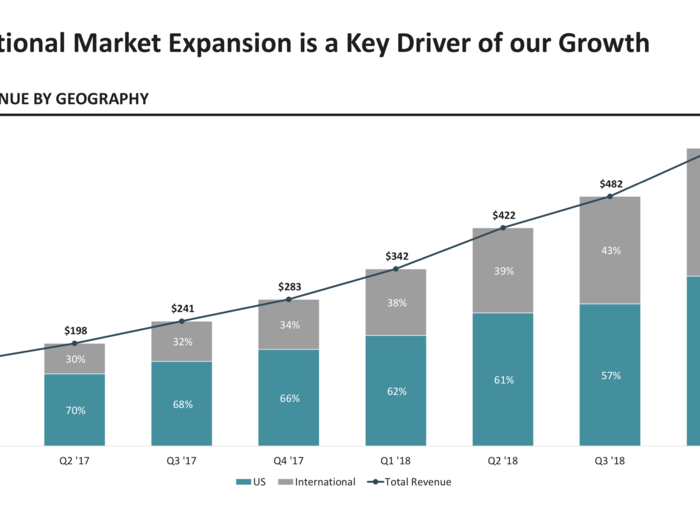

This is the main story WeWork is promoting ahead of its IPO — its revenue growth. The company says its Q4 2018 revenues give it a revenue run-rate that would imply $2.4 billion in revenues annually.

The definitions exclude many of WeWork's ongoing costs. Crucially, they both only show "EBITDA" profits — or "earnings before interest, taxes, depreciation and amortization."

WeWork is not profitable on a standard accounting basis.

The red lines show profits using WeWork's definitions, and at far right you can see that once other ongoing costs are factored in WeWork is not profitable.

This chart shows the major sources of WeWork's current cash position.

Note that this is NOT an income statement and does not contain all the regular expenses you'd see on a normal income statement. In fact, many of those items in the top section under "net loss" are non-cash expenses being added back to create those margins.

WeWork is a growing business, certainly. But this section does not show net profits.

WeWork spent £163 million building its business but only made £133 in revenues.

WeWork accrued £153 million in deferred leases in the same year its revenue was £118 million.

WeWork UK made a loss of £32 million in 2017. But at the same time, it was able to defer £49 million in trade payables and defer £80 million in lease payments. That saved cash offset the huge costs of running the business. The ultimate effect was that WeWork UK's cash position increased from £3.4 million to £9.8 million over the year.

Those credits make the current carrying cost of WeWork's long-term leases much cheaper.

That's a huge commitment. The disclosures say the leases are "non-cancellable." Remember, the business only generated £133 million in revenues in the same year.

Note again that admin expenses — lease costs, mostly — far outstrip the company's revenues. Again, that led to net losses on the bottom line.

There are a total of £30 million in deferred bills and £73 million in deferred lease payments on the balance sheet for 2016.

WeWork UK recorded positive cashflow of £8.7 million from unpaid payables and £28 million in deferred lease payments. That was helpful — the company's revenues for the year were £74 million.

There was revenue of £12 million but a loss of £14 million.

Even at this early stage, WeWork's business model was clear: cashflow was more important than making a profit, and getting various forms of credit for leases it signed would be a key financial driver of the company.

Colon cancer rates are rising in young people. If you have two symptoms you should get a colonoscopy, a GI oncologist says.

Colon cancer rates are rising in young people. If you have two symptoms you should get a colonoscopy, a GI oncologist says. I spent $2,000 for 7 nights in a 179-square-foot room on one of the world's largest cruise ships. Take a look inside my cabin.

I spent $2,000 for 7 nights in a 179-square-foot room on one of the world's largest cruise ships. Take a look inside my cabin. An Ambani disruption in OTT: At just ₹1 per day, you can now enjoy ad-free content on JioCinema

An Ambani disruption in OTT: At just ₹1 per day, you can now enjoy ad-free content on JioCinema Vegetable prices to remain high until June due to above-normal temperature

Vegetable prices to remain high until June due to above-normal temperature

RBI action on Kotak Mahindra Bank may restrain credit growth, profitability: S&P

RBI action on Kotak Mahindra Bank may restrain credit growth, profitability: S&P

'Vote and have free butter dosa': Bengaluru eateries do their bit to increase voter turnout

'Vote and have free butter dosa': Bengaluru eateries do their bit to increase voter turnout

Copyright © 2024. Times Internet Limited. All rights reserved.For reprint rights. Times Syndication Service.