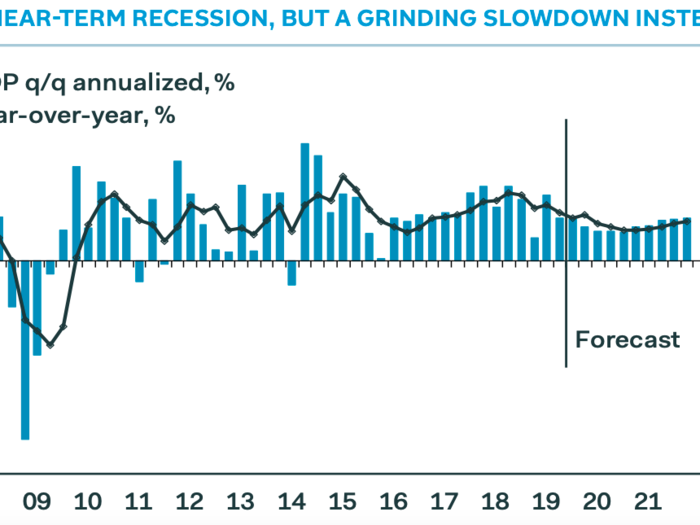

"Economic growth averaged a solid 2.5% in the first half of this year, better than the 2.0% average in the second half of last year." But the economics research firm said that this comes with a warning, that tariffs could depress real incomes and exports could "plunge."

At the start of this month, data showed that factory activity dropped unexpectedly. ISM data showed that the purchasing managers index in August fell to 49.1. The contraction came as a result of the drop in demand due to the trade war, but it was still a shock that ISM data showed that manufacturing activity dropped to below 50 as it's a signal of a slowdown.

To add to this data from smaller businesses showed that Main Street is investing less in the future, with data from the National Federation of Independent Business showing that business optimism among smaller businesses fell to 103.1 — a 1.6 point fall. With more uncertainty about the future, America's smaller businesses are feeling the heat of Trump's battle with China.

China is one of the major trading partners of the US — meaning that exports have suffered massively because of the trade war. As a result, smaller businesses and industrial production have both suffered a knock-on effect.

Pantheon said: "The intensification of the trade war is now hammering both exports and business confidence." And: "Exports appear set to plunge."

Possibly the most talked-about indicator of recession in recent months, the yield curve, inverted in July — signalling that we could have a recession within the next year. But with GDP trending upwards, Pantheon says it doesn't look ominous just yet.

Despite pressure, retail sales have remained strong and forecasts show this is set to continue. However, through other indicators, Pantheon says this might not last.

"Consumption will slow as the tariffs depress real income growth," said the research firm, adding wage growth remains subdued.

Nonfarm payrolls came in way below expectations this month, as 130,000 jobs were added to the US economy in August, compared to the 160,00 expected. Pantheon at the time warned that this is just the start and that by late fall growth could slump.

"Employer surveys and other data suggest that job growth is on course to slow to just 50,000 or so by late fall," said Pantheon Macroeconomics. "This implies that unemployment is likely to start creeping higher, and we expect layoffs to start creeping up too."

Top-selling cars in India in April 2024 – Tata Punch continues to dominate

Top-selling cars in India in April 2024 – Tata Punch continues to dominate

Apple Let Loose event today – What to expect, where to watch the live stream and everything you need to know

Apple Let Loose event today – What to expect, where to watch the live stream and everything you need to know

Happiest Minds Tech Q4 profit up 25% to ₹72 cr, co hopes to see growth in GenAI vertical

Happiest Minds Tech Q4 profit up 25% to ₹72 cr, co hopes to see growth in GenAI vertical

Copyright © 2024. Times Internet Limited. All rights reserved.For reprint rights. Times Syndication Service.