- Home

- investment

- news

- CryptoPunks, Bored Apes, Decentraland and others — these are the most valuable NFT projects of 2021

CryptoPunks, Bored Apes, Decentraland and others — these are the most valuable NFT projects of 2021

- The popularity of non-fungible tokens (NFTs) has propelled to new heights in 2021.

- NFT projects that were on the fringe of the crypto universe are now some of the most popular names in the market like Decentraland and Bored Apes.

- In 2021, NFTs sales clocked in a grand total of $14.4 billion.

In 2021, sales of NFTs hit $14.4 billion, according to data from NonFungible.com. This included stand-alone works of art, such as the disaster girl meme sold for half a million, and the Beeple NFT that sold for $69 million at the Christie’s auction house. But the biggest winners were collections of thousands of NFTs, and the projects behind the curtain like the avatar-generating CryptoPunks, metaverse Decentraland, or play-to-earn blockchain game Axie Infinity.

All-time trading volume on OpenSea, the biggest marketplace in the world for NFTs, is now at $13.25 billion as compared to just $24 million seen in all of 2020. It is home to 1.25 million traders and the all-time average price of NFTs sold on the platform stands at $933, which is around ₹70,000 — more than most people’s monthly salary in India.

From Pokemon-like pets being made to battle, to pixelated avatars that don’t discriminate, here are the 13 most valuable NFT collections of 2021:

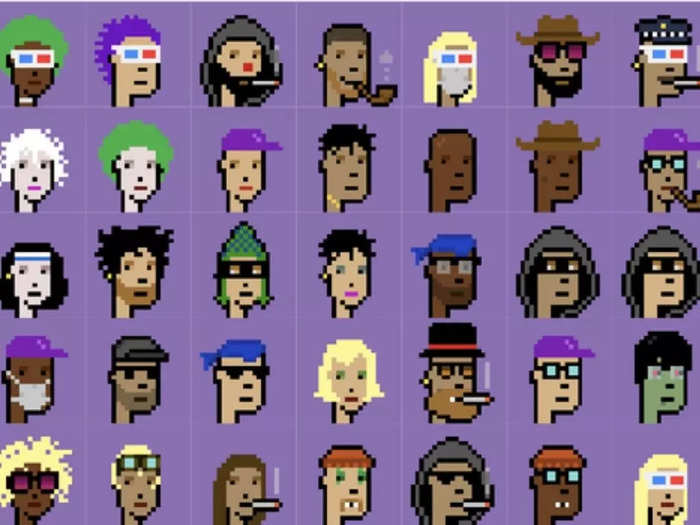

CryptoPunks

Launched in: 2017 June

All-time trade volume: $2.88 billion

All-time average price per NFT: $288,000

As an early NFT project on the Ethereum blockchain, CryptoPunks was an inspiration for developing the NFT standard itself. The project is a collection of 10,000 items, which are computer generated pixel-art characters – including human, zombie, ape and alien ‘punks.’ Each ‘punk’ is distinguishable, with its own features and accessories.

Thus, they are collectible art, valued by the item’s rarity and the buyer’s preferences. For instance, CryptoPunk #3100 depicts a blue-green alien, it was purchased for $7.58 million and promptly listed for sale again, at $149.2 million. This collection has just over 3000 owners, and a few have been auctioned at Christie’s in London.

In October, a CryptoPunks NFT avatar had sold for half a billion dollars, using Ethereum ‘flash loans’. Aside from that sale, the most expensive CryptoPunk to be sold this year was #4156 for $10.26 million.

Bored Ape Yacht Club and its cousin, the Mutant Ape Yacht Club

Launched in: 2021 April

All-time trade volume: $1.05 billion

All-time average price per NFT: $104,400

Launched in (Mutant): 2021 August

All-time trade volume (Mutant): $571 million

All-time average price per NFT (Mutant): $32,600

Entering cartoon territory here, the Bored Ape Yacht Club collection consists of 10,000 unique ‘Bored Ape’ NFTs that reside on the Ethereum blockchain. Each ‘ape’ has different attributes, including facial expressions, fur colour and accessories. As we mentioned earlier, the CryptoPunks project served as inspiration for newer NFT endeavours, like the Bored Ape Yacht Club.

And, just as with CryptoPunks, each ‘apes’ different attributes determine its rarity, and thus, its value.

Owners usually use them as online avatars and as digital collectibles, placing their valuation firmly in ‘perceived value’ territory which has appreciated fast, with recent auctions of rare apes being sold for over a million dollars. In October, Bored Ape #8817 with gold fur was sold by Sotheby’s for a whopping $3.4 million.

The project has tried to take things a step further by allowing each Bored Ape owner to use their NFT as a Yacht Club membership card to access an online club, with members-only benefits such as a collaborative graffiti board, exclusive private concerts and other ‘perks’ over time.

The over 5,500 holders of this NFT received a bonus from developers of the same project, in the form of the Mutant Ape Yacht Club. Exposing an existing Bored Ape to vials of ‘mutant serum’ would create a ‘Mutant Ape’ NFT. This new collection has a limit of 20,000 mutant apes, which are also unique from each other and currently held by over 11,000 owners.

Decentraland and its collection of wearables

Launched in: 2020 July

All-time trade volume: $904 million

All-time average price per NFT: $9,300

All-time trade volume (Wearables): $301 million

All-time average price per NFT (Wearables): $4,200

Gearing up for the metaverse, the Decentraland platform is meant to allow participation in a decentralised virtual reality. In this virtual world that resides on top of the Ethereum blockchain, users are able to buy and develop virtual land plots, create ‘avatars’, trade in digital collectibles they create, and so on.

In 2021, the nascent metaverse saw plots of land on its platform selling for upto $2.43 million with the last week of November alone accounting for $15.53 million on Decentraland as the hype around virtual worlds picked up.

Users can even buy limited-edition wearables for their in-game avatars to look different. Thus, items in Decentraland can be used to build a life online, or traded as assets to monetise them. Decentraland considers itself to be user-centric, with the crucial feature of being able to play in a browser window making it easy to use.

In November, crypto giant Grayscale said the metaverse, a main focus of Decentraland, could be a trillion dollar revenue opportunity.

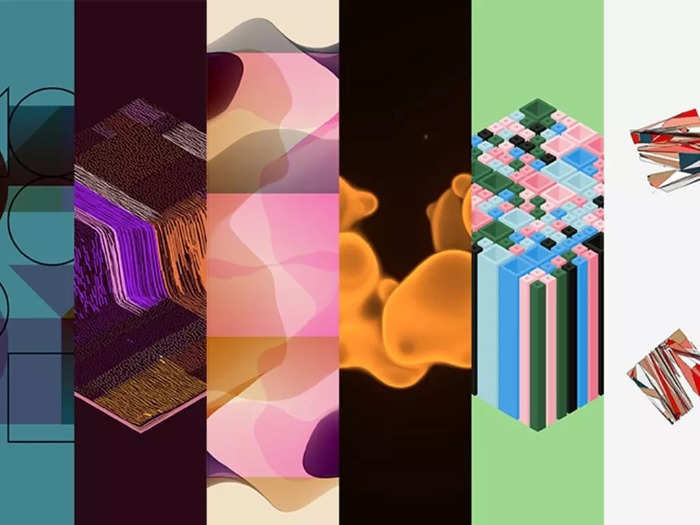

Art Blocks Curated

Launched in: 2020 May

All-time trade volume: $805 million

All-time average price per NFT: $17,000

Various artists have submitted their original artwork, from 2D images to 3D interactives, to Art Blocks. A curation board then showcases innovative work by adding them to the ‘curated’ collection.

Selling for as high as $6.9 million, 41 of these NFTs so far have sold at million-dollar prices. Items from this collection currently have no other metaverse utility, and are sold on art value alone.

The Sandbox

Launched in: 2020 October

All-time trade volume: $490 million

All-time average price per NFT: $4,750

Currently in testing until the end of 2021, this metaverse game is made by players as a community. The Sandbox collides worlds of 3D (voxels), blockchain, metaverse, and player-built virtual worlds.

That allows players to purchase virtual land, develop it, allow others to experience it and sell it to monetise their investment. Most assets in the game are NFTs, be it land, structures built by players, or movable assets used in the game. As a result, the NFTs created along the way gain value – and an influx of new players into metaverse games are expected, increasing trade opportunities.

The Sandbox project was in the spotlight recently, when a plot of virtual land was sold for a record $4.3 million, and when rapper Snoop Dogg hosted a VIP concert virtually — right after he revealed he was the face behind famous Twitter NFT influencer CozomoMedici.

Rarible

Launched in: 2020 July

All-time trade volume: $368 million

All-time average price per NFT: $1,200

In addition to being a marketplace that connects art creators to art collectors, the Rarible platform also features a tokenised curated digital art collection.

The option of transacting in its own RARI cryptocurrency opens up a few possibilities. For instance, creators can store data in the peer-to-peer InterPlanetary File System (IPFS), instead of on the blockchain. Rarible’s ‘lazy minting’ feature allows for transaction fees to be paid by the buyer at the time of purchase, instead of by the creator when uploading the NFT (or minting). Moreover, artists can specify a royalty share, to continue earning even on resale transactions.

The highest priced NFT sold on the platform was the modern portrait RARI #542819 at $285,000 in April. As a platform for art creators however, Rarible does have its interesting moments, such as when the NFT depicting Mona Lisa holding a portrait of a Bored Ape was sold for $3.

Meebits

Launched in: 2021 May

All-time trade volume: $294 million

All-time average price per NFT: $14,700

Launched by the same developers as CryptoPunks, the Meebits NFT project offers pixelated 3D avatars for use in upcoming metaverse virtual worlds, and virtual reality applications. Residing on the Ethereum blockchain, there are 20,000 unique 3D voxel Meebits characters. Owners can animate or render their Meebit using a full 3D model which is available as an additional asset pack.

Usable in the metaverse or games, an in-demand character such as Meebit #17522 had sold for the equivalent of $3.7 million in June. Further driving up demand, NFT funds such as Meta4 have been acquiring dozens of NFTs as an investment, including Meebits.

Loot (for Adventurers)

Launched in: 2021 August

All-time trade volume: $271 million

All-time average price per NFT: $34,700

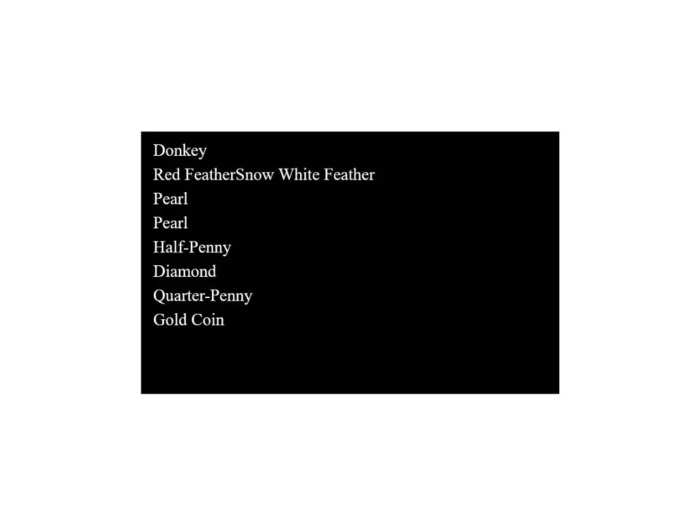

The Loot NFT collection is basic – 8,000 NFTs that feature text descriptions of items for role-playing games (RPGs). That means adventurers who play RPGs can use this kit and interpret it as they choose, since character statistics, images and functionality are deliberately left to the players’ imagination.

For example, the text for one of them simply says “Shoes”, leaving you to decide whether you,the RPG’s adventurer, want to gain speed, defence, flying ability, or something else from that item.

But since nature abhors a vacuum, a community is quickly gathering around the collection to document everything, build a hierarchy of items, agree upon interpretations, and so on. In September 2021, holders of Loot tokens could claim a bonus release – 10,000 Adventure Gold (AGLD) tokens, designed to provide a currency for the emerging game’s universe.

Released by the same developer who made the Vine app — the six-second video app that was acquired by Twitter in 2012 — this collection of text, which is fast becoming a game, may remind you of Dungeons and Dragons sessions.

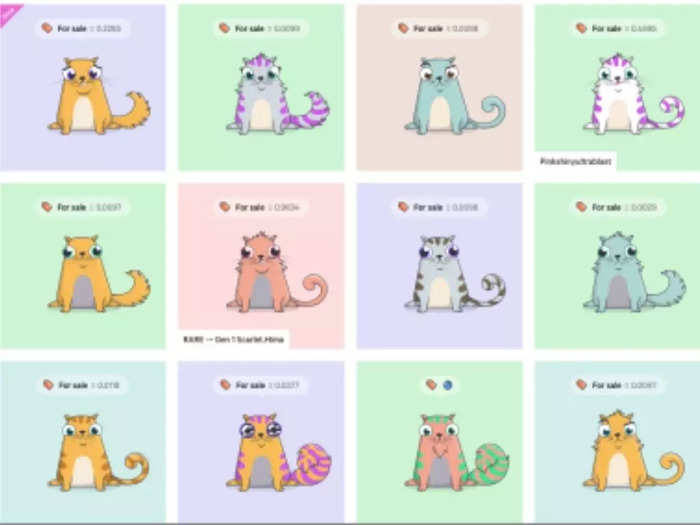

CryptoKitties

Launched in: 2017 December

All-time trade volume: $263 million

All-time average price per NFT: $132

Infamous for congesting Ethereum blockchain transaction processing in 2017 December, CryptoKitties collided the worlds of cryptocurrency and feline lovers on the Internet. It is an early example of using blockchain technology for leisure, building a game with no defined goal.

The game begins when you buy an Ethereum NFT token represented by a CryptoKitty, with further spending of Ethereum currency for every in-game action. Each virtual cat is unique, because of DNA resulting in ‘cattributes’ that decide their features and appearance. When bred, the ‘offspring’ cats retain many traits from their ‘parents’. Players can collect or trade cats at market prices – a pink kitty was sold three years ago for the crypto equivalent of $2.5 million today.

While players own the NFT representing their cat, the art that shows them how their cat looks is not, and is owned by a different company (Axiom Zen). As a happy side effect, the Ethereum congestion early on is said to have inspired this collection’s developer to build a solution to prevent it, the Flow blockchain.

Cool Cats NFT

Launched in: 2021 June

All-time trade volume: $238 million

All-time average price per NFT: $24,000

Considered a blue-chip NFT project because of its high floor price, Cool Cats is one more entity that tested the Internet’s affinity for cats – and won!

The Cool Cats NFT collection consists of 9,999 unique curated items, all based upon the ‘Blue Cat’ cartoon character with differing combinations of traits, faces and outfits. They have differing levels of rarity, with the developer retaining the option of using these cats to ‘breed’ a second generation. Some cats are apparently cooler – at the top is the zombie Cool Cat #1490, which was purchased for a cool $3.5 million.

Apart from the art, there is no other utility currently planned for this NFT collection. Apart from holding the NFT itself, Cool Cats holders can be a part of events such as NFT claims, community giveaways, raffles, etc.

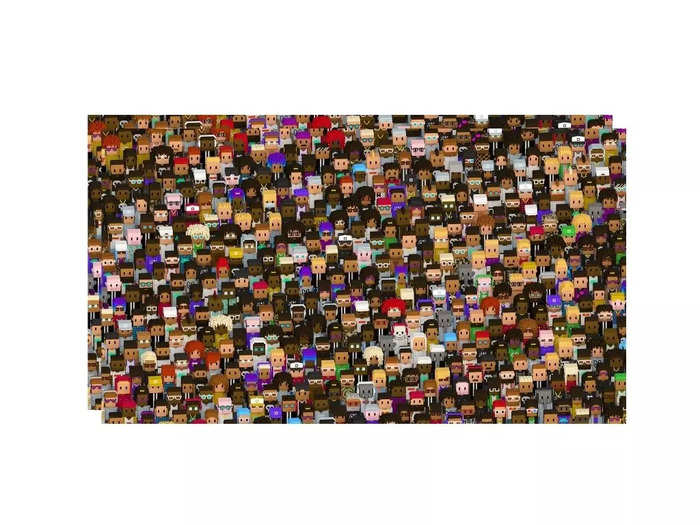

Axie Infinity

Launched in: 2018 May

All-time trade volume: $3.81 billion

All-time average price per NFT: $223

Axie Infinity has gained a large following over the past year, perhaps 1.4 million people if using the number of Axie traders from Dappradar as a proxy. While it doesn’t quite call itself an MMO game, it is a strange cross residing in the metaverse between games like Pokemon/CryptoKitties, and Massively Multiplayer Online (MMO) games like EVE Online.

By their own description, Axie Infinity is about battles between fierce creatures called ‘Axies’, collecting NFTs to breed them and own a kingdom, with the player eventually earning real-life money by selling their lands and Axies. There are multiple in-game currency tokens, used for different purposes. The most well-known Axie token is AXS, which has risen in value from $1 to over $100 in 2021.

This ability to ‘cash out’ at a profit and the rise in value of AXS tokens, has acted as a powerful push in favour of the metaverse and ‘play to earn’ models. A quick Google search reveals that Axie Infinity players call its gameplay fun and entertaining, and it is still growing, to the point where its all-time total of NFTs traded could technically put it at the top spot above all NFT projects.

While it does use the Ethereum blockchain, Axie Infinity differs from the 12 other projects mentioned here, in that only a minor fraction of its NFTs are traded on third party marketplaces like OpenSea. While DappRadar reports a lifetime trade volume of $3.71 billion with the last 30 days alone accounting for $725 million, Axie Infinity traded only a total of $126 million over its lifetime on the largest NFT marketplace, OpenSea.

This indicates that most trade happens over the course of playing the game itself, with tokens being ‘burnt’ to maintain its in-game economy. Moreover, the average value of trades done are relatively low, pointing to frequent trades being made in pursuit of the game itself, with less of an art/investment angle to it.

READ MORE ARTICLES ON

Popular Right Now

Advertisement