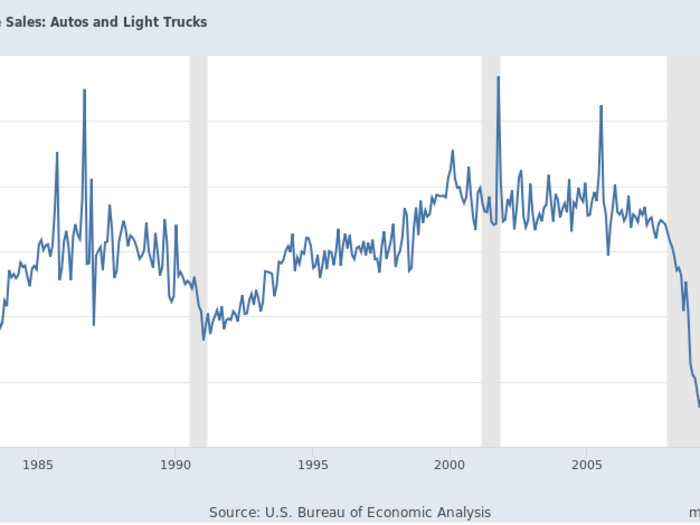

The US market has tanked twice in the modern period: during the early 1990s, when the first Gulf War provoked an oil-price shock; and during the Great Recession, when the credit that fuels the auto market was obliterated.

After the recovery of the 2000s began, auto sales settled to a 16-17-million annual range that lasted for almost a decade.

As we've seen from the previous period of sustained high annual sales in the 2000s, the US market can maintain a sales plateau for a long time. This is what the peak of the cycle actually looks like: high sales clustered around a standout year.

When all around you there are people saying the car business is being disrupted, that electric vehicles are coming to eat the gas-powered automobiles' lunch, and that Uber and Lyft will destroy traditional car ownership, it can be easy to overlook the basic fact that US auto sales are strong, have been strong, and should be relatively strong in the future.

Something like 85 million vehicles will have been sold in the US in the past five years by the end of 2019.

The consensus in the auto industry these days is that we're in something of a sales plateau, at historically high levels. Pretty reliably over the past two years, whenever it's looked as though US sales might slip below a 17-million pace, they've recovered.

It would be strange if this level holds up for several more years. My own view has been that 2019 should see the US market dip below 17 million, but I also think it's possible that through 2020, sales could settle into a mid-to-high-16-million range. The biggest wild cards are gas prices — currently low — and the impact of the used-car market.

The latter has been cited as a concern for new-car sales, but it's important to remember that automakers know that if they sell and lease a lot of new vehicles, they'll have to deal with a larger used-car fleet eventually. It's all part of the cycle, and used cars can actually be a boon to dealers as they have vehicles to sell when consumers become more price-sensitive.

What genuinely worries me more that a run-of-the-mill cyclical downturn is some of the catastrophic rhetoric around auto sales. Yes, the last downturn was a humdinger. But it was also an unusual event, and the Great Recession came at the end of a challenging business period for the auto industry, when the business had been managed away from return on investment and was saddled with legacy costs.

We've almost forgotten what a mild erosion in sales looks like, and the amnesia has been exacerbated by all the so-called "disruption" of transportation, which on closer examination is no disruption at all. New ideas about how to provide mobility are emerging, but they're far from overturning the familiar paradigm.

India's gold demand up 8% in Jan-Mar to 136.6 tonne despite high rate

India's gold demand up 8% in Jan-Mar to 136.6 tonne despite high rate

Mahindra XUV 3XO compact SUV launched in India starting at ₹7.49 lakh

Mahindra XUV 3XO compact SUV launched in India starting at ₹7.49 lakh

Markets trade firm on global rally, fresh foreign fund inflows

Markets trade firm on global rally, fresh foreign fund inflows

Copyright © 2024. Times Internet Limited. All rights reserved.For reprint rights. Times Syndication Service.