BCCL

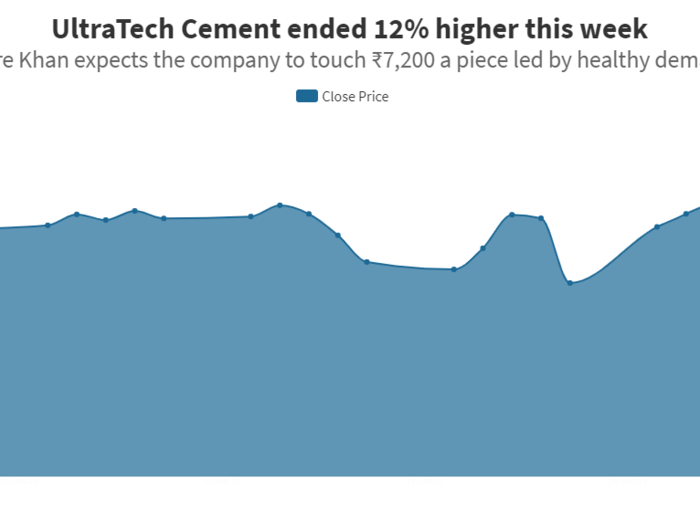

The Aditya Birla Group's cement subsidiary, UltraTech Cement, shares recorded an all-time high of ₹6,944 a share this week after a great demand for cement shares flooded the otherwise tepid market. Its peers ACC, Ambuja Cement and Ramco also recorded their fresh highs.

The stock has already surpassed ICICI Securities and Motilal Oswal's target price, and Share Khan expects the company to touch ₹7,200 a piece led by healthy demand.

Another Aditya Birla Group's subsidiary Grasim Industries was the second top gainer in Nifty's weekly list. The Analysts have maintained a bullish recommendation for the stock expecting an upside of nearly 10% from here onwards. Independent market expert Kunal Bothra told ET Now that he expects a target price of ₹1,456.

Share Khan also expects the stock to touch ₹1,430 led by strong performance.

Adani Enterprises joined the ₹1 trillion market capitalisation party after an 11% rally in its shares in the past one week. The stock has rallied more than 44% percent since the company acquired a stake in Mumbai Airport.

There were many triggers for Kotak Mahindra Bank's share price this week. The private sector lenders acquired a 9.99% stake in Ferbine Private Limited's equity shareholding at the beginning of the week. Followed by inking a pact with the Indian Army to handle their salary accounts and divestment of a 10% stake in ECA Trading Services to one of its subsidiaries for nearly ₹2 crore.

The shares of Hero MotoCorp saw an increased interest from investors after the bike two-wheeler major beat the street's expectations and reported higher sales. The company's total sales were marginally higher at 1.5% YoY to 5,05,467 units.

Brokerage firm Sharekhan is bullish on Hero MotoCorp and has pegged a target price of ₹4030.

The chemical industry company UPL gained over 6% after the company said there was no material impact on revenues while responding to the clarification sought by the exchange about Tuesday's fire incident.

There are alternative sources available for the products that were manufactured in the Jagadia unit in Gujarat, the company said.

Maruti Suzuki also had many triggers this week. India’s largest carmaker reported 11.8% higher sales to 1,64,469 units in February. The company also announced that its service network had crossed 4,000 touch-points across the country, covering 1989 towns and cities. This is the widest service network offered by any automobile brand in the country.

A reported $500 million deal with internet giant Google once again brought the limelight back on Infosys. The stock rallied 6% in the past one week. The company also announced that it would double Canada’s employee headcount to 4,000 by 2023.

Credit Suisse has maintained an “outperform” outlook on Asian Paints with a target price of ₹2800. Edelweiss has also maintained a “buy” rating for the stock with a target price of ₹3140 after it clocked a record-breaking third quarter.

Shree Cement is another cement stock that saw a great demand in the market. Just like its peers ACC, Ambuja Cement and Ramco — Shree Cement was up 5% this week.

Sharekhan expects the stock to hit the target price of ₹31,610 in its research report dated February 19.

TVS Credit posts 33.43% rise in Q4 PAT at ₹148.29 crore

TVS Credit posts 33.43% rise in Q4 PAT at ₹148.29 crore

Gold rate today: Latest gold rates in Mumbai, Delhi, Kolkata, Bengaluru, Chennai and other Indian cities

Gold rate today: Latest gold rates in Mumbai, Delhi, Kolkata, Bengaluru, Chennai and other Indian cities

AI Express cancels 75 flights on Friday, expects normal ops by Sunday: Official

AI Express cancels 75 flights on Friday, expects normal ops by Sunday: Official

Copyright © 2024. Times Internet Limited. All rights reserved.For reprint rights. Times Syndication Service.