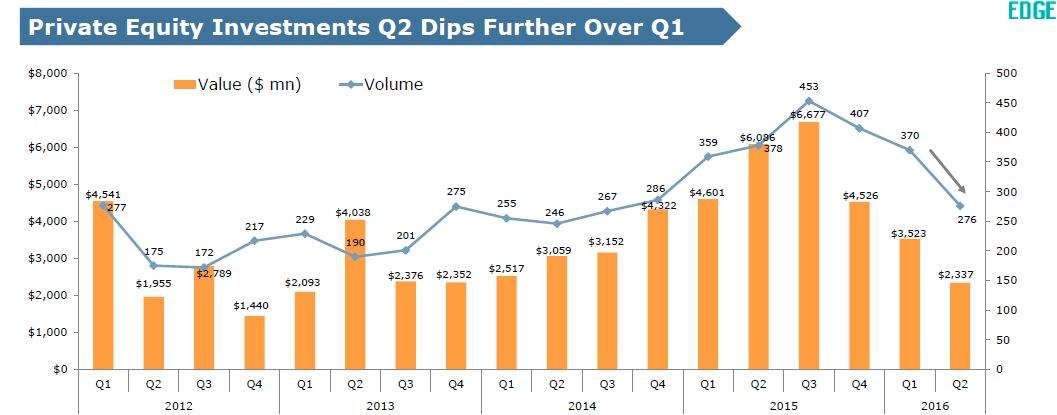

India just had the most investment-starved second quarter since 2013. The total value of deals is down by 62% from $6.1 billion from the same period last year to $2.2 billion in Q2 CY16, according to News Corp VCCEdge.

On a half yearly basis, $4 deals slipped as much as much as 46% in the first half of this year. Only 643

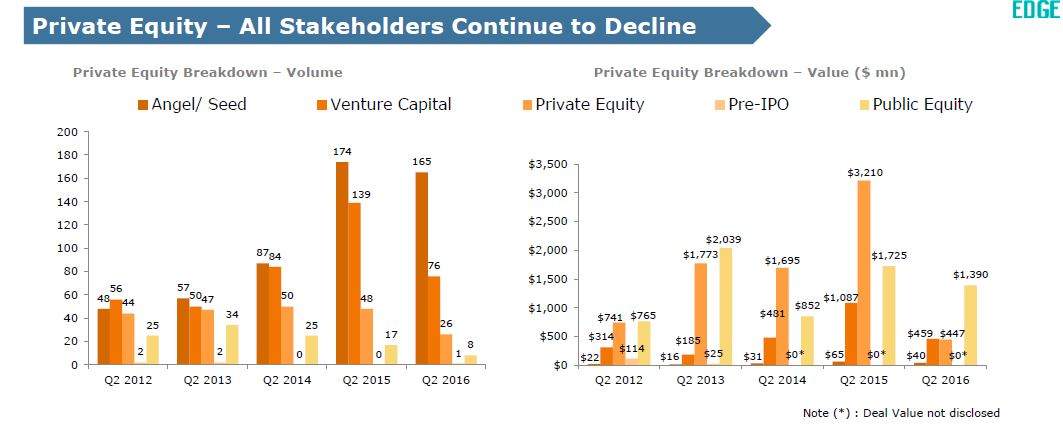

Interestingly, 2016 saw an uptake in $4. Seed and

Venture and late stage capital declined significantly. The figures are down by 55% in the first half of this year. The deal volume has also slipped 44%.

The rush of capital for Indian startups began way back in 2014. $4 raised a whopping $1 billion in July 2014, and after Chinese e-commerce giant $4 successfully listed its stock in the US markets, $4 across the world got a boost globally.

With a couple of failures, and the financial downturn, the mood has changed A handful of hedge funds are now making new investments. The global internet investors like $4 and $4 are however quieter.

$4