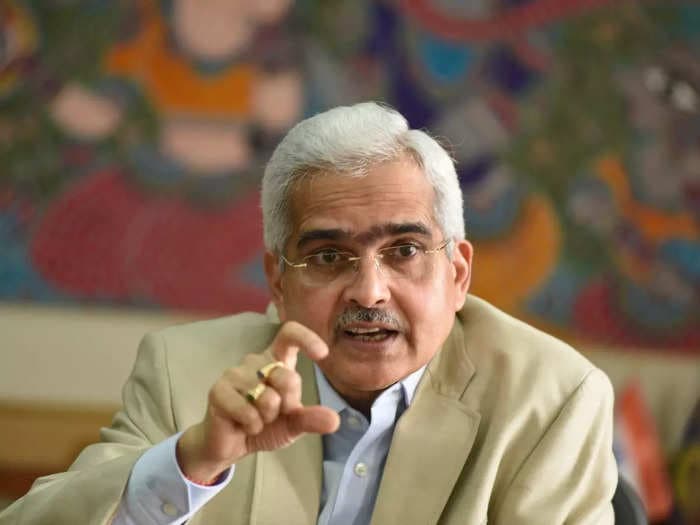

RBI governor Shaktikanta Das today reiterated that keeping theRupee stable is his primary goal.- He underlined that the central bank is not targeting any particular level, and exports have echoed the same sentiments earlier.

- Das also said “all options are on the table” as he seeks to maintain the Rupee’s stability.

Speaking at a banking event in India’s financial capital Mumbai, Das underlined that the Reserve Bank of India has a “zero tolerance” for high volatility in the value of Rupee. Das’ comments come at a time when the $4 against the Dollar – something most experts predicted will happen by October.

RBI’s efforts to keep the volatility low has been $4, too, who say the central bank has done a “good job” of it.

“Indian Rupee has been a slight outperformer when compared against a basket of 26 top currencies, year-to-date. INR has depreciated 7.5% whereas median losses have been around 8.5%,” Anindya Banerjee, VP, currency & interest rate derivatives at Kotak Securities told Business Insider India

Several experts have already pointed this out, and Das reiterated the same thing at the event, crediting strong fundamentals for it.

“The Indian Rupee is holding up well relative to both advanced and emerging market peers. This is because our underlying fundamentals are strong, resilient and intact,” he said.

This is easily backed up by data. Amongst some of the top currencies of the world, only the Chinese Yuan and Russian Ruble have managed to perform better than the Rupee. In fact, the Ruble is an exception to the rule here – while other currencies have declined against the US Dollar, Ruble has gained over 24% this year already.

RBI intervention in currency markets has helped the Rupee avoid a free fall against the US Dollar – so far, $4.

“Our estimates indicate that there can be a further $40-50 billion drain in FY23E, and global stagflationary phases are typically followed by a phase of banking, currency and debt crisis in emerging markets (1980s-90s),” stated a report by JM Financial.

RBI is not targeting any particular level, and this has once again been reiterated by both experts as well as Das.

“We have no particular level of rupee in mind but we would like to ensure orderly evolution,” Das said at the event. However, he added, “all options are on the table,” when asked if RBI will intervene further.

Controlling Rupee volatility is important for emerging markets like India, which run a trade deficit – that is, imports are higher than exports. While a declining Rupee benefits exporters, the fact that we have more imports means the downside is worse for the Indian economy.

But beyond this, capital outflows from emerging markets like India to safer places like the US are another major concern.

$4 (approx. ₹2.4 lakh crore) from the Indian markets so far, and it’s not clear if the tide has stemmed yet.

This has Das concerned, too, who said, “Emerging market economies are particularly affected by capital outflows, currency depreciation and reserve drawdowns complicating macroeconomic management in these countries.”

At this point, it’s anyone’s guess as to where the Rupee will be at the end of the year, and only a decisive stability in macro-economic factors will offer some respite. Until then, we will have to buckle up – RBI and Das already have.

SEE ALSO:

$4

$4

Decoded: How the rupee trade settlement is tied to India’s trade deficit and forex reserves>$4