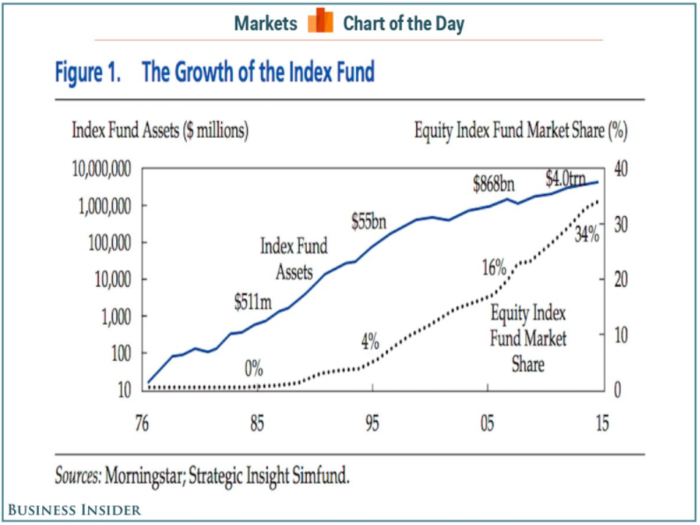

"In the wake of [the] new push towards low-cost financial products, the amount of money that has piled into index funds is truly incredible, rising from around $11 million 1975 to $4 trillion today."

"No single asset class has been the market's top performer year after year on a consistent basis. Unfortunately, no amount of skill or experience has enabled anyone to forecast how various asset classes will stack up in any of those given years. And as a result, those who try to predict and time the markets usually get burned."

"[This chart] shows the sector composition of the S&P 500 by market cap since 1975. As you can see, sector bubbles manifest when they suddenly explode as a percentage of the S&P 500."

"The latest ISM manufacturing purchasing manager index (PMI) fell to 48.2 in December from 48.6 in November. Any reading below 50 signals contraction in the industry. But is that a sign of contraction in the US economy? Two Wall Street pros looked at a chart of the ISM PMI overlaid with bars that highlight recessionary periods."

"Stock prices and any revisions to earnings expectations rarely move in the same direction in the short run. While that's a principle that plays out in the market in the long run, it's actually not unusually to see the exact opposite moves happens."

"JP Morgan's Dubravko Lakos-Bujas reminds readers that while it's true there are just a handful of stocks doing most of the work to keep the S&P 500 afloat, nothing way outside historical norms has been going on."

"It's no surprise that oil and gas producers took advantage of all this cheap money."

"The current total of 10 (of a possible 12) month-over-month declines in Industrial Production has never been observed except in the context of a U.S. recession.Historically, as Dick Van Patten would say, eight is enough."

"In a note to clients Wednesday, Gluskin Sheff's David Rosenberg shared this cool chart showing oil's increased correlation to stocks and bonds."

"In December, the Fed tightened monetary policy by raising its target short-term interest rates. Interestingly, however, long-term interest rates have actually been coming down since that event."

"The average gain for the S&P 500 during the 3/6/12-months following the 20 worst months is roughly 3%, 7%, and 15%, respectively."

"The actual increase to China's GDP every year from 2010 to 2015 (except 2012) has been roughly equal to that of 2007."

"For a while the most shorted stocks did better than the average as the bull market raged and every dip was a time for buying."

"One of the reasons to believe the so-called manufacturing 'recession' is likely to be short-lived is that it has been limited to a handful of industries. In other words, it has not been a pervasive slowing."

"Citi calculates that more than 50% of index earnings come from services and that does not include profits coming from the financial subsidiaries of auto, truck, aircraft and equipment producers. An all-inclusive definition of services comprises near 60% of the bottom line versus misperceptions of something closer to half that."

"On Monday, the latest Senior Loan Officer Opinion Survey indicated that credit conditions across the economy were tightening, a sign that businesses could be facing more challenges to get additional funding could potentially put hiring plans on hold."

"As asset prices adjust to the shift in monetary policy, it is to be expected that the pricing of risk will realign to this different rate environment."

"Manufacturing jobs past six months, starting with July: -18K, -9K, +2K, +3K, +13K, +29K. Maybe all the recession talk is, well, a bit wrong."

"In total, Sløk shows, global markets have lost $6 trillion since the start of 2016 (and more including Monday's sell-off). And so the question becomes: is this just a correction or the start of something bigger?"

"The stocks with the most Buy ratings by analysts have gotten slammed in 2016, falling an average of 16.5% year-to-date. The most unloved stocks, on the other hand, have outperformed."

"There have been 24 days in 2016 during which oil prices have moved by more than 5% intra-day. Trading has only taken place on 26 days. In the few years before oil prices crashed last year, a move this big was a rare occurrence and in 2013 there was no day with a trading range this wide."

"In this week's survey, negative sentiment spiked 14 percentage points from 34.7% up to 48.7%. Back in late January we saw a similarly high reading, but before that the last time bearish sentiment was higher was in April 2013."

"The P/E ratio of 14.7 for the index as a whole is above the prior 5-year average forward 12-month P/E ratio of 14.4, and above the prior 10-year average forward 12-month P/E ratio of 14.2."

"Put differently, markets are currently pricing a deep recession, but that is simply not what the data is showing. Jobless claims today, industrial production and capacity utilization yesterday, and consumer spending last Friday suggest that things are actually getting better. In other words, rates markets seem significantly mispriced at the moment."

"In just seven years, shoppers have shifted from making one monthly purchase on average online, to 6.5. Meanwhile, purchases at brick-and-mortar stores dropped from 7 visits to just under 5."

"From 2010 to 2015, the number of major work stoppages ranged from 11 to 19. In 2009, there were 5 major work stoppages recorded, the lowest of any year since the series began in 1947. In general, the number of major work stoppages has declined over time."

"Though regardless of direction, the volatility for earnings estimates — which are based off either past or expected results — is at its widest in six years, setting up for continued volatility in the market."

"Marginal workers who were forced into unemployment or out of the labor market entirely may have seen their skills atrophy. Now that they're coming back to the labor force as the economy improves, their time out of employment lowers the average number of years worked among all workers."

"Whether its currency moves out of China or the Federal Reserve's next interest rate decision, the overriding narrative in the market has been the certainty of uncertainty about what happens next."

"When you've got a chart showing commodity-related (read: oil) defaults flying through the roof, spreads rising across the high-yield complex probably don't mean what those extrapolating about broader macro fears think they do."

"Because of how much damage occurred in the housing sector and how slow and long the recovery took, other industries absorbed housing sector resources. And now we're nearing overall US economic resource utilization levels that typically makes the Fed uncomfortable."

"The increased pressure on margins with the labor market operating at or near full employment could prompt firms to make more effective use of their resources, boosting business productivity."

"Looking at the 30 companies in the Dow Jones Industrial Average, Butters found that 20 companies reported non-GAAP earnings with these results, on average, coming in 30.7% higher than their GAAP earnings in 2015. In the 2014, this spread was 11.8%. So said another way, US companies tried to get investors to ignore a whole bunch of bad news last year."

"The following chart, which comes to us from the team over at Societe Generale, shows the momentum of earnings as measured by the 3-month rolling percentage revision of 12-month forward earnings forecasts. Basically, this is a smoothed view of how much or how little companies are cutting expectations."

"In 2015, there were 70 activist campaigns in which a dissident objective was to return cash via dividends and/or buybacks. This was a 37% increase from the number in 2014 (51 campaigns), and represented the highest total since FactSet began tracking the data in 2005."

"On the demand side, world demand growth, supported by cheaper prices, should erode the majority of the surplus and help bring the market into balance by the end of the year. Looking at the market fundamentals in place, I believe we have reached a new point in the global energy story: The endgame in the decline of the price of oil."

"While the construction of homes of all sizes cratered after the housing bust, as the market has come back to life most of the growth in new homes has come from larger homes, doing little to alleviate the squeeze being put on the next generation of would-be homeowners."

"Demographics alone have shaved two percentage points off participation, as the large baby boomer generation started to reach retirement age around the start of the recession."

"In its 2016 energy outlook, the oil giant BP predicted that the US would be "energy self-sufficient" by 2021 and oil self-sufficient by 2030. Oil is used for products beyond just power, such as plastics, which is why oil independence would come shortly after energy independence."

"For about 14% of households in high density urban core areas (or 4.2% of total households in the broader metro areas) it might be cheaper to use the basic versions of Uber or Lyft instead of owning a car."

"Consumers’ assessment of current conditions posted a moderate decline, while expectations regarding the short-term turned more favorable as last month’s turmoil in the financial markets appears to have abated."

"Within a few years, just before 2020, people ages 65 and over will begin to outnumber children under the age of 5."

"On a sector adjusted basis, our LGBT 270 index has outperformed MSCI ACWI by an excess 3% per annum over the past six years returning, 6.4% on average each year."

"This cohort [of discouraged workers] has been declining as we get farther from the crisis, suggesting these individuals either found employment or became increasingly detached. If we include other measures of labor market slack, such as workers who are employed but desire full-time work (involuntarily part-time workers), we see a similar trend. This suggests that there is a shrinking share of workers who are on the fringe of the labor force."

"Fatalities in the 2010's (approximately around 35,000 per year) are far lower than the peak around the late 1960's (approximately around 55,000 per year)."

"Expectations for 2016's earnings are already down about 16% from when estimates were first made and we still have over half the year left. If the downward trend holds, earnings this year could be truly terrible."

"It is an urban myth that the young generation today is more indebted, it is the older generations that have higher debt levels. The reason is that since 2009 it has been difficult for Millennials to get a loan. As a result, 25 to 35 year olds today have less debt than in 2003."

"Entry-level and mid-market buyers — typically the housing market's bread and butter — are likely to face stiff competition, rapidly rising prices and very limited inventory. The patience of many buyers will be tested in coming months."

"The difference in consumer confidence between Americans younger than 35 and those older than 55 is at a record high."

"Several energy companies have cut back capital spending plans to focus on maintaining liquidity and paying off debt, as revenue streams dried up in the wake of the oil crash."

"In the next five years the proportion of Americans who identify as Hispanic or Latino will increase by a "whopping" 1.6 percentage points and that of people over 65 will increase by 0.9 of a percentage point."

"The highest number of counterfeit shipments being seized originates from East Asia, with the People's Republic of China (hereafter 'China') being on top."

"One of China's long-term economic plans is to get its workers out of rural areas and into cities. This is part of China's larger goal of transforming the country's economy into one based on services and consumer spending. Ultimately, the government wants to get about 70% of its population into cities. But it seems as if China may actually be on the edge of a reverse migration, as many migrants are returning back home."

"Tech disruption is negative for workers: attempts to address inequality via higher minimum wages is likely to accelerate automation in the labor force."

"People are telling employers to put up or shut up. Job leavers as a percent of unemployment hit a cycle high of 10.8%. Job switching --> wage growth."

"In 2015, the US saw a startling spike in multifamily housing starts — apartments and condos, basically — and New York City was the reason."

"While the abundance of jobs is often interpreted as a sign of strength in the market, there's a persistent and growing gap between the number of jobs available and the number of hires being made that points to a nagging skills gap in the labor market that is unresolved."

"According to Jill Cary Hall and Savita Subramanian, equity strategists at Bank of America-Merrill Lynch (BAML), clients have now been net sellers of US stocks for 15 consecutive weeks, the longest stretch of continuous outflows since the bank first began tabulating the data in 2008. That’s a remarkable statistic given some of the volatility witnessed over the past eight years."

"About 40% of the energy dividend has gone toward the healthcare sector, followed by restaurant sales and recreation."

"Since January 2009, department-store sales have fallen 61% of the time month-on-month, versus 28% of the time for online shops."

"People report the lowest levels of well-being in their early 50s. This is the age at which most people are starting to seriously think about their retirement plans, might be figuring how to pay for their kid's college tuition, and may even be thinking about taking care of their aging parents."

"Deaths by poisoning — mostly alcohol and/or drug poisoning, according to Case and Deaton — shot up dramatically from 2000-2013. Meanwhile, death by suicide and by chronic liver disease, which is associated with obesity, alcohol abuse, and hepatitis, also increased significantly."

"Rising rents would not be welcome news for renters, particularly if wages continue to rise slower than inflation. But they would be for the Federal Reserve, which is counting on more inflation to justify higher interest rates."

"There are a whopping 138 million elderly Chinese people — a number that's greater than the combined elderly populations of Italy, Germany, Japan, France, and the US."

"In the first quarter of 2016, non-GAAP earnings were 28.9% higher than GAAP earnings, on average, among companies that reported both, according to FactSet Research. In the same quarter last year non-GAAP earnings were 19.7% higher than GAAP earnings, on average."

"Default cycles of the past have never been about a single sector, or small group of sectors. Yes, cycles were always driven by concentrated distress but they always found their way to affect other areas of the market."

"Of the $22.8 trillion in stock outstanding (not including US ownership of foreign stock and stock owned by "pass-through entities" such as exchange-traded funds), retirement accounts owned roughly 37%, the most of any type of holder."

"There have been only $4.88 billion worth of IPOs in 2016 in 31 deals. That compares with $13.4 billion in IPOs at this time last year and a total of 173 IPOs in 2015."

"Baker Hughes' tally shows a 35% drop in the total number of rigs over the last year, as commodity prices continued to slide and producers responded by paring output."

"Total value of M&A deals in 1Q16 was $283 billion, a clear slowdown from the average quarterly deal value of $530 billion from Q214-Q415."

"According to Deutsche Bank economist Torsten Sløk, since the implementation of negative interest rates in Japan, the sale of safes has spiked. In a note to clients, Sløk highlighted the massive jump in safe sales since the implementation of negative interest-rate policies. Essentially, these policies force savers to pay the bank in order to keep money in a savings account. Thus, it is cheaper to pull money from the bank and store it in a safe."

"Verizon employees were on strike in May during the survey period for the report, protesting low wages. Information services employment, which Verizon workers would fall under, dropped by 34,000 jobs on net. This was a dramatic drop for a sector that hadn't lost jobs on net since November 2015."

"In June 1990, there were nearly 458,000 people employed in the newspaper publishing industry; by March 2016, that figure had fallen to about 183,000, a decline of almost 60 percent. Over the same period, employment in Internet publishing and broadcasting rose from about 30,000 to nearly 198,000."

The ratio of non-financial corporate debt to nominal GDP is at its highest level since Q2 2009, when the economy was still in recession and nominal output was substantially depressed. This is one reason why the Fed needs to be very cautious with respect to the pace of policy normalization."

"Crashes of at least 20% are incredibly painful because of their rapid pace and long recovery times, but they're also more frequent than you may expect. Since 1950, there have been 57 such crashes in four of the world's major indexes (the US' S&P 500, the UK's FTSE All Share, Germany's DAX, and Japan's TOPIX)."

"US businesses took an average of 29.3 working days to fill a job opening in April, according to DHI Group's DHI-DFH Mean Vacancy Duration measure. That's an all-time high, and a solid uptick from March's revised 27.7 days."

"Texas’ Permian Basin has long been considered to be American oil's "sleeping giant." And, notably, in the past week, operators in the region added five rigs to their active count, which OilPrice.com's Irina Slav suggested demonstrated "that the basin is perhaps the most viable across the shale patch, with its low production costs and abundant reserves.""

"The amount of money that investors can expect to make from their nest egg has been deteriorating over the past 30 years, and the trend doesn't look to improve."

"According to Bank of America Merrill Lynch's latest fund manager survey, investors surveyed by the firm now have 5.7% of their net holdings in cash, the highest percentage since November 2001. Recall that in November 2001 the US was mired in recession while dealing with the fallout of both the tech-bubble bursting and the September 11 terrorist attacks."

"With markets expecting no more rate hikes in 2016, the dots showed that every Fed official expects at least one more 0.25% rate hike this year. Additionally, one Fed official then projected it would not be appropriate for the Fed to raise interest rates in 2017 or 2018. And what's more, one official declined to give a projection for where interest rates are likely to be over the longer run."

"Shelter — the yellow line — has outpaced everything else since mid-2012."

"Citing a speech by Bank of England Chief Economist Andy Haldane, Bank of America Merrill Lynch's Michael Hartnett and his team previously shared this chart, which shows just how low today's rates are relative to other times in history."

"About 9 million people, or 18.8%, of Americans age 65 and up report being full- or part-time employees, according to a new report by the Pew Research Center. By comparison, in 2000, only 12.8% of those 65 and up were working — about 4 million people."

"Back in 1983, the median net worth of white households ($98,700) was about eight times that of black households ($12,200), according to a newly released Pew Research Center analysis of data from the Federal Reserve’s Survey of Consumer Finances. The wealth gap narrowed in the 1990s and early 2000s, but started increasing again around the Great Recession. And by 2013, the median net worth of white households ($144,200) was about 13 times that of black households ($11,200), according to the Pew analysis."

"The economic confidence of people under the age of 35 is at its highest level since October 2000 and is approaching a historic record. At the same time, confidence for people over the age of 54 has slid in the past year, leading to a record divergence between the two cohorts."

"The Migration Fear Index as measured by Economic Policy Uncertainty has spiked over the past year. The index is constructed by taking terms related to immigration such as "immigrant," "border control," and "open borders" and seeing how many news articles include one of those terms along with a fear-related term such as "anxiety," "crime," and "worry.""

"People are leaving a lot of homes sitting empty."

"History says that short-term rallies are not likely to last inside a commodity bear super-cycle. And, in our opinion, gold is comfortably stuck inside a commodity bear super-cycle. As for an ideal entry point, history suggests that gold could eventually retest its lows this cycle, around $1,050 per ounce."

"Given the recent water crisis in Flint, Michigan, perhaps it should not be too surprising to see that public construction spending on our water supply is running just 0.07% of GDP, lower than at any time in the last decade."

"The only clients who were net buyers in the first six months of 2016 — meaning they bought more than they sold — were firms doing share buybacks"

"The Brexit vote has damaged the outlook for the global economy and EPS. This is clearly unhelpful for global equities. It also drove global bond yields down to unprecedented levels, which has increased the relative income attractions of equities. These two opposing forces are likely to keep share prices trapped in the current trading range."

"Wage growth since the Great Recession has remained fairly low, hovering around just 2%. This is most likely not high enough to support the Fed's stated inflation target of 2% year-over-year. Over the past few months, wages have grown at a somewhat faster rate than this, reaching a post-crisis high of 2.5% in December, January, April, and May."

"The Dutch bond yields are the lowest the country has ever seen. Amazingly, there's nearly half a millennium of records to compare that against, as record keeping began in 1517. As a historical reference point, that's the same year that Marin Luther published his 95 Theses."

"Using the aggregated data of those with Bank of America debit cards and credit cards, US economist Michelle Meyer identified a growing trend in customers' spending habits: Instead of purchasing goods, more and more Americans are putting their incomes toward experiences."

"CRE portfolios have seen rapid growth, particularly among small banks. At the end of 2015, 406 banks had CRE portfolios that had grown more than 50 percent in the prior three years. Of note, more than 180 of these banks more than doubled their CRE portfolios during the past three years. At the same time we are seeing this high growth, our exams found looser underwriting standards with less-restrictive covenants, extended maturities, longer interest-only periods, limited guarantor requirements, and deficient-stress testing practices."

"100 defaults is the second highest since record keeping began in 2004, trailing only 2009, the middle of the financial crisis. According to Global Market Intelligence, 67 of the defaults were US companies. At this point in 2015, there were only 62 defaults worldwide."

"John Butters of FactSet went through the 30 conference calls of firms that have held them so far and found that the largest complaint, by a mile, was the strong dollar."

"The Dow hit the ninth up day in a row — only the seventh time this has happened since 1980. In each of the other six instances, albeit on a small sample size, the index has been up the following six months with an average gain of 10.41%."

"Markit Economics' flash purchasing managers' index for July — a preliminary reading — rose to 52.9, its highest level since November. Output growth jumped to the best level in eight months, and, more notably, manufacturing payrolls had the biggest gain in a year."

"Yahoo was once the darling of the new millennium's tech future, with its market cap maxing out at over $125 billion. Now, the company would go for about 4% of that."

Global stocks rally even as Sensex, Nifty fall sharply on Friday

Global stocks rally even as Sensex, Nifty fall sharply on Friday

In second consecutive week of decline, forex kitty drops $2.28 bn to $640.33 bn

In second consecutive week of decline, forex kitty drops $2.28 bn to $640.33 bn

SBI Life Q4 profit rises 4% to ₹811 crore

SBI Life Q4 profit rises 4% to ₹811 crore

Copyright © 2024. Times Internet Limited. All rights reserved.For reprint rights. Times Syndication Service.