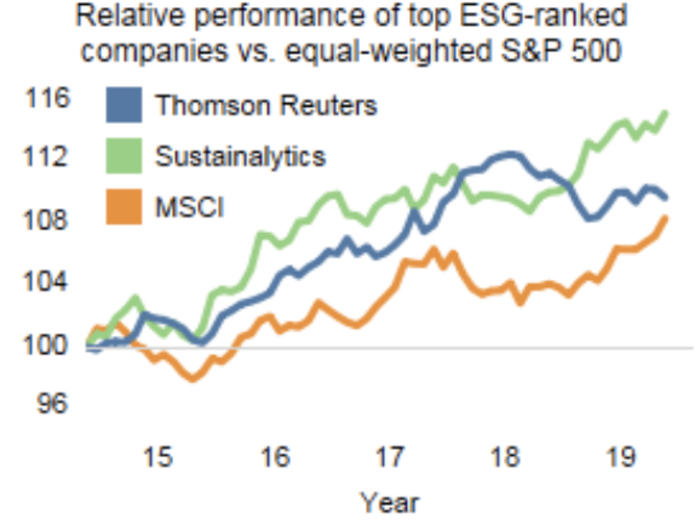

"ESG could boost your returns by a significant amount," the analysts wrote. "A strategy of buying stocks that rank well on ESG metrics would have outperformed the market by up to 3ppt per year over the last five years."

The top three groups that care about ESG are women, millennials, and high-net-worth individuals, according to the note.

"Based on demographics, we estimate over $20 trillion of asset growth in ESG funds over the next two decades," the analysts wrote. That's equivalent to the size of the S&P 500 today.

A majority — 70%— of US assets cannot be analyzed without ESG, the analysts wrote. In addition, assets tied to reputation, brand, and intellectual property have reached record highs for S&P 500 companies.

"Analyzing financial metrics alone simply won't suffice anymore, in our view," the analysts wrote.

According to BAML analysis, companies with high employee satisfaction rankings on Glassdoor.com have outperformed those with low ratings by nearly 5 percentage points over the past six years.

"ESG is the best measure we've found for signaling future risk," the analysts wrote. It's superior to leverage or other risk and quality factors, they said.

"15 out of 17 (90%) bankruptcies in the S&P 500 between 2005 and 2015 were of companies with poor Environmental and Social scores five years prior to the bankruptcies," the analysts wrote.

"Just like consumers have credit scores, companies pay different rates depending on their risk profiles," the analysts wrote. The cost of debt for companies with better ESG scores can be nearly 2% lower than companies with worse scores.

"Major ESG-related controversies during the past six years were accompanied by peak-to-trough market capitalization losses of $534 billion for large US companies," the analysts wrote. "Loss avoidance is key for portfolio returns over time."

Climate change is the top-ranked ESG concern for ESG asset managers, according to the US Forum for Sustainable and Responsible Investment.

There are currently $3 trillion of ESG assets considering climate change as part of investment decisions, BAML wrote.

"Stocks have been bought and sold on ESG concerns for decades," the analysts wrote. "Today's ESG discussions are largely focused on standardizing or codifying these elements, like we have seen for accounting and financial standards."

Voter turnout numbers affecting sentiments, but Indian markets to soon get an upsurge: Expert

Voter turnout numbers affecting sentiments, but Indian markets to soon get an upsurge: Expert

Markets decline in early trade amid weak global trends, unabated foreign fund outflows

Markets decline in early trade amid weak global trends, unabated foreign fund outflows

Rupee opens on flat note against US dollar in early trade; Underperformance partly due to election worries

Rupee opens on flat note against US dollar in early trade; Underperformance partly due to election worries

Copyright © 2024. Times Internet Limited. All rights reserved.For reprint rights. Times Syndication Service.