Byju’s, Swiggy and Dream11 — the top 10 startup deals of 2021 that raised $7.7 billion overall

- The Indian startup ecosystem raised close to $30 billion till November this year.

- Byju’s raised over a billion dollars in 2021 across multiple tranches.

- CRED increased its valuation manifold from $800 million in January to $4 billion by October 2021.

It is safe to say that 2021 was the prime year of the Indian startup ecosystem, which raised close to $30 billion till November this year. The top 10 funding rounds — excluding Walmart-owned Flipkart — raised $7.7 billion this year till December 6.

Here are the top funding rounds of 2021:

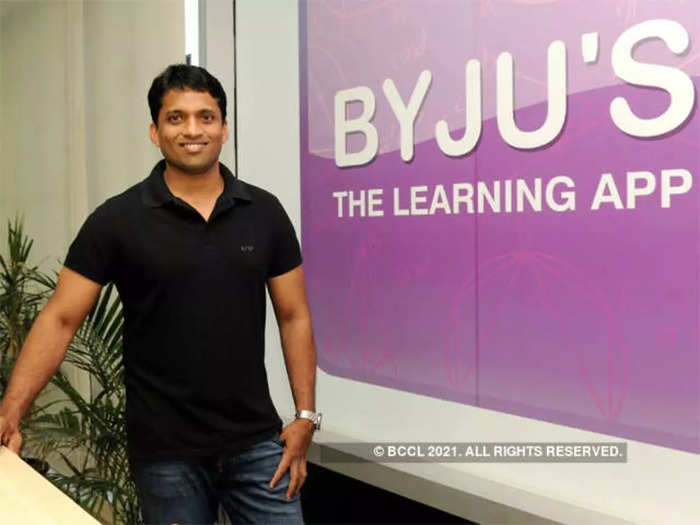

Byju’s | $1.3 billion

Byju’s — jokingly known as Buy-ju’s because of its massive acquisition streak — raised over a billion dollars in 2021 across multiple tranches. It also surpassed Paytm (now publicly listed) to be the highest valued startup in India, and maintained its lead as the highest valued edtech startup in the world.

The company raised capital from MC Global Edtech, Zoom founder Eric Yuan, Abu Dhabi’s sovereign fund ADQ and others, at a valuation of $18 billion.

Byju’s acquired nine companies this year, including coaching centre chain Aakash Institute, rival Toppr, US-based learning platform Epic and upskilling platform Great Learning.

Swiggy | $1.2 billion

Food delivery business Swiggy raised $1.2 billion in funding in July, only a few days after Zomato closed its $1.3 billion initial public offering (IPO). The company was reportedly valued at $5 billion post-issue.

The Bengaluru-based company intends to use this capital to double down on its core business, make acquisitions and invest in its grocery delivery business Instamart.

Swiggy will reportedly also close a $700 million funding round this month, at a valuation of $10-11 billion. Though Swiggy is yet to confirm the reports, it has announced that it will invest $700 million in its quick commerce business InstaMart.

Meesho | $870 million

Social commerce platform Meesho has raised $870 million this year. The company had raised $300 million in April at a valuation of $2.1 billion, It raised another $570 billion in October, at a valuation of $4.9 billion.

Notably, Meesho is the first Indian social commerce startup that is valued over a billion dollars and is now being pitted against Flipkart.

The company plans to use this capital to double down on its research and development (R&D) teams and acquire more users. It aims to reach 100 million monthly transacting users by December 2022, growing over seven times from the current 15 million.

Dream Sports | $840 million

Dream Sports — the parent company of popular fantasy gaming company Dream11, raised $840 million in November. The round was led by Falcon Edge, Tiger Global and others, who valued the company at $8 billion.

The company claims to have over 140 million users across the globe, and it runs companies like FanCode, Dream Game Studios, Dream Capital and DreamSetGo.

Last year, Dream11 became the first Indian startup to be the title sponsor of Indian Premier League (IPL).

PineLabs | $700 million

Payments and merchant commerce startup PineLabs has raised $700 million this year, ahead of its public listing in the United States. The company raised this capital in several tranches spread across the year, raising its valuation to $3.5 billion.

PineLabs closed its $600 million round in July this year, and raised another $100 million in September 2021 to fill up its treasury. The fintech startup plans to hit the stock exchange in the next two years.

It counts Sequoia Capital India, Temasek, PayPal and Mastercard among its early backers.

Eruditus | $650 million

Mumbai-based edtech firm Eruditus raised $650 million, in August 2021, in a funding round led by investment firms Accel and SoftBank. This round has valued Eruditus at $3.2 billion, making it the third highest valued edtech startup in India.

Founded in 2010 by Chaitanya Kalipatnapu and Ashwin Damera, Eruditus works with universities globally to offer six to eight month-long executive-level courses to students present across 80 countries.

These courses cost anything between $5,000 to $40,000, and are available for on-campus, off-campus and online modes.

ShareChat | $647 million

Vernacular social media platform ShareChat has raised close to $650 million across two rounds. The company had raised $502 million in April, marketing its entering into the unicorn club. Then again, it raised $145 million in July at a valuation of $2.88 billion.

ShareChat claims to have 180 million monthly active users. Meanwhile, its nearly one-year-old short video app Moj claims to have garnered over 160 million monthly active users and 50 million creators to date.

CRED | $547 million

Kunal Shah-led credit card payments app CRED increased its valuation manifold from $800 million in January to $4 billion by October 2021. The company has raised close to $550 million in that process from some of the top investors in the country, including DST Global, Tiger Global, Sequoia Capital, Coatue, Sofina and others.

Founded in 2018, CRED started off as a credit card bill payments app. Over the years, it has entered e-commerce, lending, payments and now investment segments. The company claims that almost a quarter of all credit card bill payments in India are processed by it.

Ola | $500 million

Ride hailing giant Ola has raised half a billion dollars ahead of its public issue this year. Investment titans Temasek and Warburg Pincus participated in the round, along with Ola’s CEO Bhavish Aggarwal.

Ola’s sister company Ola Electric had raised $200 million led by Falcon Edge, SoftBank and others in October 2021. Ola and Ola Electric are two separate businesses under ANI Technologies. Ola focuses on ride hailing business, whereas Ola Electric has entered electric scooter manufacturing and selling.

Cars24 | $450 million

Cars24, which is valued at $1.85 billion, the highest among all automobile ecommerce players, has raised over $450 million this year. Though the company’s chief executive officer Kunal Mundra says that Cars24’s initial public offering (IPO) is still a year or two away, the thing to note here is that the company has already converted itself to a public limited company.

Founded by Vikram Chopra, Gajendra Jangid, Ruchit Agarwal and Mehul Agrawal, Cars24 allows customers to sell their old cars through their omnichannel network. A consumer can simply book an appointment with any of the Cars24 branches, visit the branch and sell a car in a single visit. The company has recently expanded to Australia and UAE.

Flipkart | $3.6 billion

While e-commerce titan Flipkart may not be a right fit to be considered as a startup after its multi-billion dollar acquisition by retail giant Walmart, Flipkart closed the biggest funding round of 2021. The Walmart-owned company raised $3.6 billion (approximately ₹26,800 crore), at a valuation of $37.6 billion.

The company was valued at $16 billion when Walmart bought it in 2018.

Flipkart’s latest round was led by Singapore-based GIC, Canada Pension Plan Investment Board (CPP investments), Softbank Vision Fund 2 and Walmart. Tiger Global and Qatar Investment Authority, among other marquee investors also participated in the round.

Popular Right Now

Advertisement