its kind to be listed on a major exchange in Toronto last year Unsplash

The Bitcoin Fund, based out of Canada, has become the first digital asset-based fund to list in the Middle East and North Africa marking a huge sign of adoption within the region.

While countries like Dubai are crypto-friendly — with the Bitcoin Fund listing and giving permission to CoinMENA to set up base locally — many other Arab countries are still playing the ‘volatility’ card and asking investors to be careful. Iran, for instance, has seemed to have taken an anti-crypto stance when it outlawed its own blockchain association.

Google, Facebook, and Tesla crypto tokens are launching on a crypto exchange

Tesla, Google, Facebook and other crypto tokens of US-based companies will now be available for purchase on the Hong Kong-based FTX crypto exchange Canva

While the cryptocurrency space is still in its nascent stages, crypto tokens for stocks are even younger. Hong Kong-based FTX exchange is following Binance and Bittrex’s lead by allowing its users to trade in US-based tokenised stocks, which include Google, Facebook, Tesla, Netflix and others.

These tokes essentially function like stablecoins, in the sense that their crypto value is determined by the value of their stock. The one primary difference is that traders will be able to put in orders 24 hours a day, and 365 days a year — no downtime whatsoever.

Bitcoin billionaires, the Winklevoss twins, bought $4 million in credits to offset carbon emissions

Wikimedia

Tyler and Cameron Winklevoss' crypto exchange, Gemini, has bought $4 million in carbon offsets. The move is likely aimed at assuaging Gemini customers — especially institutions — that their crypto trading does not conflict with their ESG goals with increasing concerns about the energy consumption of crypto mining.

World’s largest Bitcoin mining rig seller isn’t taking any new orders for foreseeable future

Bitmain's mining facility in Rockdale, Texas Bitmain

Bitmain Technologies, the world’s largest mining rig seller, has stopped spot delivery of its Bitcoin mining rigs globally. Bitcoin mining rigs refer to the computing infrastructure employed by mining farms to mine Bitcoins.

The company claims it was forced to make this move after China’s crackdown on mining led to the prices of rigs falling by over 75% in a little over one month. On the flip side, the crunch in supply will likely lead to a spurt in prices for those looking to sell their rigs in the second-hand market.

India is reportedly mulling over a new crypto tax which could make trading on foreign exchanges more expensive

Equalisation levy usually applies to foreign companies operating in India BCCL

Officials in India are currently mulling over adding a 2% equalisation levy to the crypto transactions conducted on exchanges outside the country. The tax is normally reserved for companies so it’s unclear how it will affect individual traders and exchanges operating within India.

It is also unclear as to whether cryptocurrencies can be categorised as goods, services or commodities.