Lakshmi Vilas Bank is the fifth financial firm to collapse in India within the last 30 months

- Lakshmi Vilas Bank (LVB) is the fifth Indian financial firm to collapse over a span of 30 months after IL&FS, DHFL, Yes Bank, and PMC Bank.

- The Reserve Bank of India (RBI) has placed the bank under a moratorium for the next one month, with withdrawals capped at ₹25,000 crore as it mulls over LVB’s merger with DBS Bank India.

- Here’s a quick look at what went wrong, how the RBI stepped in, and where these banks currently stand.

The downfall of Lakshmi Vilas Bank (LVB) was in the making for over a year, and it’s only the most recent of Indian banks to fail in the last 30 months. Over the last two years, India has seen other legacy names like IL&FS, DHFL, Yes Bank and PMC Bank go under.

The legacy 93-year old financial institution was placed under moratorium by the Reserve Bank of India (RBI) on Tuesday, November 17; and it will be merged with DBS Bank India in the coming days. While many have lauded the RBI’s quick turnaround, there are others who question why the RBI didn’t step in even sooner or why other banks weren’t considered for a merger.

Here’s how the LVB crisis stacks up against other banks that have collapsed over the last two years:

The IL&FS crisis

Who is IL&FS?

Infrastructure Leasing and Financial Services (IL&FS) is a non-banking financial company, commonly referred to as a ‘shadow bank.’

What led to its downfall?

An acute cash shortage that led to the bank defaulting on several of its obligations is the reason behind its downfall in 2018. No new projects were coming in, and the ones already in the bank’s pocket were facing cost overruns compounded by delays in land acquisition and approvals.

How did it unravel?

The Serious Fraud Investigation Office (SFIO) found huge procedural lapses at the hands of the NBFC’s former vice chairman, Hari Sankaran.He was arrested under the charge of granting loans to entities that were not creditworthy, thereby causing loss to the company and its creditors.

But he wasn’t the only one at fault. The SFIO also found that Deloitte’s audit of IL&FS painted a rosy picture of the troubled financial institution despite being aware of its reality.

In August last year, the Enforcement Directorate (ED) filed its first charge sheet against IL&FS under the Prevention of Money Laundering Act (PMLA) against past senior management, including Ravi Parthasarathy, Ramesh Bawa, Hari Sankaran, Arun Saha, and Ramchand Karunakaran.

How was it rescued?

In October 2018, the RBI stepped in to rehaul the board of directors, and a committee headed by former SEBI chief Vineet Nayyar started work on a resolution plan.

India’s apex banking institution pegged IL&FS as ‘systemically important’ or ‘too big to fail’. The codependent links between IL&FS would have a domino impact on other financial entities — like banks, mutual funds, and infrastructure companies — if IL&FS were not rescued.

Current status

IL&FS is still working on cancelling out its debt. As of September this year, the shadow bank reported a ₹7,300 crore shortfall in meeting its target due to the impact of the COVID-19 pandemic.

The ₹31,000 crore DHFL scam

Who is DHFL?

Dewan Housing Finance Corporation (DHFL) is another shadow bank. However, unlike IL&FS — which doled out money for large infrastructure projects — DHFL was primarily involved in giving loans to home buyers in India’s tier 2 and tier 3 cities.

What led to its downfall?

DHFL and IL&FS may cater to different segments, but the two are nonetheless interlinked. After the IL&FS crisis, banks became more stringent about their lending, especially when it came to NBFCs.

While caution was prudent and the need of the hour, it also led to a liquidity crunch in the market, leaving shadow banks like DHFL with limited credit access in the latter half of 2018. Without short term loans to finance long term lending, its stock price took a beating of nearly 60%. But alarm bells were not ringing yet — until January.

How did it unravel?

An expose by the Cobrapost claimed that the bank’s promoters — Kapil and Dheeraj Wadhwan — had been siphoning off money from their customers to the tune of around ₹31,000 crore for the last three years. The money was taken out through secured and unsecured loans and advances to shell companies owned by the Wadhwan brothers.

The blog also alleged that the bank had loaned out money without conducting due diligence. DHFL initially claimed that the accusations were malicious and untrue.

Soon after, the Serious Fraud Investigation Office (SFIO) launched an investigation into the allegations. Auditors found that when DHFL sold its stake in Pramerica Life Insurance to DHFL Investments, the deal was undervalued, amounting to a fraud of ₹2,150 crore.

In October 2020, the Economic Offences Wing of the Tamil Nadu police arrested the Wadhwan brothers on the charge of defrauding investors of their money by floating bogus schemes and non-repayment of ₹218 crore of collected deposits.

How was it rescued?

DHFL was brought under the charge of the RBI in November last year. The bank became the first financial services company to be taken in under the Insolvency and Bankruptcy Code (IBC).

Current status

In October 2020, DHFL received four bids to either pick up a stake in the company or buy out its assets from the Adani group, Piramal Enterprise, US-based Oaktree, and Hong Kong-based SC Lowy.

However, the lenders behind the deal — with the State Bank of India (SBI) leading the charge — deemed the bids unsatisfactory.

Not satisfied with the bids received, lenders of Dewan Housing Finance (DHFL) have asked the four suitors, including Adani Group and Piramal Enterprises, to come up with improved offers for the beleaguered firm in the next few days.

Kapil Wadhawan has also offered to put up ₹43,000 crore from his family assets to repay the lenders.

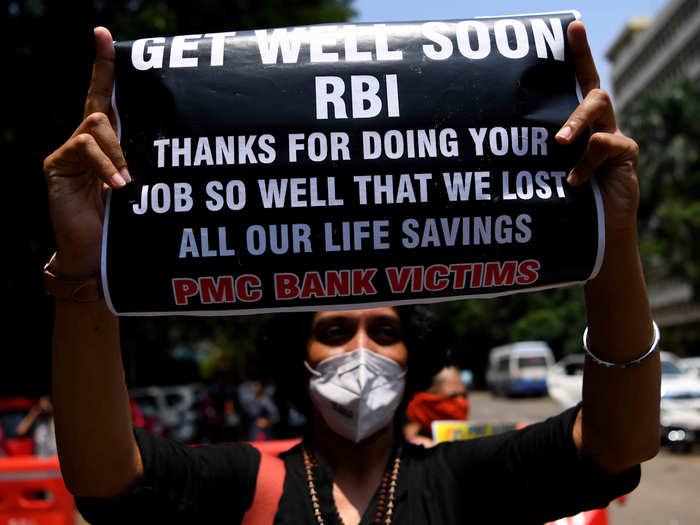

The troubles at PMC Bank

Who is PMC Bank?

The Punjab and Maharashtra Cooperative (PMC) Bank is a public sector bank set up in 1984. The regional lender has 137 branches across six states, and before the crisis, it had deposits amounting to around $1.5 billion.

What led to its downfall?

The bank’s chairman S Waryan Singh held a 1.91% stake in the troubled Housing Development And Infrastructure (HDIL) as a promoter.

PMC Bank had initially loaned a ₹2,500 crore loan to HDIL, which the company eventually defaulted on, but the non-payment was not reported. After which, Singh was allotted a personal loan of ₹96.5 crore without proper due diligence and much above the regulatory limits.

The governance issues and the lack of liquidity and lack of capital infusion plan led to the bank coming under the RBI’s purview.

How did it unravel?

PMC Bank's top officials and the owner of HDIL were arrested.

How was it rescued?

It hasn’t been. Not yet, anyway. The RBI clamped down on PMC Bank in September 2019 after it found that the bank had under-reported bad loans during its annual inspection and that the actual non-performing assets (NPAs) could be in high double-digits.

Current status

The PMC Bank crisis has sparked courtroom battles. In one of them, Sandeep Bhalla, whose parents have nearly ₹1 crore blocked in the bank, told the Delhi High Court that depositors of PMC were ‘discriminated against’ compared to those from commercial lender Yes Bank.

Union minister Nitin Gadkari also wrote to the RBI to speed up the redressal of depositors of PMC Bank.

While the Yes Bank moratorium was lifted within a month of being implemented, the fate of PMC Bank is still uncertain, with curbs on withdrawals still in place till December 22.The Yes Bank fiasco

Who is Yes Bank?

Yes Bank is a private sector bank founded in 2004 by Rana Kapoor and Ashok Kapur with its headquarters in Mumbai.

What led to its downfall?

The Yes Bank crisis was building for a while, with the surge in bad loans, slowdown in the economic sector, governance issues, and regulatory restructuring woes despite the bank’s co-founder Rana Kapoor being asked to step down a year before the RBI jumped in.

The final nail in the coffin was a sudden run on the bank. Customers were withdrawing money faster than new money was coming in. The steady withdrawal of deposits added to Yes Bank’s woes and already troubled balance sheets, leaving it with limited liquidity and no way out.

How did it unravel?

Kapoor, his family members, and other associates have been accused of laundering ₹4,300 crore by receiving kickbacks in exchange for lending heavily to big borrowers — loans that were later declared NPAs. The Enforcement Directorate (ED) arrested Kapoor on the charge of conducting large scale fraud with public money.

The Central Bureau of Investigation (CBI) has also filed a charge sheet against Kapoor, along with DHFL’s Wadhawan brothers, under the same allegations.

How was it rescued?

As per Section 45 of the Banking Regulations Act, the RBI jumped in yet again in March earlier this year. It removed the board, appointed its own representatives, and put a restructuring plan in place.

SBI, India’s largest lender, picked up 725 crore shares at ₹10 each to help with the capital infusion. HDFC Ltd and ICICI Bank also stepped with an investment of ₹1,000 each to help the bank get back on its feet. Meanwhile, Axis Bank stepped up with ₹600 crore and Kotak Mahindra Bank with ₹500 crore.

Current status

The moratorium on Yes Bank has been lifted, and its business as usual under the leadership of CEO Prashant Kumar, who was formerly with the State Bank of India.

The bank has also paid back the entire dues worth ₹50,000 crore to the RBI, putting any merger rumours to rest.

Lakshmi Vilas Bank’s collapse

Who is Lakshmi Vilas Bank?

LVB has been around for 93 years. According to the bank’s RBI appointed administrator and former Canara Bank Chairman, TN Manoharan, the bank’s legacy lends to the confidence customers have that it will be able to get back its feet.

What led to its downfall?

The bank’s financial situation had been deteriorating over the last few quarters. There was also an absence of any credible plan for the fresh infusion of capital, since the deal with Clix Capital fell through.

Auditors have also pointed out serious governance issues in recent years.

How did it unravel?

LVB has been bleeding for several quarters now and been unable to fund its activities. According to Manoharan, one of the reasons for its downfall was shifting from retail loans towards the corporate sector. And, then a big chunk of the corporate sector loans went bad.

LVB was on the hunt for capital when it decided to merge with Indiabulls Housing Finance (IBHF). However, the RBI halted that process after reports revealed that IBHF may have its own bad loan problem along with the misappropriation of funds.

In October, the apex bank placed LVB under Prompt Corrective Action (PCA) citing high bad loans, insufficient capital, negative return on assets and high leverage to its list of reasons.

The bank then turned towards Clix Capital for a rescue plan, but that deal fell through due to valuation issues.

With no other capitalisation plan in sight, the RBI decided to step in and bring DBS Bank India along to help.

What next for LVB?

LVB has been placed under moratorium until December 16, with withdrawals capped at ₹25,000 per depositor. The RBI’s proposed plan is to merge the bank with DBS India with an upfront capital infusion of ₹2,500 crore.

Since the bank is being merged, it will also be delisted from the stock exchange. This means that while the LVB customers’ deposits will be safe, shareholder wealth will be completely wiped out.

LVB will also be losing its identity since all of its assets will now be with DBS India.

RBI has left its proposal open to suggestions and objections till November 20. The regulator will consider the comments before announcing the final details of LVB’s restructuring, hopefully before the December deadline.

READ MORE ARTICLES ON

Popular Right Now

Advertisement