The cool thing about the paid version of the Albert app is the cost is up to you — starting at $4, you can pay whatever you think is fair.

That's a serious steal because with that membership you get access to extra features. You can add as many new savings goals as you want, and even pause savings on your rainy-day fund as your other goals fill up.

You also get access to the advice from Albert's Geniuses, or financial experts. If you have questions about anything, from what credit card to get to smart investing moves, you can text Albert and an expert will give you advice.

Albert recently added an investing option as well.

Yes, it's true that a savings account with your bank with automatic paycheck deductions would accomplish most of the important features that Albert does, but Albert does it better.

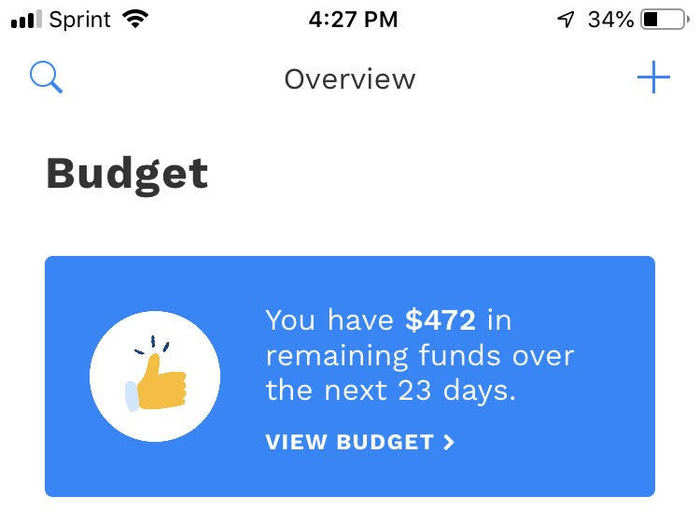

First of all, you don't have to go anywhere or sign any paperwork to get started. Everything is done on your phone.

Second, you earn more interest saving with Albert. The average annual percentage yield or APY for a savings account with a bank is 0.09%. With Albert, however, you get a full 1%. Your savings are also still FDIC-insured, up to $250,000.

Last, and perhaps most important, you wouldn't be able to separate your savings out and see your goals fill up the same way you can with Albert. This is how the app really changed my views on money and savings.

I may occasionally get the satisfaction of looking at my bank savings and seeing a larger number than the last time I saw it, but if I ever want to use it for something, I have to do a lot of math, and experience the guilt of watching the number go down when I take the money out to use it.

On Albert, I can open the app and instantly see how much money I have for each purpose. When I wanted to go to Puerto Rico, I opened up the app and saw that I had $653 dollars set aside specifically for a vacation, so I knew immediately how much money I had to work with. I was able to skip the stress of budgeting and immediately get to the fun part and start planning my trip.

It was only then that I truly understood the old adage "pay yourself first." It's a simple thing, but you cannot underestimate the joy of having money accumulate into organized goals without you thinking about it.

I saved over $1,500 in the first six months of downloading Albert with absolutely no effort. It was like buying a pair of jeans that always has money in the pockets when I put them on.

A centenarian who starts her day with gentle exercise and loves walks shares 5 longevity tips, including staying single

A centenarian who starts her day with gentle exercise and loves walks shares 5 longevity tips, including staying single  A couple accidentally shipped their cat in an Amazon return package. It arrived safely 6 days later, hundreds of miles away.

A couple accidentally shipped their cat in an Amazon return package. It arrived safely 6 days later, hundreds of miles away. Colon cancer rates are rising in young people. If you have two symptoms you should get a colonoscopy, a GI oncologist says.

Colon cancer rates are rising in young people. If you have two symptoms you should get a colonoscopy, a GI oncologist says. Having an regional accent can be bad for your interviews, especially an Indian one: study

Having an regional accent can be bad for your interviews, especially an Indian one: study

Dirty laundry? Major clothing companies like Zara and H&M under scrutiny for allegedly fuelling deforestation in Brazil

Dirty laundry? Major clothing companies like Zara and H&M under scrutiny for allegedly fuelling deforestation in Brazil

5 Best places to visit near Darjeeling

5 Best places to visit near Darjeeling

Copyright © 2024. Times Internet Limited. All rights reserved.For reprint rights. Times Syndication Service.